Some of the biggest buyout funds KKR, Carlyle, EQT, Hillhouse and TA Associates are competing against each other to buy out Healthium Medtech, the largest homegrown surgical sutures manufacturer, also the largest manufacturer of surgical needles globally by volume, in what is turning out to be the fiercest bidding process of the year.

Healthium (formerly Sutures India), 99.8% owned by Apax Partners is the fourth largest surgical suture manufacturer in the world with a market share of about 18% in India. These funds were shortlisted this weekend after the first round of screening based on non-binding bids submitted last week which largely value the company between Rs 6300 crore to Rs 6500 crore.

A formal sale process was launched earlier this year with Jefferies mandated to sell the company with close to two dozen funds including Blackstone, Partners Group, Canadian pension funds, picking up the information memorandum and signing non-disclosure agreements.

Apax, TA Associates, Carlyle declined to comment. Mails sent to EQT, KKR, Hillhouse did not generate any response till press time.

Ethicon Inc, from Johnson & Johnson is the largest player in the market. Arthrex Inc, and Covidien Holding Inc are some of the other global players in this surgical sutures market.

Healthium has four key product areas – wound closure, arthroscopy, wound care and infection prevention portfolio. The company has a strong market position as one of the largest manufacturers of surgical needles and sutures in the global market. The company had introduced value-added products over the past few years, ranging from anti-microbial gloves and barbed sutures to meniscus guns and ligation clips.

In FY24, the company had Rs 820 crore in revenue and Rs 256 crore EBITDA while in next financial year (FY25) it is expected to clock Rs 1020 crore in sales and Rs 330 crore in EBITDA. So at Rs 6500 crore valuation, the company will be valued at 20 times forward EBITDA.

