Kumar Mangalam Birla flagship UltraTech is in advanced negotiations with the promoter of Orient Cement Ltd (OCL), his uncle CK Birla, after restarting talks in recent weeks, amid intensifying consolidation efforts in the sector, said people familiar with the discussions.

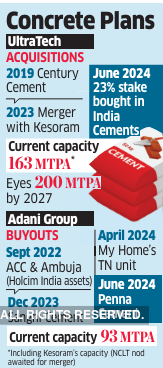

Kumar Birla’s renewed efforts to buy Orient are seen as an attempt to trump Adani Cement and consolidate UltraTech’s position in the southern and western markets, especially Maharashtra and Telangana, after buying a 23% stake in India Cements at the end of last month. Adani Cement, which controls India’s second largest cement capacity, has been engaged in talks with CK Birla since late last year but is said to have baulked at the valuation sought.

UltraTech’s spokesperson was unavailable for comment. Deepak Khetrapal, MD and CEO of OCL, denied discussions were taking place and any talk of sale plans was a “figment of one’s imagination.”

The promoter stake in Orient Cement held by the Birla family and private investment vehicles is 37.9%. The company has a market value of Rs 6,290.50 crore, having almost doubled from Rs 3,878 crore in October when ET first reported on CK Birla’s approach to Adani.

UltraTech is said to have offered a price of Rs 350-375 per share, a 22% premium to the current market price of Rs 307. In the past month, the Orient Cement stock has shot up 45%, hitting an all-time high of Rs 329 on July 1, largely on speculation that an acquisition deal was near conclusion.

The UltraTech offer translates to an enterprise value of Rs 7,300-7,800 crore ($840-$938 million) or $109-110 per ton based on Orient Cement’s current installed capacity of 8.5 million tons per annum, aligning with recent transactions in the range of $90-110 per ton for mid-tier companies. The India Cement investment by UltraTech at Rs 267 a share also translates to $93 per ton. Last month, the Adani Group, through Ambuja Cement, acquired South-based Penna Cement at $90 per ton. In 2019, UltraTech acquired the cement assets of Century Textiles at $91 per ton valuation and those of Kesoram Industries in November 2023 at an implied valuation of $95 per tonne through a share swap.

According to one of the persons cited, Adani’s offer was also contingent on obtaining environmental clearance for the expansion phase in Telangana, which the current Orient management was unable to commit to definitively.

“UltraTech’s offer carries weight due to the family association and cross holdings in Pilani Investments, holding company of the Birla family,” said one of the persons cited.

A formal announcement is expected before or during Orient Cement’s upcoming quarterly earnings scheduled for July 19. However, the final valuation is still being worked upon and the deal may not happen if there’s a mismatch, said the people cited. A successful closure will accelerate Birla’s plans to achieve a 200 million tons per annum (MTPA) capacity for UltraTech by 2027. At the end of May 2024, UltraTech’s capacity stood at 152.69 MTPA, excluding Kesoram’s capacity of 10.75 MTPA.

Mining Spoilts

Linkages to limestone mines are a key factor in determining cement asset valuations.

Following a government directive, Orient Cement transferred the mining lease held by it for limestone, a key raw material for cement, in the Ralli reserve forest in Telangana to Telangana State Mineral Development Corp. (TSMDC) in 2000. TSMDC in turn obtained renewal of the mining lease over an extent of 210 hectares and awarded the raising-cum-self consumption contract of the Devapura I Mines to Orient Cement to sustain its cement plant. TSMDC has been charging 25% royalty as premium for the limestone supplied. The average production is 3.101 MTPA.

In 2018 Orient Cement declared to double its capacity to 16 MTPA with an investment of Rs 2000 crore based on the supply contract of limestone from TSMDC (Devapura II Mines – 275 Hectors). To supply the limestone to Orient cement plant, TSMDC proposed to produce 9.06 million tonnes per annum (MTPA) of limestone from this mine eventually. The bilateral contract between Orient and TSMDC – is likely to come up for renewal by 2025 (for another 25 year tenure). The first lease of Devapura I was to get exhausted last year and therefore Devapura II (588 Hector) was proposed to supply both existing and expanded capacity of Orient Cement. The mining lease deed of Devapur II is believed to be still pending.

In its FY23 annual report, Orient Cement noted the reopening of its Rajasthan mines and its intention to enter Northern Indian markets with a greenfield capacity of over three million tons, diversifying its geographical reach to mitigate risks. This strategic direction has contributed to Orient Cement commanding a higher valuation compared to standalone regional cement companies.

According to one of the sources, Adani’s offer was also contingent on obtaining environmental clearance for the expansion phase in Telangana, which the current Orient management was unable to commit to definitively. The source added, “Ultratech’s offer carries weight due to the family association and cross holdings in Pilani Investments.”

Orient Cement reported a sales volume of 1.72 million tons per annum in the fourth quarter of FY24, with total sales for the year reaching 6.13 million tons per annum, as per the post-earnings transcript on the stock exchange. The company achieved 81% utilization in the fourth quarter, with sequential sales volume growth of 24%. Headquartered in Bhuvneshwar, Orient Cement saw its revenue grow by 8.5% to Rs 3200 crore in FY24, with net profit rising by 42% to Rs 174 crore. The company has been focusing on increasing the proportion of premium cement sales, which accounted for 22% of total volume in FY24, up from 14% in the previous fiscal year.