Buyout giants such as KKR & Co, Baring Private Equity Asia and Singaporean sovereign fund Temasek Holdings, an existing investor, are in talks to buy a 21.5% stake in Manipal Hospitals. Existing investor TPG Capital Management is looking to encash a seven-year-old investment said people aware of the negotiations.

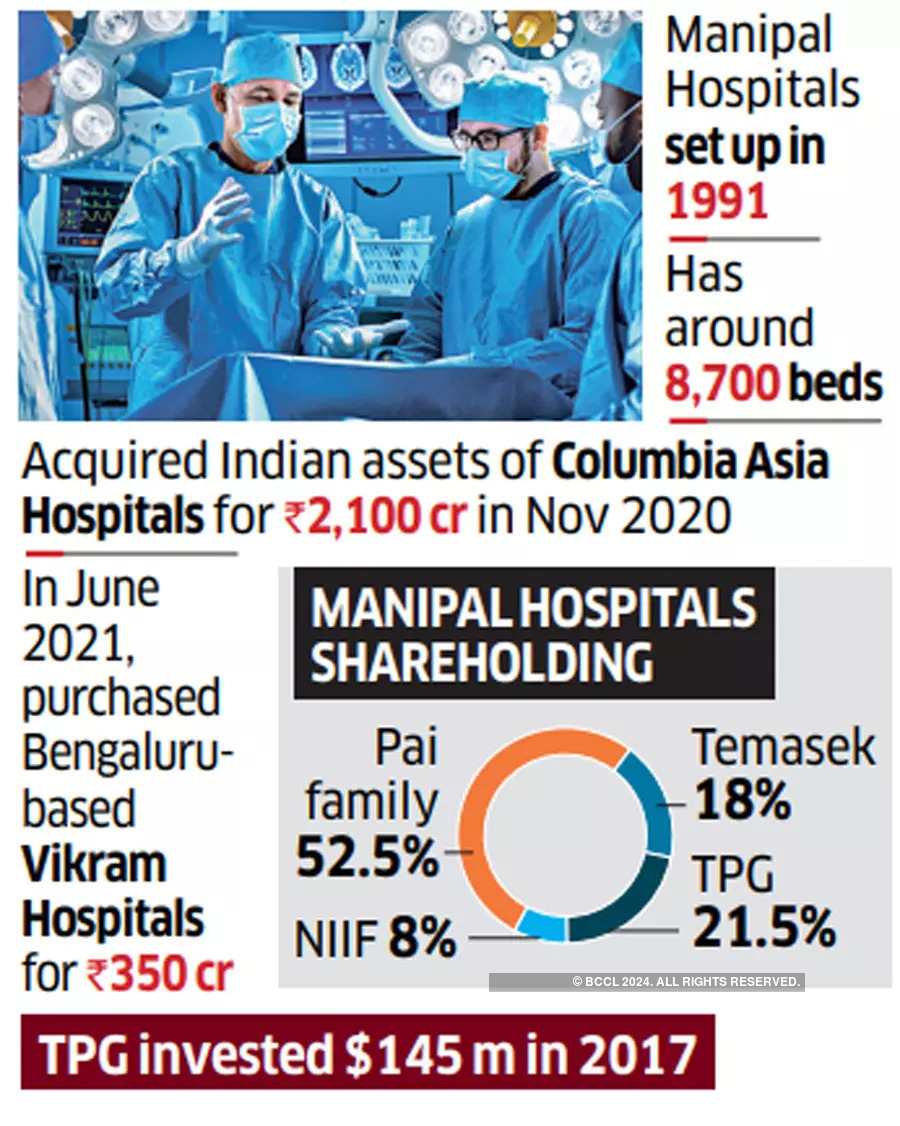

The fresh round of talks with global buyout giants was initiated after the Texas-based private equity fund’s attempts to sell the shares back to Manipal’s Pai family didn’t fructify. Temasek already owns an 18% stake in Manipal Hospitals while National Infrastructure Investment Fund (NIIF) holds 8%. The remaining 52.5% is held by the Pai family.

The proposed transaction is expected to value the hospital chain at ₹30,000-32,000 crore ($4 billion), said one of the persons mentioned above. The proposed transaction will be a precursor to Manipal’s proposed public issue, which is expected in 2023-24.

TPG invested $146 million in Manipal in 2015 and, based on the estimate above, the US PE firm could generate more than 5x return on the investment.

Hospital Sector in Focus

Manipal, TPG, Temasek and KKR declined to comment. Baring PE Asia didn’t respond to queries.

The Pai family had been in talks with banks including Barclays, Deutsche Bank, DBS, Nomura and Standard Chartered Bank to raise $400-500 million as it sought to buy back the shares held by TPG, ET had reported in July.

Besides the minority stake in Manipal Hospitals, TPG is also in talks to exit its investment in another leading hospital chain, Care Hospitals. Blackstone, CVC Capital, Brookfield, Temasek and Max Healthcare are vying to acquire Care Hospitals from Evercare, a wholly owned entity of TPG Growth, ET reported September 13. TPG also owns India’s largest mother and child hospital chain, Motherhood Hospitals, and infertility chain, Nova IVF.

The Pai family, which founded India’s first privately owned medical college in the town of Manipal in Karnataka in 1953, set up Manipal Hospitals in 1991 in Bengaluru. It has about 8,700 beds spread across the country. In November 2020, Manipal Hospitals acquired the Indian assets of Columbia Asia Hospitals for Rs 2,100 crore and in June 2021 purchased Bengaluru-based Vikram Hospitals from private equity firm Multiples for Rs 350 crore. India’s hospital sector has been a major attraction for global buyout firms as well as pension and sovereign money managers as the sector is considered relatively recession-proof.