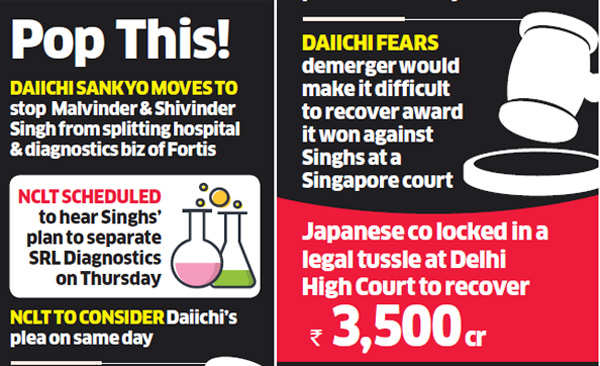

Japanese drugmaker Daiichi Sankyo has approached the National Company Law Tribunal (NCLT) in Chandigarh to stop former Ranbaxy promoters Malvinder and Shivinder Singh from splitting hospital and diagnostics businesses of Fortis HealthcareBSE -1.92 %, citing its ongoing legal tussle with the Singhs.

Just as NCLT is scheduled to hear the Singhs’ plan to separate SRL Diagnostics, India’s largest diagnostic chain, from its parent Fortis Healthcare, Daiichi Sankyo has filed an application with the tribunal seeking an intervention on the move. ET has reviewed a copy of this application.

Daiichi fears the proposed demerger— approved by Fortis Healthcare’s board last year-—would make it difficult to recover an award it won against the Singhs at a Singapore court last year. The Japanese firm is locked in a legal tussle at the Delhi HC to recover Rs 3,500 crore, including legal fees and interest, as part of the award.

“The demerger is being carried out in violation of the orders of the Delhi HC, and Daiichi Sankyo will avail all remedies in law to object to the demerger and will take action against all persons/entities, including third parties, who are carrying out the demerger in violation of the Delhi HC orders,” said P&A Law Offices, which is representing Daiichi Sankyo at the Delhi HC, in response to ET’s emailed queries.

The court had directed the Singhs to maintain the value of some unpledged assets being considered to pay Daiichi’s award if it is enforced, irrespective of any transactions that the brothers may enter into.

The development follows several attempts by Daiichi to stop the Singhs from selling their stake in entities like Fortis and Religare during the ongoing litigation.

ET reported on Wednesday that SRL is likely to be listed on Indian stock exchanges by August as part of the demerger scheme. The demerger is expected to unlock significant value for Fortis Hospitals’ shareholders and analysts believe that SRL will get a valuation of Rs 6,000-7,000 crore.

In its application to NCLT, Daiichi has alleged that the Singhs have failed to comply with an order to apply to the Delhi HC before changing the status of unencumbered assets of RHC Holdings Pvt Ltd and Oscar Investments Ltd—two of the respondents in its enforcement litigation.

The value of RHC and Oscar’s unencumbered assets is derived from the valuation of Fortis Healthcare and Fortis Hospitals, Daiichi claimed. The proposed scheme would change the status of the Singhs’ unencumbered assets and it was “necessary” for them to first seek permission from the Delhi HC before approaching NCLT for obtaining a sanction to the demerger scheme, it said.

“If the honourable tribunal sanctions the scheme, then it would dilute the proceedings before the Delhi HC,” said the application. NCLT is expected to consider Daiichi’s application on Thursday, the same day as the hearing on the Singh brothers’ demerger plan.