KKR & Co. plans to split India’s largest waste management company Re Sustainability Ltd and sell its industrial waste management business at a valuation of at least $1 billion, or ₹8,300 crore, multiple people aware of the development told ET.

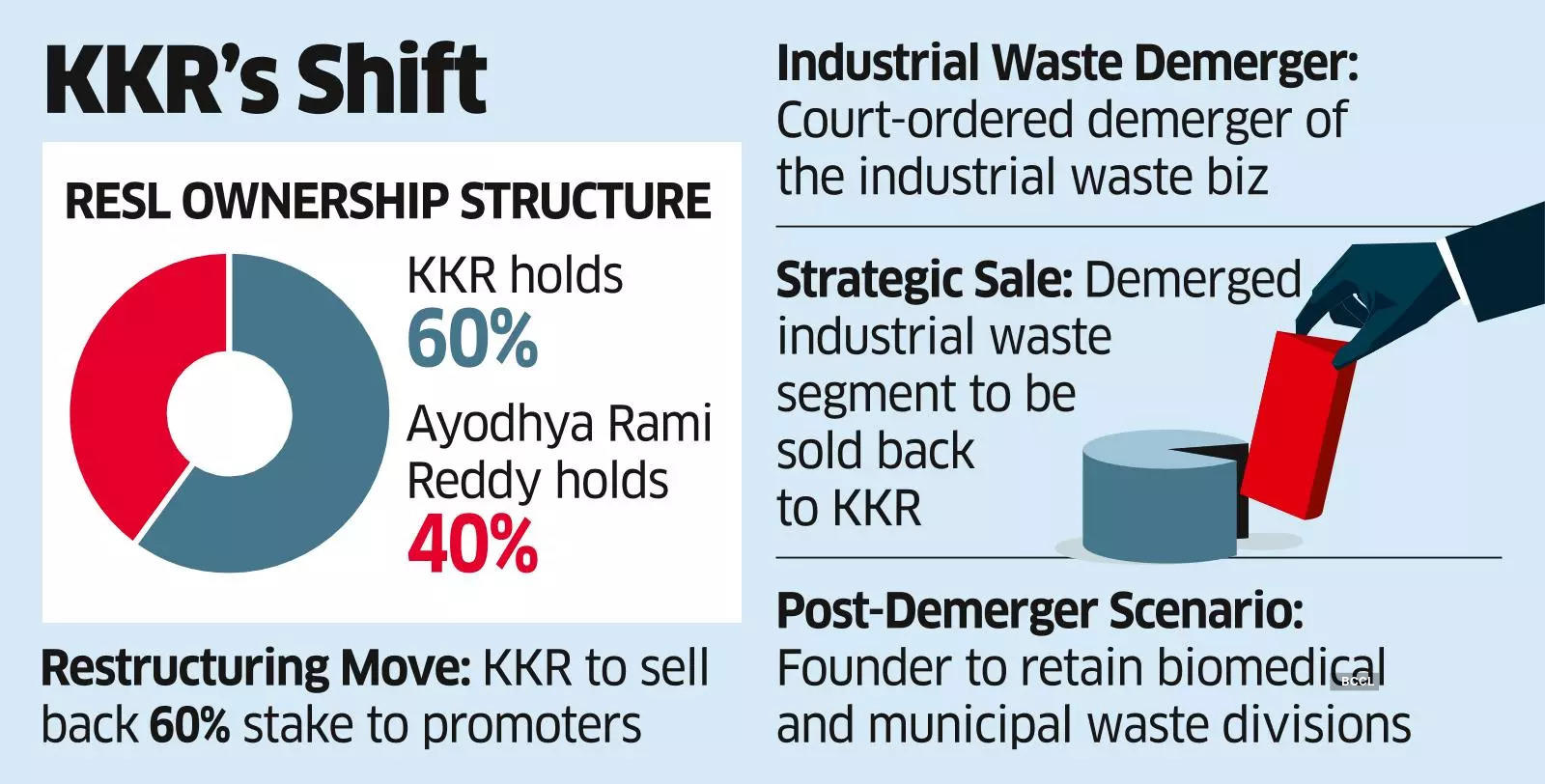

The US private equity giant currently owns 60% stake in Re Sustainability (formerly Ramky Enviro Engineers) that handles municipal solid waste, industrial waste and biomedical waste across the country. The balance 40% is held by founder promoter Ayodhya Rami Reddy.

As per the proposed demerger plan, which will go through a court-approved process, KKR will buy Reddy’s 40% stake in the non-municipal industrial waste management business and sell him back its 60% stake in the municipal business at a pre-agreed price, people cited above said.

Once the demerger is completed KKR will seek to exit the six-year-old investment by selling the industrial waste business, sources said. It has initiated discussions with at least two global advisors to initiate sale negotiations with global waste management companies and PE buyout funds, they added.

An email sent to Goutham Reddy, managing director of Re Sustainability (ReSL), on Wednesday did not elicit any responses till the press time Thursday. A KKR spokesperson declined to comment.

This will be KKR’s second attempt to exit ReSL, but this time it is only looking to sell the business of non-government waste management contracts which, sources said, has ready buyers.

In 2021, KKR had tried to sell its 60% stake in ReSL and engaged in talks with firms such as Brookfield Asset Management. JP Morgan had advised the fund then. However, the discussions did not proceed further.

KKR announced the acquisition of a 60% stake in Re Sustainability in August 2018 for $530 million, or about Rs 3,500 crore, via a combination of primary and secondary investments through its KKR Asian Fund III.

Back then, it was the largest buyout by a PE fund in India’s environmental services sector. The investment was part of the private equity firm’s impact investing strategy, which refers to identifying businesses with positive social or environmental impact.

The industrial waste management business accounted for 40% of ReSL’s revenue of Rs 3,630 crore in FY23.

The revenue had increased 21% from Rs 2,990 crore in FY22, driven by strong growth in its municipal waste and industrial waste management business, according to a recent India Ratings report.

Consolidated Ebitda increased to Rs 1,120 crore in FY23 from Rs 940 crore in FY22, with a slight reduction in its margin to 30.7%, due to an increase in the revenue contribution of the municipal waste management segment, which yields lower margins compared to the waste-to-energy and industrial waste management segments, it said.

Post demerger, biomedical and municipality waste management businesses that account for about 60% of ReSL’s revenue will be left with promoter Reddy, sources said.

Re Sustainability processes around 5 million tonnes of municipal solid waste and more than 1 mt of industrial waste a year, besides serving 45,000 healthcare establishments and 43.8 MW of operational waste-to-electricity generation capacity.

It serves close to 10,000 industrial clients across the country.

Majority of its revenue in industrial waste management is contributed by subsidiaries like Mumbai Waste Management (Rs 441 crore), Tamil Nadu Waste Management (Rs 105 crore), Pithampur Industrial Waste (Rs 366 crore), Adityapur Waste Management (Rs 316 crore), Re Sustainability Solutions (Rs167 crore) and West Bengal Waste Management (Rs64 crore), according to Tofler data.

ReSL has expanded its presence in around 50 cities in India and globally to 10 countries including Singapore, the UAE, the US, Bangladesh, Qatar, Saudi Arabia, Kuwait, Oman and Tanzania.

Source: Economic Times