India’s largest merger and acquisition deal in the media and entertainment (M&E) sector has concluded, with the merger of Viacom18’s TV and digital businesses into Star India securing all necessary regulatory approvals in India and abroad.

In February, Reliance Industries (RIL), Viacom18 Media and The Walt Disney Company had signed an agreement to combine Viacom18 and Star India’s assets to create India’s largest M&E company valued at ₹70,352 crore ($8.5 billion).

Additionally, RIL has invested ₹11,500 crore ($1.4 billion) into the joint venture -Star India, also known as Jio Star-to be chaired by Nita Ambani with Uday Shankar as vice chairperson, providing strategic guidance.

RIL has also bought out Paramount Global’s 13.01% stake in Viacom18 for ₹4,286 crore, increasing its holding to 70.49%, followed by 15.97% by Bodhi Tree Systems and 13.54% by Network18 Media & Investments, on a fully diluted basis.

At the closing of the transactions noted above, post-merger Star India will be controlled by RIL and owned 16.34% by RIL, 46.82% by Viacom18 and 36.84% by Disney.

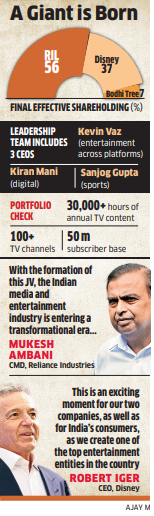

The effective shareholding will be 56% by RIL, 37% by Disney and 7% by Bodhi Tree, due to RIL’s majority shareholding in Viacom18 and Network18.

The JV will be spearheaded by three CEOs – Kevin Vaz, who will head the entertainment business across platforms; Kiran Mani, who will take charge of the combined digital business; and Sanjog Gupta, who will lead the combined sports business.

The combine now owns two strong linear brands in TV broadcasting – Star and Colors – and digital streaming – JioCinema and Hotstar. The JV operates over 100 TV channels and produces 30,000+ hours of TV entertainment content annually. The JioCinema and Hotstar digital platforms have an aggregate subscription base of over 50 million.

Star India will be one of the largest M&E companies in India with pro forma combined revenue of approximately ₹26,000 crore ($ 3.1 billion) for the fiscal year ended in March 2024.

The Competition Commission of India (CCI) approved the transaction on August 28, 2024, subject to the compliance with certain voluntary modifications offered by the parties including selling seven linear TV channels and not bundling TV and digital ad slots for cricketing rights.

“With the formation of this JV, the Indian media and entertainment industry is entering a transformational era.” Reliance Industries chairman Mukesh D Ambani said.

Disney CEO Robert Iger said, “By joining forces with Reliance, we are able to expand our presence in this important media market and deliver viewers an even more robust portfolio of entertainment, sports content, and digital services.”

Source: Economic Times