KKR and Co. is in advanced negotiations to invest around $400 million in Hero Group’s renewables energy company Hero Future Energies (HFE), in what would be the US private equity manager’s single largest cheque in the Indian clean energy space so far, said people aware of the development.

The final rounds of negotiations are ongoing before a formal announcement, which is expected in a few weeks. The investment is for a significant minority stake but comes with significant governance rights that would make KKR a co-promoter along with founder chairman and managing director Rahul Munjal. Munjal is the nephew of Pawan Kant Munjal, chairman and chief executive officer of Hero MotoCorp. The investment will largely be a primary infusion to reduce debt and grow the business. JP Morgan is advisor on the transaction.

KKR declined to comment.

Rahul Munjal and his spokesperson didn’t respond to ET queries.

Valuation may cross one billion

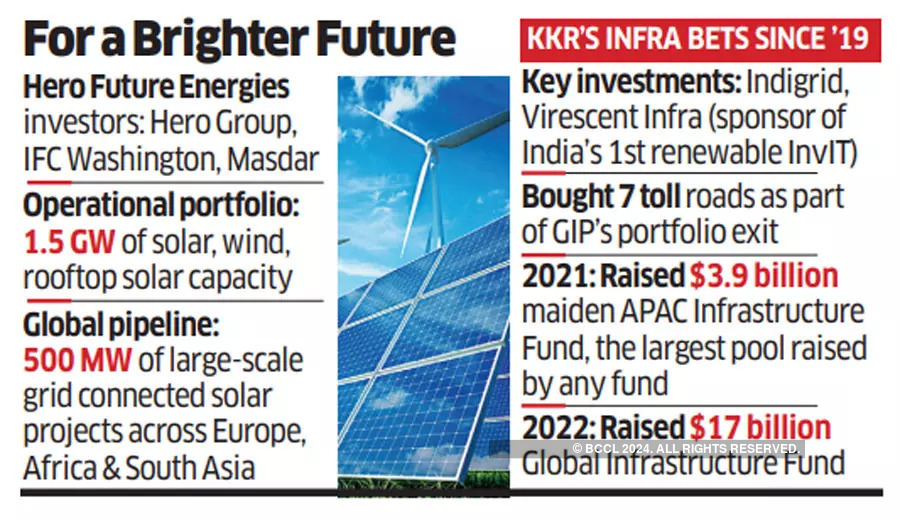

Apart from the Hero Group, the International Finance Corporation (IFC) is an investor in the company, along with Masdar, also known as Abu Dhabi Future Energy Co., which picked up 20% stake for $150 million in November 2019, valuing the New Delhi-based company at $750 million. The KKR round is expected to see valuation cross the $1 billion threshold.

KKR will be using its infrastructure fund as the vehicle for this investment. But it will be kept outside the KKR-backed Virescent Infrastructure, which manages the Virescent Renewable Energy Trust, India’s first renewable energy infrastructure investment trust (InvIT). It is not clear yet if KKR will subsequently bring on board one of its limited partners or a co-investor.

Decade-old HFE operates in wind, grid-connected solar, rooftop sectors and energy storage and has a portfolio of 1.5 GW of operating assets and another 1.5 GW under construction. According to its website, the company has a pipeline of 500 MW of large-scale, grid-connected solar projects in Europe, Africa and South Asia. It aims to have a capacity of 5 GW by 2024. In 2021, HFE had sold a 49% stake in two of its projects totalling 500 MW to O2 Power.

HFE’s wholly owned subsidiaries include Hero Wind Energy Pvt Ltd (HWEPL), Hero Solar Energy Pvt Ltd (HSEPL) and Hero Rooftop Energy Pvt Ltd (HREPL). These in turn house the various individual projects as special purpose vehicles (SPVs) created for undertaking wind and solar energy projects.

Early this year, the company partnered with US-based Ohmium International to set up 1 GW of green hydrogen production facilities in India, the UK and Europe. Last month, the company won a contract for the construction of a 10 MW grid-connected energy storage plant in Kerala by the Kerala State Electricity Board.

The operational portfolio comprises wind capacity of over 580 MW in Rajasthan, Maharashtra, Tamil Nadu, Karnataka, Madhya Pradesh and Andhra Pradesh, as well as solar capacity of over 950 MW in Madhya Pradesh, Telangana, Andhra Pradesh, Karnataka and Rajasthan as of December 31, 2021. It has long-term power purchase agreements with the distribution companies of Rajasthan, Karnataka, Madhya Pradesh, Andhra Pradesh, Maharashtra, several private industrial and commercial customers and Solar Energy Corporation of India (SECI). The diversification of assets in terms of location and presence of strong counterparties reduces associated credit risks, experts said.

According to Crisil Ratings, the holding companies of the Hero Future Energies platform are majority owned, directly or indirectly, by the promoters of the Hero Group.

“These entities draw strength from their 20% and 13.99% stakes, respectively, in Hero MotoCorp,” said Manish Gupta, analyst with Crisil.

These promoter entities have funded the initial equity requirement for the platform.

“Presence of the Munjal family members on the board of group companies substantiates the importance of the venture to the Hero Group and the Munjal family,” Gupta said in a report in April. “The market cover of HFE holding companies declined from 5.2 in September 2021 to 3.8 as on March 23, 2022, primarily on account of fall in market capitalisation of Hero MotoCorp. The planned equity infusion in HFE by its shareholders, will be primarily utilised for reducing the debt at the holding companies by September 2022.”

In the past three months, the Hero MotoCorp stock has appreciated 7%.

HFE is expected to have cash flow for debt servicing of over Rs 1,275 crore in FY23. That will adequately cover its long-term debt obligation of around Rs 1,010 crore. In addition, HFE had cash and cash equivalents of more than Rs 720 crore on a consolidated basis on March 23, including Rs 499 crore unencumbered cash. The holding companies had unencumbered cash of about Rs 320 crore on March 23, as per Crisil’s calculations. Market cover for the consolidated debt stood at 3.8 times on March 23.

“For KKR it’s a great platform to build on while the investment will help Hero Future Energies ( HFE) to deleverage and the primary infusion will help in the growth plans,” said a person aware of the investment thesis on condition of anonymity.

Last year, KKR raised a record $3.9 billion maiden Asia Pacific Infrastructure Fund. It followed up this year with a $17 billion Global Infrastructure Fund, exceeding the initial $12 billion target.

KKR Infrastructure Fund’s first India transaction was a co-investment in May 2019 with Singapore’s GIC in Indigrid, an operator of 11 electricity transmission assets, where it invested $148 million. In April 2020, it acquired five operational solar energy assets from Shapoorji Pallonji Infrastructure Capital (SP Infra). It transferred those assets to Virescent Infrastructure, the renewable energy platform KKR launched in October. It entered India’s highway sector by signing definitive agreements to acquire Global Infrastructure Partners’ entire stake in Highway Concessions One (HC1) and seven highway assets totalling 487 km for an undisclosed sum.