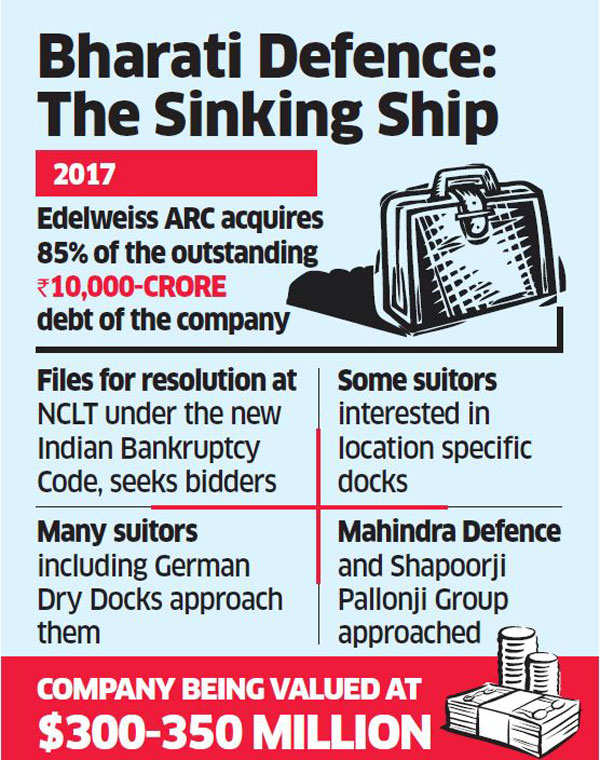

Mahindra Defence and Shapoorji Pallonji Group may independently bid for the troubled Bharati Defence and Infrastructure (formerly Bharati ShipyardBSE 4.89 %) in the first such bankruptcy resolution attempt under the Insolvency and Bankruptcy Code for the security industry.

The two companies are currently evaluating the deal that values the target company at $350 million, said three people with direct knowledge of the development.

Bharati has also seen interest from other suitors such as German Dry Docks and other companies seeking to control individual docks along India’s eastern and western water margins.

“Mahindra Defence and Shapoorji Pallonji group have been approached and they are currently carrying out due diligence on the company,” said one of the persons with direct knowledge of the development. EY is acting as advisor to the lenders.

Bankers now have to take a call on liquidating the company that has been taken to the National Company Law Tribunal (NCLT) by the asset reconstruction arm of EdelweissBSE -1.56 %, which has a controlling stake in it through pledged shares.

“This opportunity has been presented to us. However, we have not put in any formal bid as of date for Bharati Shipyard,” a Shapoorji Pallonji Group spokesperson said in an e-mailed response to queries from ET.

“Given our significant presence and strengths in the infrastructure sector, our strategy and business development teams are regularly evaluating opportunities.”

Edelweiss declined to comment, and Bharati couldn’t be immediately contacted. Mahindra spokespersons were traveling and could not be reached.

Mahindra Defence considered acquiring Pipavav DefenceBSE 1.02 % in a Rs 3,000-crore deal in 2015. However, the Anil Ambani-led ADAG bought the company in a slump sale. “Mahindra Defence has been actively looking at acquisition opportunities and this could be an ideal fit,” said another person with knowledge of the development.

Earlier this year, creditors led by Edelweiss, which owns 85% of the Rs 10,000-crore debt of the company, filed a case at NCLT seeking permission to turn around the company under new management. Creditors have proposed a revival package for the ailing company under the Insolvency and Bankruptcy Code. This will require infusion of Rs 400 crore initially.

The new code requires lenders to approach NCLT with a concrete revival plan, which, if approved, has to be set in motion within 180 days.

Edelweiss has appointed former naval officer Narendra Kumar as CEO of the company.

“Edelweiss has approached the court and got a restraining order for the promoters from coming to the office,” said another person. The fund is now looking at giving the company a fresh infusion of capital to ensure some orders are delivered to the Coast Guard and the Indian Navy.

Edelweiss’s Distressed Assets Resolution Business could play a role in the revival. It is unclear whether CDPQ of Canada, which has an agreement with Edelweiss, will invest in the company, ET reported in August.

Source: Economic Times