Days after Deloitte bought BMR Advisors’ corporate tax team; KPMG on Thursday acquired the boutique firm’s mergers and acquisitions (M&A) and risk team.

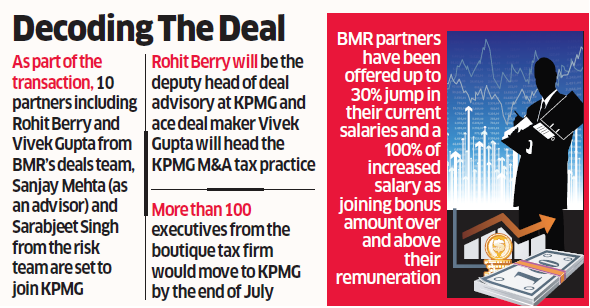

As part of the transaction, 10 partners including Rohit Berry and Vivek Gupta from BMR’s deals team, Sanjay Mehta (as an advisor) and Sarabjeet Singh from the risk team are set to join KPMG. More than 100 executives from the boutique tax firm would move to KPMG by the end of July.

According to people in the know, Deloitte and PwC were in race to acquire the M&A tax team. Talks were on with Deloitte after the BMR direct and indirect tax teams moved to Deloitte on Monday. But finally, the BMR partners opted for KPMG, a person in the know said.

ET had reported on July 16 that Deloitte, KPMG & PwC were in a close race to acquire different teams of BMR Advisors. BMR founding partners — Bobby Parikh and Mukesh Butani — were not part of any discussions. Sources said Parikh will most likely retire after the transaction and Butani will set up an independent law practice. Third founding partner of BMR Rajeev Dimri is set to join KPMG.

BMR was started in 2004 by ex-Arthur Andersen partners Bobby Parikh, Mukesh Butani and Rajeev Dimri, who had moved out of Big Four firm EY. The trio along with others had joined EY after Arthur Andersen wound up in 2001-02 in the wake of the Enron collapse. Under Bobby Parikh’s leadership, Andersen was India’s fastest growing and most profitable accounting firm.