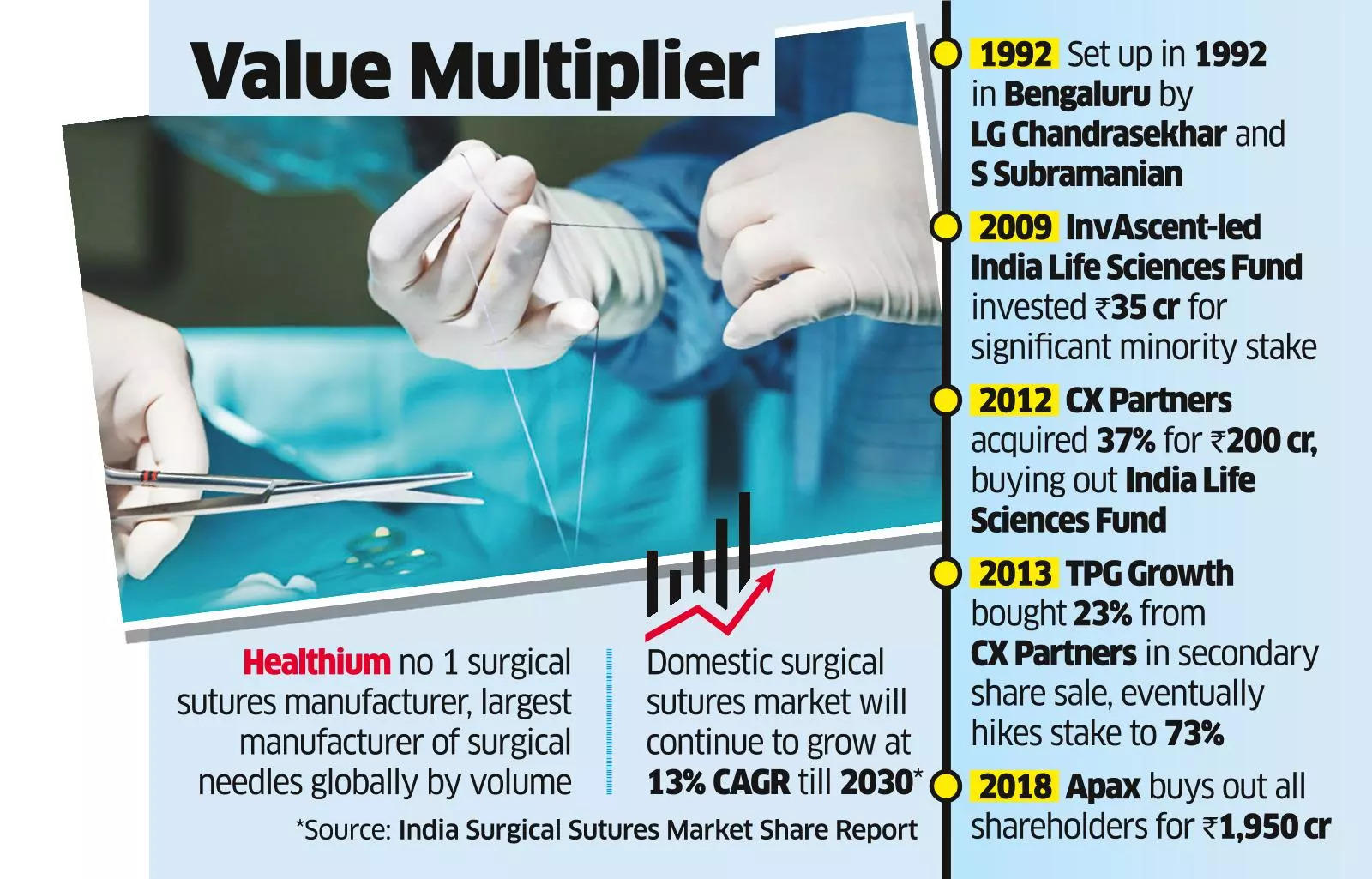

Sutures India was originally set up in 1992 in Bengaluru by L.G. Chandrasekhar and S. Subramanium, former executives with Smith & Nephew, and Johnson & Johnson. Currently, it exports its products to over 90 countries including Europe, South America, Africa and Asia. Revenues from the foreign market constituted 45% of its FY2023 revenues while the domestic market contributed to 55% of its total sales. The company has a network of 80 international distributors selling its products, while it is present in more than 700 districts and over 450 cities across India.

Healthium products are claimed to have covered over 40,000 surgeons across 18,000 hospitals, reaching 90% of all districts in India. While it has strong position in tier 2-6 cities in India where competitors have lower presence, said analysts who track this space, giving the company a competitive advantage, it has also gained market share from some of the established MNC players in Tier 1 cities. With its top-10 customers generating 21% of its total revenues in FY2023, the company has moderate client concentration risk.

Starting 2009 the company has received multiple investments from PE funds like InvAscent-led India Life Sciences, CX Partners to TPG Growth. Over time, TPG raised its stake to 73% and held a majority in Sutures. In 2018, Quinag Acquisition (FDI) Limited, a company backed by funds advised by Apax Partners, acquired the stake from the company’s existing investors — TPG Growth, CX Partners, and founding shareholders, for about Rs 1950 crore ($300 million).

This was Apax’s second investment in the healthcare space in India, following its maiden bet in Apollo Hospitals in 2007. In 2013, Apax exited Apollo Hospitals with a 3-fold return. In December 2022, Healthium had sold its UK-based subsidiary Clinisupplies to KKR Health Care Strategic Growth Fund II, for an undisclosed amount.

The revenue growth was majorly supported by volume growth on the back of strong distribution network in the domestic markets, new product launches and established relationships with existing clients, said a January ICRA report.

The operating margin of the company improved to 28% in FY2023 from 23% in FY2022 on the back of favourable product mix with increased revenue contribution from the high-margin wound closure segment, sale of the UK business which had relatively lower margins, enhanced backward integration for sutures by improving the cost efficiency of needles manufacturing facility and healthy operating leverage, it added. Going forward, its diversified client base and wide geographical reach are expected to support revenue growth.