Lenders to embattled Reliance Communications Ltd. have bought themselves some time in taking provisions on $7 billion of debt, but still face an uphill struggle in turning around the phone company.

Last week, the carrier currently controlled by billionaire Anil Ambani proposed banks convert about 15 percent of the loans owed to them into a 51 percent stake, a move facilitated by the central bank’s Strategic Debt Restructuring program.

The swap gives lenders an 18-month grace period during which they can try to revive Reliance Communication and avoid having to recognize losses on their loans. It’ll be a challenge, some analysts warn, given the harsh competitive pressures in India’s telecommunications industry.

“Keeping the business viable is going to be extremely difficult,” said Hemindra Hazari, an independent banking analyst based in Mumbai. “It would have been advisable for the banks to take the provisions hit now and move on.”

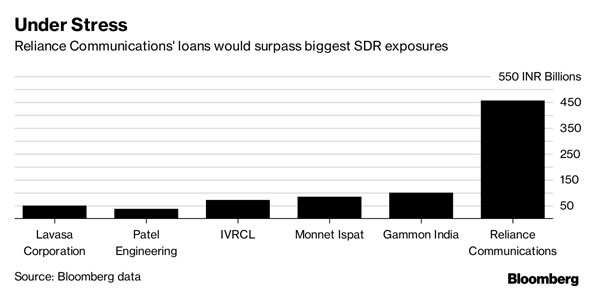

The track record of the handful of companies which have exited from the SDR program isn’t encouraging. Lenders to IVRCL Ltd., a construction firm, and steel and power producer Monnet Ispat Ltd. started setting aside provisions to cover about $3 billion in soured loans once their SDR grace periods expired.

Since the program started in June 2015, banks have converted, or sought to convert, about $31 billion of loans into equity in distressed companies, according to exchange filings. More provisions are likely as later entrants to the program start to emerge without a business turnaround.

“Time is running out for banks,” said Diksha Gera, a Bloomberg Intelligence analyst in Singapore. The provisions “will weigh down on their profits over the next few quarters.”

Distressed Assets

That will add pressure on beleaguered lenders already battling the highest ratio of stressed assets since 2001, which prompted the government to agree to a $32 billion recapitalization of state banks last month. Under the terms of the SDR program, they can end up burdened with majority stakes in distressed companies that they’re unable to sell.

The Reserve Bank of India unveiled the SDR in June 2015 in a bid to help lenders combat an explosion in bad debt. The program allows them to convert loans into controlling stakes if the change is likely to improve the economic value of the debt and the prospects for its recovery. Banks can install managers of their choice to address inefficiencies. The goal is to revive the company and sell the equity within 18 months, after which lenders will have to recognize provisions for loan losses.

Trouble is, banks have had little success in finding industry specialists to replace managers at companies in the SDR program, making turnarounds almost impossible. Even after the RBI eased some restrictions over the sale of equity stakes in February 2016, there still hasn’t been a successful exit from any of the SDR accounts.

Price War

Reliance Communications is now poised to hand over control to its lenders, which include Punjab National Bank and Bank of Baroda. The carrier has had a rough few weeks, which included announcing the collapse of a merger that could have helped it pare debt. It’s exploring the sale of assets such as spectrum, phone towers and real estate that could raise as much 270 billion rupees for loan repayments, it said last week.

Like other smaller operators in India’s mobile market, Reliance Communications has seen revenue dwindle thanks to a vicious price war that erupted after Reliance JioInfocomm Ltd. — controlled by Ambani’s brother Mukesh — entered the market in September 2016. In August, Reliance Communications reported a quarterly loss of 12.3 billion rupees.

Source: Economic Times