A Reliance Industries-backed company and Jupiter Hospital are in the fray to acquire the unlisted SevenHills Healthcare, people with knowledge of the matter told ET. The target is a 1,500-bed hospital embroiled in a prolonged legal battle with Mumbai’s civic body over compensation for the land on which it is built.

SevenHills Healthcare, which operates SevenHills Hospital in suburban Mumbai, came into the limelight when superstar Amitabh Bachchan’s granddaughter Aaradhya Bachchan was born there.

NK Holdings, the Reliance-backed company, has submitted a resolution plan for SevenHills Healthcare, people cited above said.

Both bidders have offered around ₹450 crore, but with differing payment schedules.

Jupiter has proposed an upfront payment of ₹450 crore within 30 days of bankruptcy court approval, while NK Holdings has offered ₹450 crore payable over five years.

Abhilash Lal, the resolution professional overseeing the insolvency proceedings, Jupiter, and Reliance Industries did not respond to ET’s mailed requests for comments.

LEGAL tangle Dispute between lenders and the civic body has been blocking the hospital’s sale

Seven-Year Wait

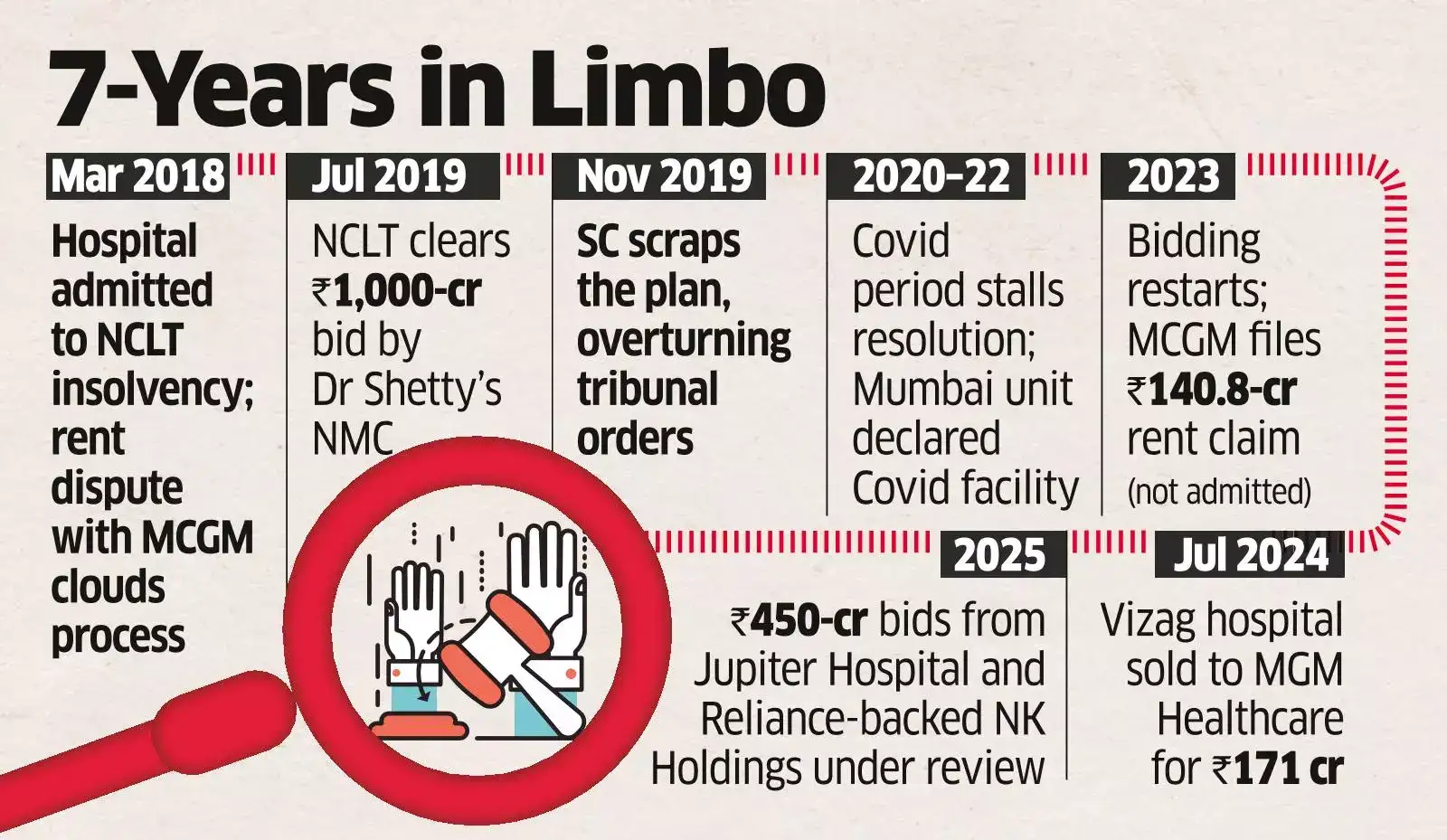

Creditors are reviewing both the resolution plans for the hospital, which remains unresolved despite being admitted to the National Company Law Tribunal (NCLT) in March 2018.

SevenHills originally owned two hospitals-one in Mumbai and another in Visakhapatnam. The bankruptcy court allowed creditors to sell the Visakhapatnam and Mumbai hospitals separately to overcome delays caused by disputes between the Municipal Corporation of Greater Mumbai (MCGM) and lenders, coupled with the Mumbai hospital being declared a Covid-19 facility under the Disaster Management Act.

In July 2024, NCLT approved a plan by MGM Healthcare to acquire the Visakhapatnam hospital for ₹171 crore.

MCGM, which owns the land on which the Mumbai hospital is built, has submitted a claim of ₹140.8 crore as unpaid rent. This claim is not yet admitted by the RP until March 2023. The RP has not provided an updated claim list to the regulator-the Insolvency and Bankruptcy Board of India (IBBI).

In July 2019, the NCLT approved a ₹1,000-crore resolution plan by Dr Shetty’s New Medical Centre (NMC), but the plan was challenged by MCGM at the National Company Law Appellate Tribunal. The appellate tribunal rejected MCGM’s petition. However, in November 2019, the Supreme Court overturned both the tribunal orders.

Lenders blame the U-turn by MCGM for delays, saying it initially agreed to NMC’s ₹102-crore offer and a promise to reserve 20% of beds in the Mumbai hospital for economically deprived patients. Later, MCGM declined the offer, arguing before the Supreme Court that it was not bound to accept a resolution plan even if approved by the tribunal, as it had issued a notice to terminate the lease agreement before the company was admitted for insolvency.

Post-Covid, the RP restarted the process by inviting offers in 2023. Several hospital chains, including Max Healthcare, KIMS Hospital, and Virinchi Hospital, had shown interest in acquiring SevenHills, ET reported on February 17, 2023.

The outstanding claim by lenders for the Mumbai hospital is not known as the RP has not updated the list of verified creditors after the Visakhapatnam hospital was sold in 2024.

The last updated admitted claims for both hospitals, as of March 31, 2023, stood at ₹1,361 crore, including ₹1,273 crore from financial creditors. JM Financial ARC is the largest debtholder with over 75% share.

Source: Economic Times