Lenders have entered the final stage of negotiation with Reliance Industries (RIL) after declaring it the highest bidder for Sintex Industries on Monday evening, said two people aware of the development.

At a committee of creditors’ meeting held on Monday evening, lenders asked Reliance Industries and Assets Care & Reconstruction Enterprise (ACRE) team to submit an improved offer by Wednesday, the people said.

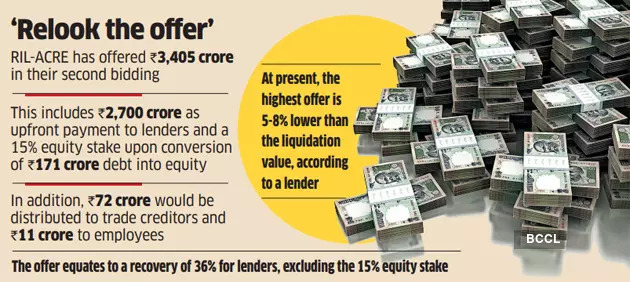

In most cases, lenders negotiate with the highest bidder to maximise recoveries from buyers of the bankrupt companies, said one of the lenders of Sintex. The Reliance-ACRE offer equates to a recovery of 36% for lenders, excluding the 15% equity stake.

Reliance Industries did not respond to the request for comments.

In the second round of bidding, the Reliance Industries-ACRE team has offered ₹3,405 crore, which includes ₹2,700 crore as upfront payment to lenders and a 15% equity stake upon conversion of ₹171 crore debt into equity, as reported by ET earlier. This apart, ₹72 crore would be distributed to trade creditors and ₹11 crore to employees. ACRE is an asset reconstruction company backed by Ares SSG Capital.

In the first round, the duo offered a 10% equity stake and an upfront cash payment of ₹2,280 crore to lenders.

The Reliance-ACRE team is among the four applicants that submitted a resolution plan for the Gujarat-based textile manufacturing company. The other three bidders were Himatsingka Ventures offering ₹3,297 crore, Welspun group entity offering ₹3,102 crore and GHCL ₹2,140 crore, as reported earlier.

Lenders expect the Reliance-ACRE team to improve the resolution plan by making an offer above the liquidation value, said one of the persons cited above. If the offer is above the liquidation value, the resolution professional (RP) would invite lenders to vote on the resolution plan. The liquidation value is 5-8% higher than the highest offer, said a lender but declined to give a number due to confidentiality issues.

The RP invited a second round of bidding early last month in hope of receiving improved offers that would be above the liquidation value.

Since the offers in the second round too were lower than the liquidation value, lenders are now negotiating with the highest bidder. In the past, lenders have considered various options such as holding a Swiss challenge auction and inviting fresh offers to get better offers.

The RP has admitted ₹7,534.6 crore of claims from 27 financial creditors.