JSW Cement, the building-materials business of steelmaker JSW Group, is in initial talks with Germany’s Heidelberg Materials to acquire the latter’s 13.4 million-tonne-a-year cement businesses in India, industry sources aware of the talks told ET.

The people cited above said the discussions, currently bilateral, began after the JSW Group made an unsolicited offer to acquire Heidelberg’s local entities that primarily have capacities in peninsular India. The world’s second-biggest cement market, both by capacity and consumption, India has a highly regional and freight-intensive building-materials industry where manufacturing proximity to the end consumption market often determines profitability-linked enterprise valuation multiples in mergers and acquisitions.

To be sure, Heidelberg is yet to take a final call on its India exit strategy and according to the people cited above, it is possible that it may eventually decide to opt for a bidding process for the assets to allow other potential buyers to participate and increase competitive intensity for the plants.

A Heidelberg Materials spokesperson declined to comment, while the JSW Group did not respond to ET’s email seeking comments.

Holcim Exit

If concluded, it will mark the exit of a second global cement manufacturer from India after Swiss building materials company Holcim Group exited India in 2022, selling Ambuja Cements and ACC to the Adani Group in a closely contested bidding in which JSW Group had also participated.

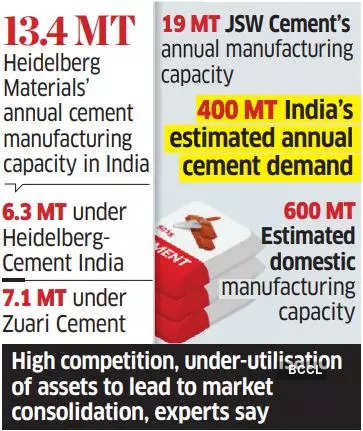

Heidelberg has more than 13 million tonnes per annum (MTPA) cement making capacity in India, of which 6.3 MTPA is with the listed entity HeidelbergCement India, and 7.1 MTPA is with the closely held Zuari Cement. This compares with nearly 140 MTPA capacity of market leader UltraTech Cement and nearly 70 MTPA of the second-largest player, the Adani Group.

JSW Cement expects to increase its capacity from 19 MTPA at present to 60 MTPA in the coming five years, Parth Jindal, the managing director of JSW Cement, told ET in a recent interview. The company aims to be amongst the five largest cement makers in India, he said.

According to experts, increased competition in the Indian cement market since the Adani Group’s entry last year is forcing mid-sized players into consolidation.

In a recent report, Fitch Ratings analysts noted that average new cement manufacturing capacity addition between FY24 and FY25 would be 40 MTPA, double the 20 MTPA of average capacity added between FY18 and FY23. For reference, India’s current total cement manufacturing capacity is just under 600 MTPA.

Capacity Overhang

Growth in new manufacturing capacity is expected to exceed demand growth, leading to lower capacity utilisation across the industry. Fitch Ratings estimated that demand in FY23 was around 400 MTPA, which it expects to go up to around 450 MTPA by FY25.

The mismatch between demand and available capacity leads to poor capacity utilisation, which adversely affects margins. In such a scenario, larger players will have better cost efficiencies and profitability given their scale, forcing smaller players into consolidation, experts said.

“We believe industry capacity additions are likely to remain high after FY25 as cement companies strive to maintain their market share in India – a market with long-term growth visibility,” Snehdeep Bohra, director at Fitch Ratings said in the report cited above.

Source: Economic Times