LIC Mutual Fund has started the process of absorbing IDBI Mutual Fund to fulfil regulatory norms after two attempts to find a buyer for IDBI Mutual Fund failed.

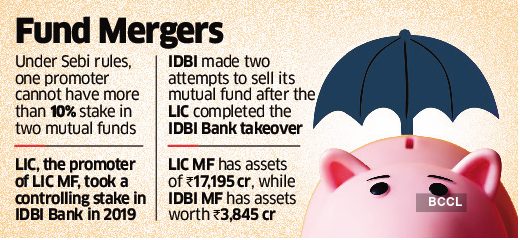

IDBI Bank-promoted IDBI MF had to be either sold or merged with LIC MF because, under Sebi rules, one promoter cannot have more than 10% stake in two mutual funds. Life Insurance Corp of India (LIC), the promoter of LIC MF, took a controlling stake in IDBI Bank in 2019.

“As part of regulatory compliance, LIC MF proposes to takeover schemes of IDBI MF, subject to regulatory approvals,” said T Ramakrishnan, MD, LIC Mutual Fund. “This proposed scheme acquisition transaction will result in merger of like-to-like schemes wherein unique schemes of IDBI MF will continue on a stand-alone basis with the acquiring entity and the merger process is underway.”

Valuations have been completed and both sides will approach the Securities and Exchange Board of India later this month to start the process. The merger is expected to be completed this quarter, said a person who didn’t want to be named.

“There are some matters of tax to be clarified because this is a merger of schemes and not a share sale as the promoter is the same,” said a second person aware of the plans. “So the 18% GST has to be factored into the valuations. All formalities will be completed by the end of the month.”

IDBI made two attempts to sell its mutual fund after the LIC completed the IDBI Bank takeover. In November 2019, Kerala-based non-banking finance company Muthoot Finance had signed a share purchase agreement to acquire IDBI MF for ₹215 crore. However, after almost a year of waiting, the deal fell through because the Reserve Bank of India (RBI) did not give its assent.

“Another attempt was made to find a buyer after this but the valuations were not up to the mark, so it was thought that it is better to merge the schemes with LIC MF,” said the first person cited above. “Both companies have some synergies with IDBI MF strong on equity schemes and LIC MF stronger on the debt side so it was thought, instead of selling it cheap, why not merge it and make it stronger?”

The ₹215 crore valuation offered by Muthoot included the cash with IDBI MF. The latest deal will discount the cash in the company, which will be transferred to IDBI Bank. IDBI MF did not respond to an email seeking comment.

“The bouquet of products offered by the combined entity will increase sharply and the total equity assets will get a step up,” said Kaustubh Belapurkar, director, fund research, Morningstar India.

Sebi rules on categorisation of schemes stipulate that a fund house can have only one scheme in each category and any duplicates need to be consolidated. Hence, mergers are the best fit for fund houses when schemes don’t overlap. Both are relatively small in the ₹37.22 lakh crore mutual fund industry. LIC MF has assets of ₹17,195 crore and is ranked 22 out of 43, while IDBI MF has assets worth ₹3,845 crore and is ranked 30.

While LIC has a larger presence in the debt and passive equity products space, IDBI MF is strong in the actively managed equity funds space. A few schemes in the equity space – large cap, large and midcap, tax saver and flexi cap – are common between the two. IDBI MF has focused, value, midcap, health care and small cap schemes, which are not present in the LIC portfolio.