JSW Steel has transferred Rs 19,350 crore to a Punjab National Bank (PNB) account to complete the acquisition of Bhushan Power and Steel (BPSL), bringing the three-and-a-half-year-old resolution process to an end, paving way for the Sajjan Jindal led company to enter the mineral-rich eastern India, which has so far been the dominated by state-owned SAIL and Tata Steel.

“The money has just come to the account a few minutes ago. This will now be distributed proportionately among financial creditors,” a person involved in the negotiations said.

In a notice to the stock exchange, JSW also confirmed the completion of the acquisition.

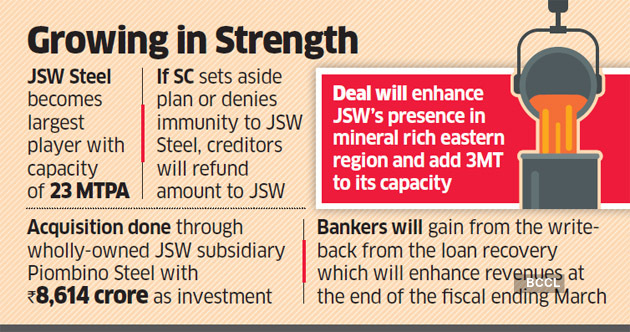

The acquisition will be done through a wholly-owned JSW subsidiary Piombino Steel Ltd, which will invest Rs 8,614 crore including equity, optionally converted debentures and debt to complete the BPSL resolution plan. Piombino Steel will hold 100% of BPSL’s equity share capital.

Financial creditors have undertaken that in case the Supreme Court, for any reason, sets aside the plan or denies immunity to JSW Steel in ED cases against the previous promoters of BPSL, this amount will be refunded to JSW.

The current steelmaking capacity of JSW Steel is around 18 MTPA and after expansion in Vijayanagar, Dolvi and Salem along with the BPSL acquisition, the capacity is likely to go up to 23 MTPA, making the company the largest steel producer overtaking Tata Steel which has 20.6 MTPA capacity.

Analyst from Rating agency ICRA said that the BPSl acquisition will provide synergy benefits to JSW Steel in the form of a strong foothold in the eastern region, higher margins associated with value-added products and freight cost savings for iron ore procurement.

JSW Steel’s total Capex commitment for FY 2021- 2023 was at Rs 25,387 crore. The proposed acquisition of BPSL, is expected to adversely impact its consolidated financial risk profile and keep the overall debt levels elevated in the near-to-medium term, analysts said.

“Debt will definitely go up till the time the company get a structure to keep it off the balance sheet,” said Amit Dixit, research analyst from Edelweiss.

JSW Steel was chosen as the winning bidder for BPSL’s assets in September 2019, and the resolution plan was approved by the National Company Law Tribunal soon after. The company offered to pay Rs 19,350 crore to the financial creditors, with the lenders taking a nearly 60% haircut. Apart from this, JSW had offered to pay Rs 350 crore to operational creditors, against their admitted claims of Rs 700 crore.

The recovery before the end of March will help banks gain on the large writeback from this account, which has been provided 100% by most lenders, pumping up their profits in a difficult fiscal year, which was hit by a severe economic slowdown due to the pandemic.

State Bank of India (SBI) will recover over Rs 4,000 crore, having admitted claims of Rs 9,825 crore against the company. PNB is slated to recover around Rs 4,399 crore, while Canara Bank will recover Rs 2,244 crore.

JSW is in the process of tying up funds for the acquisition through a mix of loans from SBI, Bank of Baroda (BoB), Deutsche Bank and Standard Chartered non-convertible debentures, overseas bonds and existing cash available with the company, ET had reported earlier this month.

JSW also has a cash balance of Rs 13,904 crore in its balance sheet at the end of third quarter a part of which can be used to complete this deal.

BPSL was among the 12 large cases referred to bankruptcy courts by the Reserve Bank of India in 2017. The company owed lenders Rs 48,000 crore. JSW’s bid for the 3.5-million tonne steel plant trumped Tata Steel’s Rs 16,000-crore offer.

BPSL has a 2.75-mtpa integrated steelmaking facility at Jharsuguda, Odisha, which is in proximity to JSW Steel’s captive iron ore mines and to JISPL’s steel plant in Chhattisgarh.

Apart from the backward integration facilities such as beneficiation, sintering, coke oven and pelletisation plants, BPSL has downstream facilities in the form of cold rolling mill, galvanising and colour coating lines and pipe and tube mill which will all synergised with the company’s existing capacity.

Source: Economic Times