US private equity giant KKR is in early talks with strategic and financial investors including American late-stage tech investor Silver Lake Partners and Accenture to sell its oldest India investment, Flextronics Software, now known as Aricent, for about $1.5 billion.

KKR has mandated JP Morgan to run a formal process and the investment bank has reached out to French technology giant Capgemini to buy a controlling stake in the Santa Clara, California-based technology firm, multiple sources in the know told ET.

The deal, if successful, will mark KKR’s exit from its oldest investment in an India-focused company. When contacted, KKR and Capgemini declined to comment. Accenture and Silver Lake did not return mails seeking comments till the time of going to press.

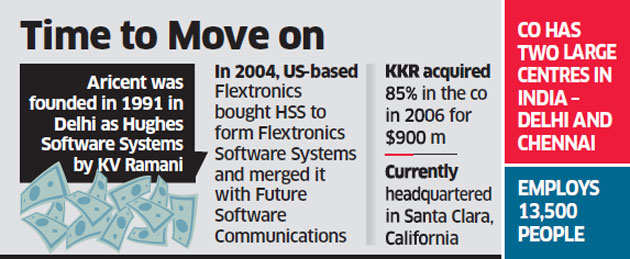

Founded in 1991 in Delhi as Hughes Software Systems (HSS) by KV Ramani, Aricent has been involved in several takeovers. In 2004, US-based Flextronics bought HSS to form Flextronics Software Systems and merged it with Future Software Communications, headquartered in Chennai.

Two years later, KKR acquired it for about $900 million in what was the biggest private equity buyout in India at that time.

The transaction was KKR’s second deal in Asia and was part of a strategic decision to step up presence in the world’s fastest-growing markets — India and China.

Flextronics Software Systems got renamed as Aricent in 2011.

Headquartered in California, Aricent has two large centres in India – in Delhi and Chennai and employs 13,500 people globally.

Revenues for FY16 were about $612 million, Moody’s investor services said in a note on August 2016.

The deal is unlikely to provide any decent returns for KKR, a firm known for its multi-bagger exits. Under the current valuations, it will provide low single-digit returns to the New York-based fund, which has been one of the most aggressive investors in India during the last one decade.

As on March 31, 2017, KKR has deployed approximately $3.2 billion in Indian companies through private equity business, and provided more than $3.5 billion of financing to companies through its corporate and real estate-focused NBFCs.

Known for its late-stage, mega buyouts, Silver Lake is famed for its surprising big-ticket entries and exits. It partnered with Michael Dell to take Dell Computers private in a $24-billion deal.

Prior to that, in 2009, at the height of the financial crisis, it acquired Skype in a $1.9-billion deal and successfully sold it to Microsoft in 2011for $9 billion.

Capgemini, which bought out iGate Systems in 2015 for $4 billion, has been looking to expand its presence and verticals and is now, one of the world’s top five technology firms.

The Paris-headquartered consulting and technology services company has grown mostly through acquisitions and is one of the world’s top five tech services firms. According to IT analysts, Capgemini, which has undergone a leadership change recently, will bid aggressively for any large tech M&A transaction.

Accenture, one of the world’s largest technology and consulting firms, has been looking to expand horizontally.

“Tech companies have mostly grown through acquisitions, but this particular company has been struggling for some time and KKR, which made its India debut with this deal, found it tough to sell the company. A successful exit will work in KKR’s favour,” said Nishit Dhruva, managing partner, MDP & Partners, a law firm.