JSW Infrastructure is in talks to buy Shapoorji Pallonji’s (SP) ports arm, Gopalpur Ports, at an estimated enterprise value of Rs 3,000 crore that includes the company’s debt, according to people familiar with the matter.

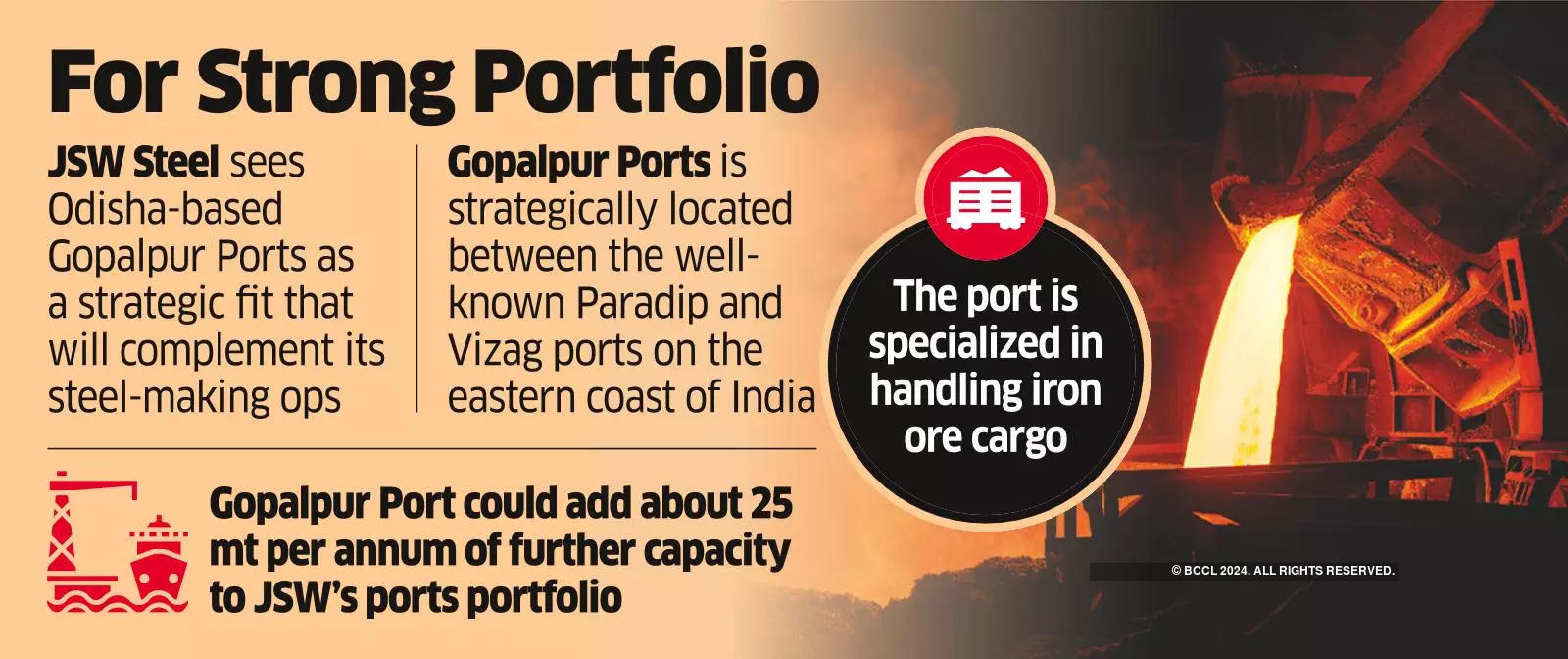

The unit is being divested as part of commitments that SP’s promoters, the Mistry family, have made to financiers in loan covenants entered into with them, according to the sources. As per the covenants, SP Group has committed to divest the unit by March 31 next year. JSW Infrastructure, whose shares were listed on bourses earlier this month, sees Odisha-based Gopalpur Ports as a strategic fit that will complement its steel-making operations.

Gopalpur Ports operates an all-weather deep-draft port in Gopalpur town of Odisha, which is strategically located between the well-known Paradip and Vizag ports on the eastern coast of India.

It specialises in handling iron ore cargo, a key raw material in JSW’s steel business. Talks may not necessarily result in a deal, the sources cited earlier cautioned.

A senior JSW official declined to comment when contacted. Shapoorji Pallonji had not responded to ET’s queries until the publication of this report.

JSW Infrastructure, which ranks second to Adani Ports and Special Economic Zone amongst private port operators in India, raised 2,800 crore through an initial public offering of shares in September. Its share offering was subscribed 37 times, drawing interest from institutional and retail investors.

Adani also operates a port at Dhamra in Odisha.

JSW Infrastructure won its first port concession at Mormugao in Goa in 2002. It had nine port concessions as of 31 December 2022. The company’s cargo handling capacity has increased to 153 million tonnes per annum.

It operates terminals at major ports on the west coast such as Goa and Karnataka as well as on the east coast such as Odisha and Tamil Nadu.

SP Group’s port at Gopalpur could add about 25 million tonne per annum of further capacity to JSW’s ports portfolio if negotiations were to result in a deal. The Mistry family has been working on restructuring SP group’s balance sheet and narrowing its business focus to areas where it can pursue profitable growth and repay debt.

As part of that plan it is looking to launch an initial public offering of shares of Afcons Infrastructure, a group company engaged in engineering and construction activities, ET had reported on June 21. The company will use proceeds from the sale of Gopalpur Ports and the planned IPO of Afcons to reduce debt. Meanwhile, it has also committed to completing certain real estate projects which could generate income to manage debt repayments.