Max Healthcare Institute and KKR & Co have initiated separate discussions with TPG to buy Care Hospitals after earlier frontrunner Blackstone pulled out due to a valuation mismatch, said people with knowledge of the matter. This follows a full-blown auction process that ran for several months, drawing interest from Temasek-backed Shears Healthcare, CVC Capital, Carlyle and the Ahmedabad-based Torrent Group.

With valuation sliding to ₹5,800-6,000 crore from the original ₹7,000-8,000 crore ask, fresh conversations – albeit preliminary in nature – have begun, said the people cited above.

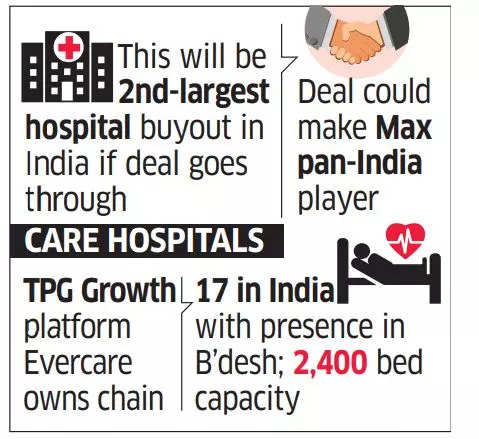

Among the largest hospital chains in India, Care Hospitals has a predominantly southern India footprint, which gives Max the chance to become a pan-India player.

FY23 Revenue Seen at $340M

The 2,400-bed hospital chain is owned by TPG Growth platform Evercare.

In 2018, Evercare acquired the healthcare portfolio of UAE’s Abraaj Growth Markets Health Fund, which owned a majority stake in Care Hospitals.

Investment banks Rothschild and Barclays have been advising TPG on the sale process.

KKR was the original backer of Abhay Soi-led Radiant Healthcare, which subsequently merged with listed Max Healthcare. Care has 17 hospitals in the country, with a presence in Bangladesh. Care Hospitals is expected to post revenue of $340 million in FY23 with an ebitda of $75 million, against $211 million revenue and $47 million ebitda in FY22, said one of the persons cited above. Revenue is expected to expand 15-29% this financial year.

Started in 1997 as a 100-bed cardiac hospital in Hyderabad, the chain has expanded into a network of 17 healthcare facilities in six states, with more than 2,400 beds offering 30 clinical specialties in India and Bangladesh.

If a deal takes place, this will be the second-largest hospital buyout in India after the IHH-Fortis transaction of 2018. However, there is still no guarantee that these fresh discussions will yield a concrete result.

ET in its November 7 edition was the first to report on Blackstone and Shears emerging as frontrunners in a keenly contested bidding process. Shears opted out first leaving Blackstone as the sole firm bidder around December but then with a wide gap in valuations, the negotiations did not fructify.

A Max spokesperson declined to comment. TPG and KKR spokespersons didn’t respond to queries.

Max vs KKR

KKR divested the last of its 47.2% stake in Max Healthcare last August with a fivefold return, marking its largest exit from an Indian investment so far. The final tranche of 27.5% was sold to financial institutions and pubic market investors such as the Government of Singapore, Monetary Authority of Singapore, BNP Paribas, WF Asian Smaller Companies Fund and WF Asian Reconnaissance Fund.

Entrepreneur Abhay Soi is now the sole promoter of Max with 23.78% and is chairman and managing director.

Last year, KKR had been keen to acquire up to 48% stake in Manipal Health Enterprises, valuing the south-based hospital chain above Rs 35,000 crore. However, those discussions also foundered on price.

Max Healthcare operates 17 facilities in India with over 3,400 beds. It has more than doubled its ebitda from Rs 590 crore in FY20 to Rs 1,390 crore in FY22 while average revenue per occupied bed (ARPOB), occupancy, ebitda per bed and return on capital employed (ROCE) are the best in class, according to a recent Jefferies report. The brokerage sees a 1,500-bed addition by FY25.

“Improved payer mix should allow gradual margin expansion in the existing operations,” said Alok Dalal of Jefferies. “Max will not leverage the balance sheet beyond net debt to ebitda.”

The Max board has approved a resolution to raise Rs 4,200 crore through non-convertible debentures (NCDs) for future M&A activities but also guided that net debt/ebitda will not exceed 2 to 2.5x. The stock has risen fourfold since its listing in 2020.

The Indian healthcare delivery industry has been growing at a compounded annual growth rate (CAGR) of about 12-14% over FY16-20 and is estimated to reach about Rs 7.3 lakh crore by FY24E. Since the abatement of Covid, the industry has witnessed a sharp recovery in the top line driven by higher occupancy, release of deferred non-Covid surgeries, higher average revenue per occupied bed (ARPOB) and increased bed capacity of hospital chains. Moving forward, prudent expansion plans of hospitals, better health insurance penetration, increasing investment in the healthcare industry and increasing public and private healthcare expenditure are expected to aid the Indian healthcare industry, said the Care Ratings report.

India still lags behind other developed and emerging economies in healthcare infrastructure, where India only has 12 beds per 10,000 people against the global median of 29 beds. In addition to this, medical tourism offers significant potential as well.

Source: Economic Times