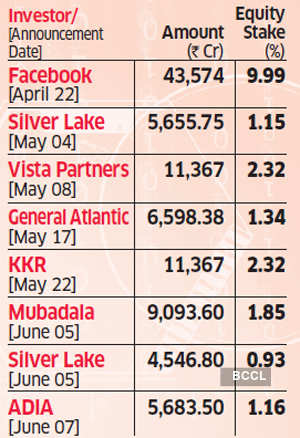

Jio Platforms is set to raise Rs 5,863.50 crore from Abu Dhabi Investment Authority (ADIA), the largest investment arm of the government of Abu Dhabi, by selling a 1.16% stake. ADIA is the seventh investor to pick up a stake in the Mukesh Ambani-led company in seven weeks.

The investment pegs Jio Platforms’ equity value at Rs 4.91 lakh crore and enterprise value at Rs 5.16 lakh crore. With the latest tranche, parent Reliance Industries stands to get Rs 97,885.65 crore from the seven investors in exchange for 21.06% stake, the group said in a statement Sunday.

ADIA’s investment follows that by Mubadala, Abu Dhabi’s second-largest sovereign wealth fund, in Jio Platforms. Mubadala’s investment of Rs 9,093.6 crore in Jio for a 1.85% stake was announced on Friday. ET had reported negotiations on both deals on June 2.

“I am delighted that ADIA, with its track record of more than four decades of successful long-term value investing across the world, is partnering with Jio Platforms in its mission to take India to digital leadership and generate inclusive growth opportunities,” RIL chairman Mukesh Ambani said in the statement. “This investment is a strong endorsement of our strategy and India’s potential.”

The Jio Platforms unit comprises mostly its telecom business under Reliance Jio Infocomm, the country’s largest with more than 388 million subscribers, besides other digital properties and investments.

Rs 97,886 cr raised from stake sales in Jio Platforms

Reliance Industries, transitioning to a consumer technology giant, has talked about building Jio Platforms into a digital entity on the lines of Alphabet and Tencent.

“We expect RJio to garner revenue/EBITDA CAGR of 22%/44% over FY20-22E along with healthy EBITDA margin expansion,” helped by “favourable competitive landscape in the Indian telecom sector”, Motilal Oswal said in a report.

ADIA is part of a consortium that has been engaged with Reliance for months to buy into its pan-India fibre network. It is also a rare case of both the UAE funds scoping the same investment opportunity. ADIA manages a global investment portfolio that is diversified across more than two dozen asset classes and sub-categories.

“The rapid growth of the business, which has established itself as a market leader in just four years, has been built on a strong track record of strategic execution,” said Hamad Shahwan Aldhaheri, executive director of the private equities department at ADIA.

The Rs 97,885.65 crore raised from stake sales so far in Jio Platforms and the Rs 53,124 crore from a rights issue will help lower Reliance’s consolidated net debt substantially from Rs 1.61 lakh crore at the end of FY20. Reliance is now well placed to meet its zero net-debt target by March 2021, analysts said.

Source: Economic Times