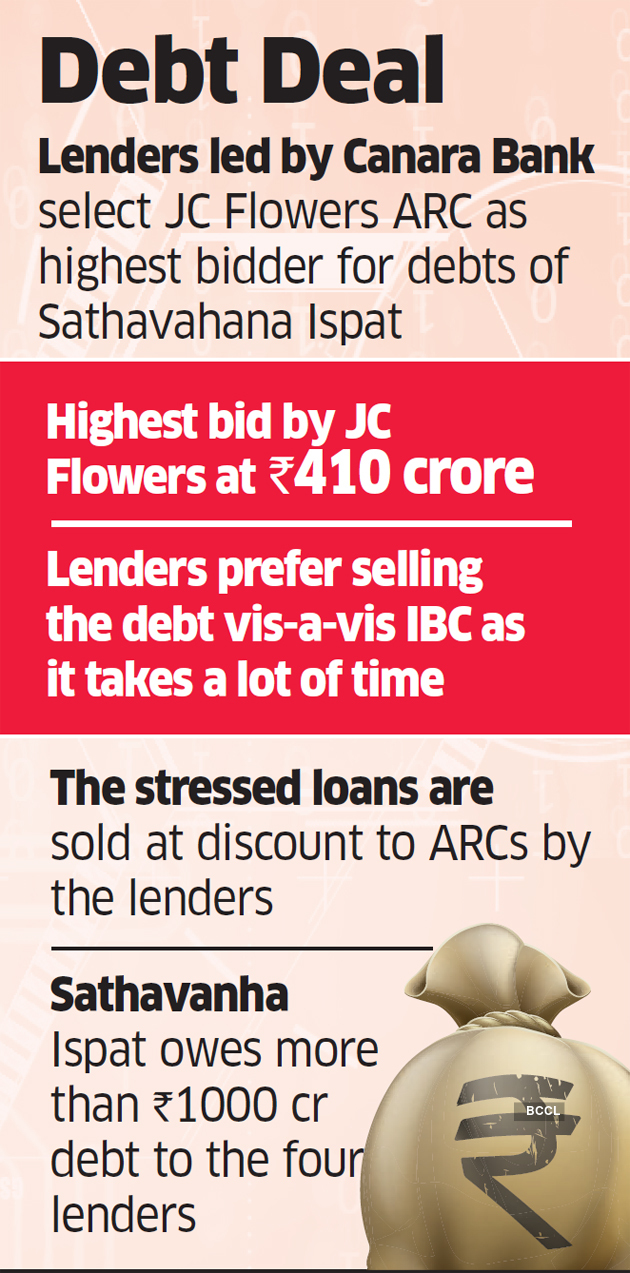

JC Flowers Asset Reconstruction (ARC) has emerged as the highest bidder for acquiring the debt of Hyderabad-based steel company Sathavahana Ispat at Rs 410 crore, said a person with direct knowledge of the development.

The consortium of lenders – SBI, Union Bank, IFCI and Canara Bank – had sought bids to sell the loan facilities extended by all of them to the company. There were four bids.

The other bidders were Welspun, which offered Rs 360 crore,

ARC Rs 380 crore, and CFM ARC Rs 370 crore.

“The consortium has evaluated the merits of all four bids and formally selected JC Flowers ARC as the H1 (highest) bidder,” the person quoted above said.

A senior executive from JC Flowers confirmed the news, however, the person did not wish to be quoted.

Mails to J C Flowers ARC and Welspun remained unanswered. Sathavahana Ispat, Canara Bank and CFM ARC couldn’t be immediately reached for comments.

“It is true that we have placed a Rs 380-crore bid for Sathavahana Ispat. After witnessing fewer transfers of ownership of large stressed companies through IBC Code, both investors and prospective buyers are keen to partner with ARCs in the acquisition of debts of such companies,” said Nanha Ram D, managing director of Maximus ARC. “This will pave the way for maximisation of value to the stakeholders including the employees,” Ram added.

The debt was classified as NPA( non-performing asset) in the books of the lenders for more than three years. Sathavahana Ispat owes more than Rs 1,000 crore to the four lenders.

These stressed loans are sold at a discount to ARCs by the lenders.

“As the next step and in accordance with due process, it has proposed to now run a Swiss challenge to maximize value. This involves optimizing the offer and discovering a better price for the lenders,” said another person familiar with the development.

The company is engaged primarily in the manufacturing of ductile iron pipes and pig iron. It also has a metallurgical coke plant.

“Insolvency today takes a lot of time, and if lenders need a good upfront payment they would take this route and they will wrap it up in 2-3 months,” said an analyst with another ARC.

“Whatever ARCs underwrite they would need a good return, so they access the business based on cash flows and that’s how they bid,” the analyst said.