Private equity investor Kedaara Capital, the biggest shareholder of microfinance lender Spandana Sphoorty Financial, has revived plans to sell off the company and has been in discussions with Yes Bank to explore an M&A deal, two people familiar with the development told ET.

About 18 months ago, Kedaara had shelved a similar plan following allegations by Spandana founder Padmaja Gangireddy that it was selling off the company to Axis Bank at a “throw-away price”.

Gangireddy, the then managing director of Spandana, was ejected unceremoniously following a disagreement on the issue with the majority shareholder.

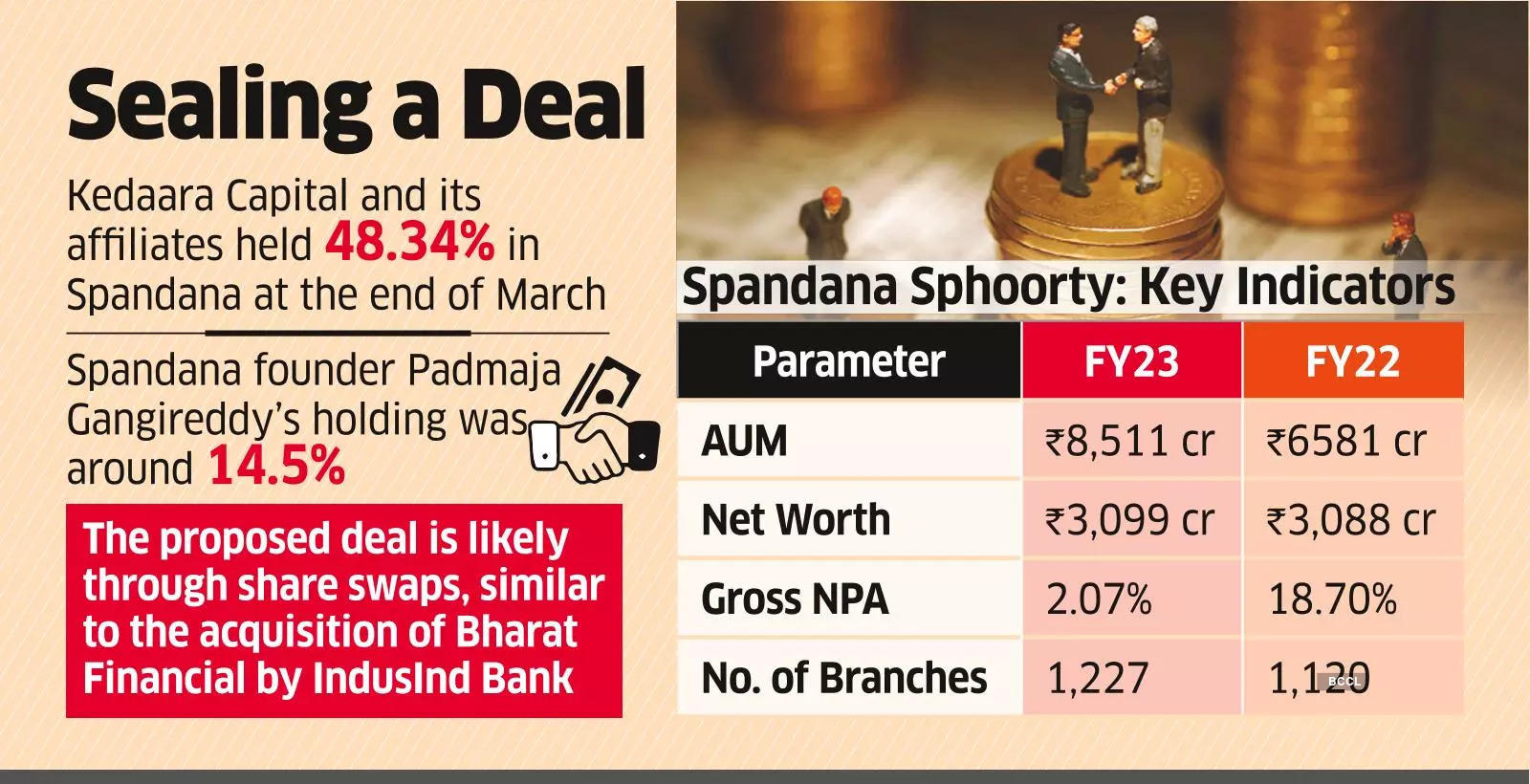

Kedaara Capital and its affiliates held a 48.34% stake in Spandana at the end of March. Padmaja Gangireddy’s holding was around 14.5%. She recently relinquished her board position, too.

“The proposed deal with Yes Bank is likely to be through share swaps, like what happened in the case of IndusInd Bank’s acquisition of microlender Bharat Financial Inclusion,” a person familiar with the matter said.

Bharat Financial Inclusion now is a wholly-owned subsidiary of IndusInd Bank and acts as the bank’s business correspondent.

Incidentally, Spandana’s managing director Shalabh Saxena was heading Bharat Financial before switching jobs.

“The fact that Kedaara has initiated talks with Yes Bank shows that it has renewed its intent to sell off Spandana,” another person said. “Irrespective of the outcome of the negotiations, the intent is clear,” he said.

Kedaara declined to comment on the matter. Yes Bank did not respond to the queries related to the development.

Last year around August, Yes Bank managing director Prashant Kumar said that the private sector lender was open to acquiring smaller entities in the microfinance sector.

The Hyderabad-based microlender, specialising in rural micro-loans, had ₹8,500 crore of assets under management at the end of March, against ₹6,581 crore a year ago.

The lender reported a net profit of ₹106 crore for the March quarter against ₹29 crore in the year-ago period. Its annual net profit for FY23, however, slid to ₹12 crore from ₹70 crore in the preceding fiscal on account of ₹700 crore of bad loan write-offs earlier in the year.

Source: Economic Times