Jet Airways won’t be returning to the skies.

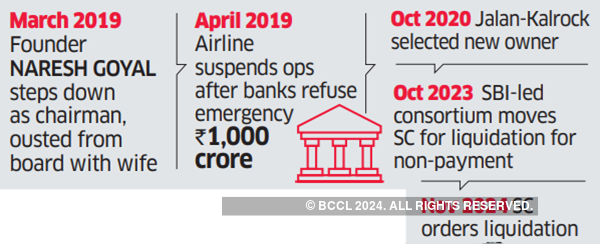

The Supreme Court has ordered liquidation of the grounded carrier, after a consortium of UK-based Kalrock Capital and the UAE-based entrepreneur, Murari Lal Jalan, failed to implement its resolution plan.

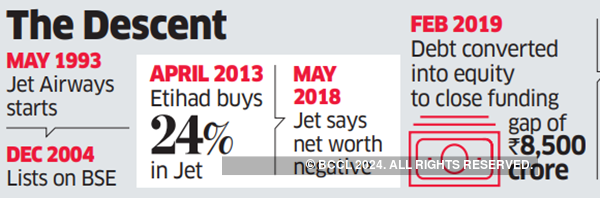

The Naresh Goyal-founded airline, which was once considered India’s best, had stopped flying in April 2019 after it ran out of money and couldn’t service its debt.

Putting an end to the five-year-long insolvency process, the Supreme Court on Thursday said liquidation must be available to lenders as a last resort since the resolution plan can no longer be implemented.

The apex court rejected the takeover bid.

The court said the ₹200 crore given by the Jalan-Kalrock (JKC) consortium, as part of the initial tranche payment of ₹350 crore, would have to be forfeited. Lenders can also invoke the performance bank guarantee of ₹150 crore, it said.

The court set aside the March order of the National Company Law Appellate Tribunal (NCLAT) that directed transfer of ownership of the debt-ridden airline to JKC.

A bench led by chief justice DY Chandrachud said the successful resolution applicant (JKC) had contravened the terms of the resolution plan and failed to infuse even the first tranche within the time stipulated. On Thursday, the top court said the appellate tribunal had acted against “settled legal principles.”

“The resolution plan is incapable of being implemented. Therefore, we must make sure the avenue of liquidation stays alive,” it said.

Under the “peculiar and alarming circumstances,” and keeping in mind that “almost five years have elapsed since the resolution plan was duly approved by the NCLAT and there being no progress worth the name, we are left with no other option but to invoke our jurisdiction under Article 142 of the Constitution, and direct that the corporate debtor be taken in liquidation… while being mindful of the underlying objective-that time and speed are of the essence under the (Insolvency and Bankruptcy) Code.”

The lenders led by State Bank of India (SBI) had challenged the NCLAT order, saying the consortium failed to implement its resolution plan, which had been approved by NCLT on June 22, 2021.

The lenders said their total admitted claim was of ₹7,800 crore, but JKC had offered ₹4,783 crore, which was payable in parts over five years. “The first tranche payment of ₹350 crore was required to be made by March 21, 2022 (which has not been paid till date, despite several extensions given by NCLT/NCLAT/Supreme Court),” the lenders said in their appeal filed through counsel Sanjay Kapur.

According to the resolution plan, airport dues and parking charges of ₹475 crore, which have ballooned to ₹1,000 crore, were required to be paid upfront by JKC in 180 days. However, the March order had confined this liability to ₹25 crore toward airport dues, SBI said. JKC had denied the allegations, arguing it had spent ₹700 crore so far in trying to revive the airline, despite lenders objecting to every step it took and every move it made.

The committee of creditors approved a resolution plan submitted by JKC in 2020, to revive and operate the airline. Subsequently, a monitoring committee comprising lenders, the consortium and the resolution professional had been formed to oversee operationalisation of the airline.

The court on Thursday said the fundamental concern was not just to ensure “substantial justice,” but also speedy disposal. “Since the resolution plan is no longer capable of being implemented, we must ensure that at least, liquidation remains as a viable last resort for the corporate debtor and its creditors,” said the bench, which also comprised justices JB Pardiwala and Manoj Misra.

It directed the Mumbai bench of the National Company Law Tribunal (NCLT) to take appropriate steps for the appointment of a liquidator and other formalities.

Pardiwala, writing for the bench, said liquidation was the only viable option through which creditors could recover some of their dues. It would best serve interests, including of employees who are yet to receive their dues. The court said the case served as an “eye-opener” and has “taught us many lessons” about the functioning of insolvency tribunals and IBC.

In its 169-page judgement, the court said the appellate tribunal allowing JKC to adjust the performance bank guarantee of ₹150 crore toward its ₹350-crore first tranche payment was “perverse” and in “flagrant disregard” of its January 18 order.

The Supreme Court had, at the time, ordered JKC to deposit ₹150 crore in an escrow account jointly held by SBI and JKC.

The apex court also said the performance bank guarantee was to be kept alive till the completion of the resolution plan, as it could only be forfeited in breach of the plan.

The contention of JKC that adjustment of payment was permissible under the resolution plan must be rejected, the court said, adding that it had also breached clause 6.2 of the resolution plan, which required payment of the minimum dues of workmen. Jet Airways, which was established in 1992, was the country’s second-biggest carrier at its height. Goyal is in jail, accused by ED of money laundering and diversion of money loaned to Jet Airways. ED arrested him on September 1, 2023.

Source: Economic Times