Leap Green Energy, a clean energy company promoted by India’s first Formula One driver Narain Karthikeyan, has bought all wind farms owned by InoxBSE -4.52 % Renewables for an undisclosed amount.

Two people directly aware of the development said the deal gave Inox Renewables an enterprise value of more than Rs 1,000 crore.

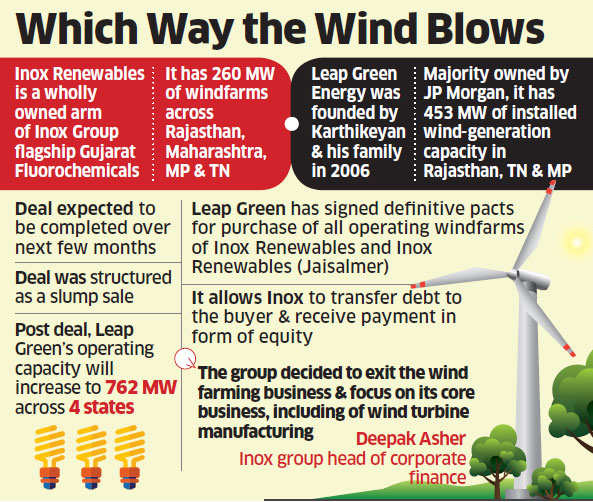

Inox Renewables, a wholly owned subsidiary of Inox group flagship Gujarat FluorochemicalsBSE 5.72 % (GFL), has 260 MW of wind farms across Rajasthan, Maharashtra, Madhya Pradesh and Tamil Nadu.

Coimbatore-based Leap Green Energy, founded by Karthikeyan and his family in 2006, entered into definitive agreements for the purchase of all the operating wind farms of Inox Renewables and Inox Renewables (Jaisalmer) Limited, GFL said in a late afternoon stock exchange filing on Tuesday, without disclosing the commercial terms of the transaction.

EThad first reported the transaction in its edition on January 30. The deal was structured as a slump sale, thereby allowing Inox Renewables to transfer its debt to the buyer, and receive payment in the form of equity consideration. UBS acted as sole financial adviser for the transaction.

Law firm Khaitan & Co advised Inox Group and MD&T Partners advised Leap Green Energy.

The transaction is expected to complete over the next few months, subject to satisfaction of certain conditions precedent, including obtaining necessary approvals and consents of regulatory and governmental authorities as well as project lenders.

Leap Green Energy, majority owned by JP Morgan, has 453 MW of installed wind-generation capacity in Rajasthan, Tamil Nadu, and Madhya Pradesh.

It clocked sales of close to Rs 300 crore in the year to March 2015. “This acquisition will help increase Leap Green’s operating capacity to 762 MW across four states, making it amongst the largest independent power producer (wind energy) companies in India,” its managing director Rajeev Karthikeyan said.

“Leap Green Energy is now gearing itself up to scale its total operating capacity to 2000 MW by 2019,” he said.

ET reported in its edition dated 30 January that Leap Green was in discussions with UK Climate Investment LLP, a joint venture between UK Green Investment Bank and the UK’s Department of Business, Energy and Industrial Strategy, for an equity investment that could help finance the current transaction.

The Karthikeyan family is the promoter of the South India-based PSG Group of educational institutions and has business interests in textiles apart from clean energy. The family is closely related to the owners of south India-based Lakshmi MillsBSE 0.00 %.

Wind power could attract investments of Rs 1 lakh crore by 2020, according to a July 2015 report by ratings agency CrisilBSE 0.21 %.