The private equity group that beat Reliance Industries in its biggest overseas bet ever, may turn out to be a strategic ally as Mukesh Ambani has sets his aim on another marque multi-billion dollar cross border buyout — Walgreens Boots Alliance Inc’s international chemist and drugstore units, said three people aware of the development.

Earlier in the week, Reliance formally teamed up with private equity giant Apollo Global Management for a consortium and jointly make a play for the potentially $9.5-$10 billion acquisition, the biggest for Ambani’s sprawling petrochemicals-to-retail business.

Apollo had beaten Ambani and scalped LloyndelBasell, in 2010 and then restructured the distressed chemical company into one of the biggest PE turnaround case study.

The combination’s chances have improved significantly over the last few days after the sale of the UK chemist, known popularly as Boots, have run into a series of difficulties after a potential buyers walked away and bidders raised concerns about financing a deal with markets in turmoil because of Russia’s invasion of Ukraine.

By the time Reliance had completed its own feasibility report, evaluating the target, Apollo had, on its own, already put in a non-binding bid, said sources involved. Reliance too wanted to join the fray but chose to team up with Apollo that already had a foot in the door, to leverage Apollo’s global expertise and financial heft. The strategic, fund offer will always have more value and both can sweat the asset best by extracting the most value,” said an official in the know. Reliance is also in early discussions with banks for financing.

Ambani has been pivoting his traditionally refining-focused conglomerate toward businesses that will better help him tap India’s billion-plus consumers.

Apollo declined to comment. Walgreens and Reliance have not generated a response as yet.

BOOT STRAPPING

A consortium of Bain Capital and CVC Capital, previously seen as a leading candidate to buy the business from US parent Walgreens Boots Alliance (WBA), when it was put up for sale initially to focus on retailing and an expansion of medical services in its home market. Bain and CVC They initially pursued the opportunity but opted out ahead of a deadline last month.

Reliance and Apollo are now expected to be competing with private equity buyout fund CVC Capital, brothers Mohsin and Zuber Issa who run a supermarket group Asda and PE firm TDR Capital. Asda group had even proposed either the supermarket group or alternately their owners could lead the buyout. Sources involved say TDR and the Issa family might also team up, just like they did to buy Asda’s UK operations. The deadline for the binding bids are due mid May.

Goldman Sachs is the sell side advisor in the sale for Walgreens.

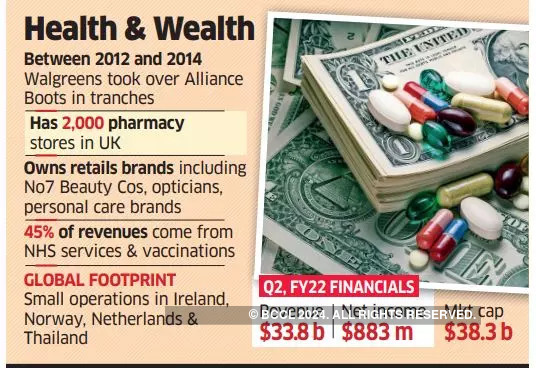

Boots, which has more than 2,000 stores in the UK alone, and brands such as No7 Beauty Company, was expected to attract strong buyer interest on the back of its market position and brand recall, stability of the pharmacy income and the potential for improving financial performance. Its plan B is to tap the public market for an initial listing wherein it may opt to keep a minority stake in Boots in any transaction, they said. It also has smaller operations in Ireland, Norway, the Netherlands and Thailand, as well as an optician business and a suite of private-label beauty and personal-care brands that could be included in a sale. The chain derives about 45 per cent of its revenue from providing services to the UK’s state-run health service, including prescriptions and vaccinations.

Walgreens has been shifting toward expanding into other health-care businesses in recent months, as drugstores face increased competitive pressure from Amazon.com Inc. and other online retailers. In October, it agreed to invest $5.2 billion in primary-care provider VillageMD, doubling its stake in the company.

Boots has a large defined-benefit pension scheme, which is in surplus but not by enough to allow a buyout by an insurer. That would leave any buyer taking responsibility for ensuring that the scheme remained adequately funded, unless Walgreens could be persuaded to retain it. However, industry analysts say, the business remains an attractive asset with huge potential in this company that can only expand in a post Covid environment where health is paramount. In UK, the NHS is looking to deliver more services through pharmacies. “The Ambani family is serious about living large parts of their free time in Europe and especially London where they have a home. They are a well-known brand in India but now they want to build their names in Europe and Silcon Valley,” said an old family friend who did not wish to be identified as these are all in private domain.

Shares of Walgreens, which also owns Duane Reade and Mexico’s Benavides, was trading at $44.42/piece on Wednesday, valuing the Deerfield, Illinois-based business at almost $38.3 billion.

HEALTH IS WEALTH

RIL’s health-tech strategy hinges on four key pillars — Online & offline pharmacies and has already started launching stores; doctor discovery and diagnostics services through its JioHealthHub apps ; Diagnostics; SaaS for doctors/hospitals and practice management. On the B2C front, Netmeds, a company it bought, allows users to order medicines online or buy offline through smart point stores. “We consider Reliance Industries diagnostics offering to be a cross-selling opportunity. Its wholesome ecosystem also gives consumers advantage of tele-consultation, allowing users to do everything in their user journey online,” said Sachin Salgaonkar, of BankofAmerica. “On the B2B front, KareXpert helps to digitize the entire hospital/clinic’s operations and use digital at the core of hospital’s operations. C-Square, another startup bet, helps provide a CRM platform for pharma marketing, distribution management solutions for distributors, ERPs for retail pharmacies and finally boost 360 Clinic helps doctors take their practices online and accept bookings through their own websites.”

Over time, Reliance is looking to offer its 500 million mobile users & 150 million retail users a variety of online & offline services including pharmacy, etc and in the process looking to increase its share of monthly household consumption spend. “In our view, RIL has a potential to emerge as one of the top 4-5 integrated healthcare players as the space consolidates on the back of its consumer connect (via Jio/retail) and its strong balance sheet,” adds Salgoankar.

CHASING APOLLO

The $489 billion investment group, that was under a cloud due to the alleged involvement of billionaire founding CEO Leon Black following an following an inquiry into his ties to the disgraced financier Jeffrey Epstein who has stepped down. Having backed Albertsons Companies, one of the largest food and drug retailers in the United States, Walgreens Boots Alliance in the UK and Europe has been a natural fit, said people familiar with the plan. As firm it has also invested or bought out several consumer facing businesses even in healthcare – it’s portfolio including RCCH Healthcare Partners, LifePoint Health.

The PE and alternative fund manager has not shied away from taking bigger, bolder bets several in consumer facing businesses. Just last week, Apollo bought out Tony Fresh Market, a Chicago based specialty grocer in line with its long list of successful investing in grocery chains — The Fresh Market, Sprouts Farmers Market, Smart & Final, through both past and present fund investments. Having backed Albertsons Companies, one of the largest food and drug retailers in the United States, Walgreens Boots Alliance in the UK and Europe has been a natural fit, said people familiar with the plan. As firm it has also invested or bought out several consumer facing businesses even in healthcare – it’s portfolio including RCCH Healthcare Partners, LifePoint Health.