Kotak Alternate Asset Managers said it has invested Rs 1,445 crore in Matrix Laboratories founder Nimmagadda Prasad’s acquisition of the active pharmaceutical ingredient (API) business of Viatris.

Kotak Alt made the investment through Kotak Strategic Situations Fund II, it said in a news release on Tuesday, but did not provide details of the funding structure. ET in April reported that Kotak would be lending $150 million (Rs 1,250 crore) under a mezzanine debt facility at 18-20% and arranging an additional $300 million from other lenders including Edelweiss Domestic Performing Credit Fund to fund the acquisition of the API business.

Kotak Alt did not respond to a request seeking comment, while Prasad could not be reached immediately. Kotak Alt said on Tuesday that the transaction would enable Matrix to consolidate its leadership position in the API business by strengthening its third-party sales and allow it to selectively evaluate inorganic opportunities in the pharma contract development and manufacturing organisation space.

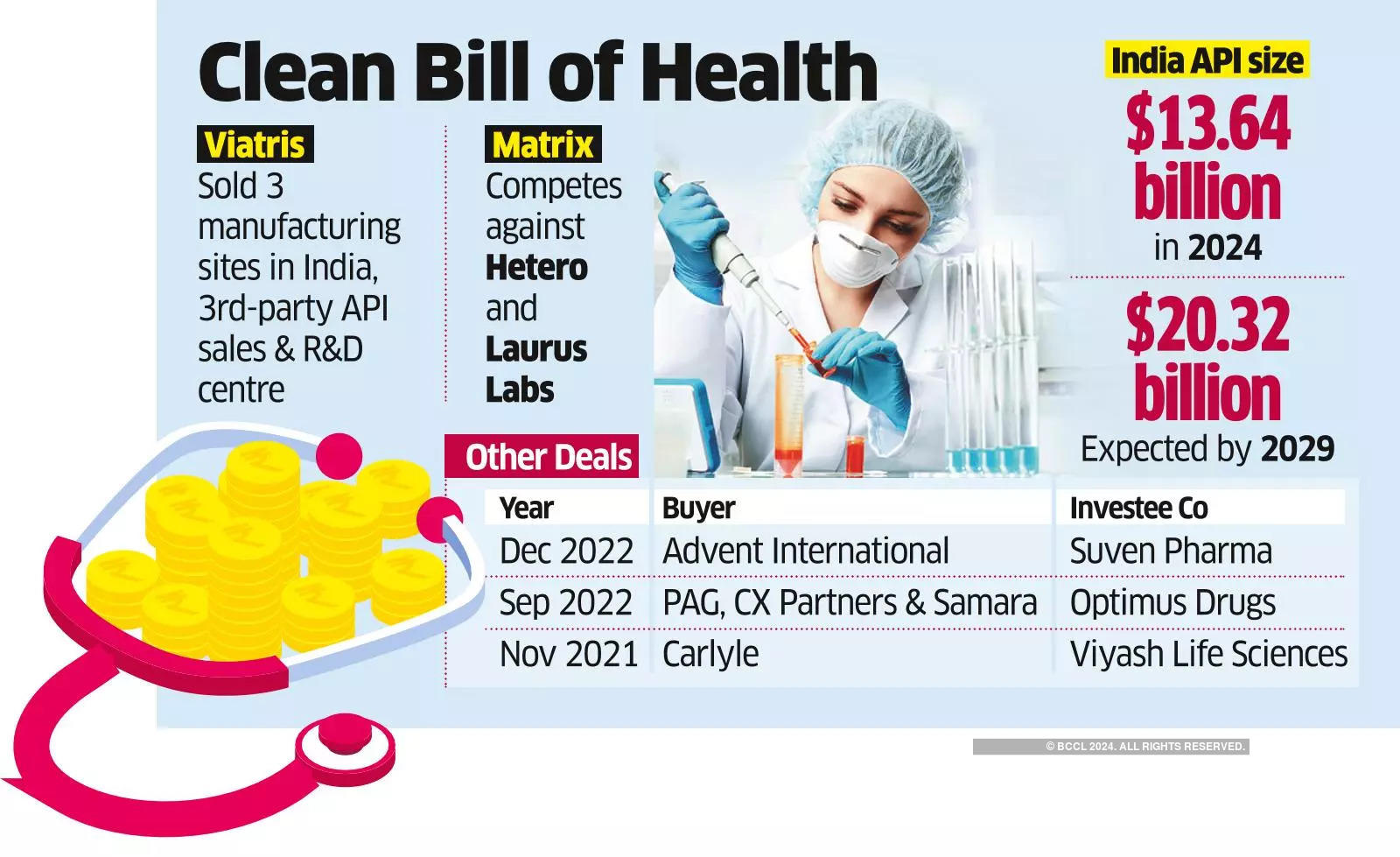

After this acquisition, Prasad’s company would be the second largest Indian API player with a global leadership in antiretroviral APIs. It would gain access to strong R&D capabilities, including 185 scientists and over 600 drug master filings. With regulatory approvals for the US and European Union, it is poised to leverage its long-standing relationships with global pharma companies.

In October last year (2023), Prasad, the Andhra Pradesh-based founder of Matrix Laboratories, agreed to buy the API business of US-based Viatris in India through his company Iquest Enterprises.

Under the deal, Prasad’s Iquest was agreed to buy three manufacturing sites and an R&D lab in Hyderabad and three manufacturing facilities in Visakhapatnam as well as take over third-party API sales. While the financial terms of the deal were not disclosed, ET reported last year that Viatris was seeking a valuation of $600-$700 million for the API business.

This acquisition marks the return of Prasad to the pharma business after about 17 years. He sold Matrix Laboratories in 2006 to Mylan NV (now Viatris) for an undisclosed amount.

“This buyout of a significant business along with key incumbent management coming on board, demonstrates Kotak Alt strong deal sourcing and structuring capabilities and also underscores our pharma industry capabilities and ability to create a platform to build a robust API business which we can support with organic and inorganic growth,” said Srini Sriniwasan, managing director, Kotak Alt.