Japan Post Holdings Co., which acquired Australia’s Toll Holdings Ltd. last year, will consider more takeovers and tie-ups as part of a plan to expand across Asia, the company’s unit said.

Japan Post needs to strengthen its foothold in the region to serve Japanese corporations in those markets, a strategy that will help the Tokyo-based company become more international, Kunio Yokoyama, the president of unit Japan Post Co., said in a news conference Tuesday. The A$6.5 billion ($4.9 billion) takeover of Toll was the biggest by a Japanese company of an Australian firm.

“We need to focus on Asia first, then eventually make efforts to widen the area of operation from there,” said Yokoyama, 59, who became president of Japan Post Co. on June 28. “Mergers and acquisitions and tie-ups that would complement our businesses in Japan are possible,” he said.

Japan Post’s aspiration to expand outside home adds to the wave of consolidation among logistics, packaging and freight companies in Asia. Billionaire Chen Feng’s HNA Group Co., the Chinese conglomerate that controls the country’s fourth-largest airline, is in exclusive talks with the biggest shareholder of CWT Ltd. for a potential acquisition of shares in the Singapore-based logistics company. Last year, Kintetsu World Express Inc. bought Neptune Orient Lines Ltd.’s logistics business for 144.2 billion yen ($1.4 billion).

Japan Post Co., a unit of Japan Post Holdings, runs more than 24,000 post offices across the nation. It also offers banking and insurance counter services, according to its Website. Japan Post Holdings Co., Japan Post Bank Co. and Japan Post Insurance Co. sold $12 billion of shares in a three-pronged initial public offering November last year.

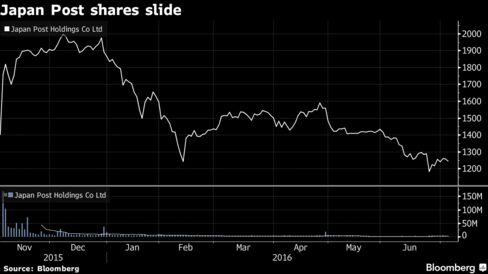

Shares of Japan Post Holdings slid 2.8 percent to 1,209 yen as of 12:58 p.m. in Tokyo on Wednesday, extending this year’s decline to 34 percent.

Japanese companies, which have embarked on a $210 billion global acquisition spree over the past three years, are also benefiting from a stronger yen, which last month soared to its highest level in more than two years. A stronger currency makes overseas acquisitions cheaper.

Yokoyama said the company would consider tying up with Japanese regional banks to improve its postal service.

“We’d like to focus on boosting the value of our postal service,” he said.

Source: Bloomberg.com