About half a dozen investors, including Masdar Energy of the UAE, Singapore’s Sembcorp, JSW Energy, Torrent Power, Sekura Energy and ONGC, have submitted non-binding bids to acquire 760 MW of operational assets in India that have been put on the block by Italy’s Enel Group, said people aware of the development.

HSBC is advising Enel on the sale. The proposed deal may have an enterprise value of $500 million (₹4,100 crore), the sources said.

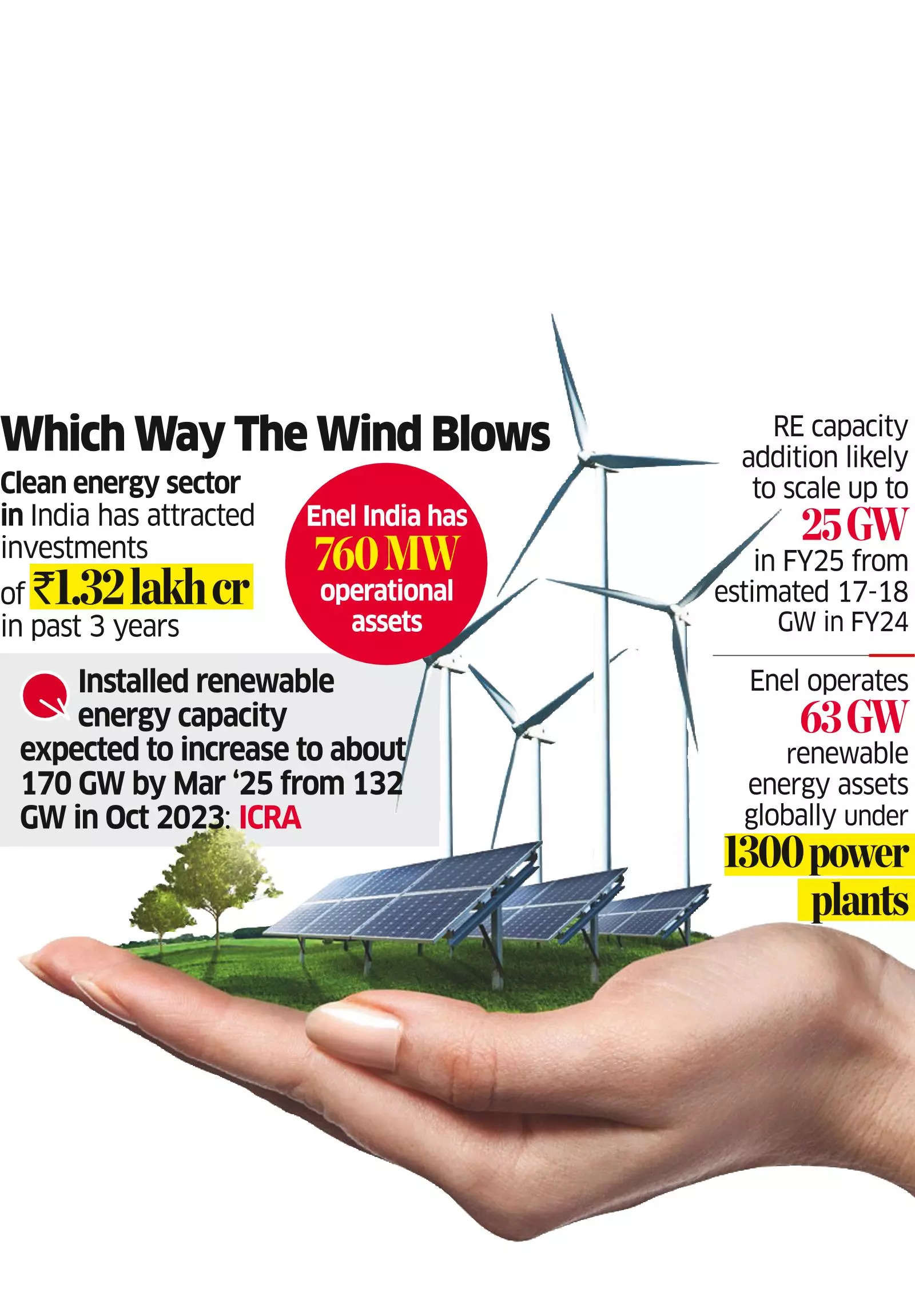

The portfolio of Enel Green Power India comprises 760 megawatts (MW) of operational wind and solar power assets and a development pipeline of 2 gigawatts (GW). Of the operational capacity, solar power projects comprise 420 MW, with the balance 340 MW coming from wind power.

Last year, Norwegian Climate Investment Fund, managed by Norfund, and KLP, Norway’s largest pension company, had together committed $100 million of equity and guarantees for a 168 MW wind power plant developed by Enel Green Power in India.

In 2020, Norfund and Enel Green Power (EGP) entered into a joint investment agreement for renewable energy projects in India. Their first project together, the 420 MW Thar solar plant, was announced in 2022.

Enel Green Power, founded in 2008 within the Enel Group to develop and manage renewable power projects globally, operates over 63 GW of installed renewable capacity at 1,300 plants in Asia, Europe, Africa and America. EGP had strengthened its position in India through an acquisition of a majority stake in renewable energy company BLP Energy for ₹30 million (₹220 crore) in 2015.

Enel, ONGC, Masdar and Sekura Energy spokespersons declined to comment. JSW, Sembcorp and Torrent didn’t respond to queries.

Energy producers such as Sekura Energy, Sembcorp and Masdar Energy are already in the race for several Indian renewable assets that are on the block. These three were among the contenders for the 2 GW renewable portfolio of Brookfield in India that’s up for sale at an estimated enterprise value of $800 million-1 billion (₹6,600-8,300 crore).

JSW Neo Energy and Sekura Energy are among the bidders that have made non-binding offers to acquire a controlling stake in Ayana Renewable Power, majority owned by National Investment and Infrastructure Fund (NIIF), at a valuation of about $2 billion, ET had reported.

ONGC is another contender for several assets in the clean energy space as part of decarbonising its operations. ONGC plans to have a renewable energy capacity of 10 GW by 2030 at an investment of ₹1 lakh crore.

The outlook for the renewable energy (RE) sector remains stable, led by strong policy support from the government, superior tariff competitiveness and sustainability initiatives by large commercial and industrial (C&I) customers.

Source: Economic Times