The government must back state control of Vodafone Idea (Vi) by quickly merging it with Bharat Sanchar Nigam (BSNL) and recapitalise the ailing telco to save it from going bankrupt, especially after the Supreme Court ruled out any relief on its huge adjusted gross revenue (AGR) dues, brokerage Deutsche Bank said.

“…the only viable solution is for the government to recapitalise Vi by converting its debt into equity, preferably while merging it with BSNL, and then providing it a clear commercial mandate based on profitability targets and incentives,” Deutsche Bank said in a note seen by ET.

It added that “should this happen, Vi’s shareholders would be heavily diluted as government debt is roughly six times the (telco’s) current market cap, and such a solution might be an acceptable outcome to shareholders, with a $20 billion enterprise value feasible and non-dilutive”. Shares of India’s only loss-making private telco, which reported a negative net worth of ₹38,228 crore at the end of March, closed 0.8% down at ₹8.29 on Monday on the BSE, giving it a market cap of ₹23,821.64 crore.

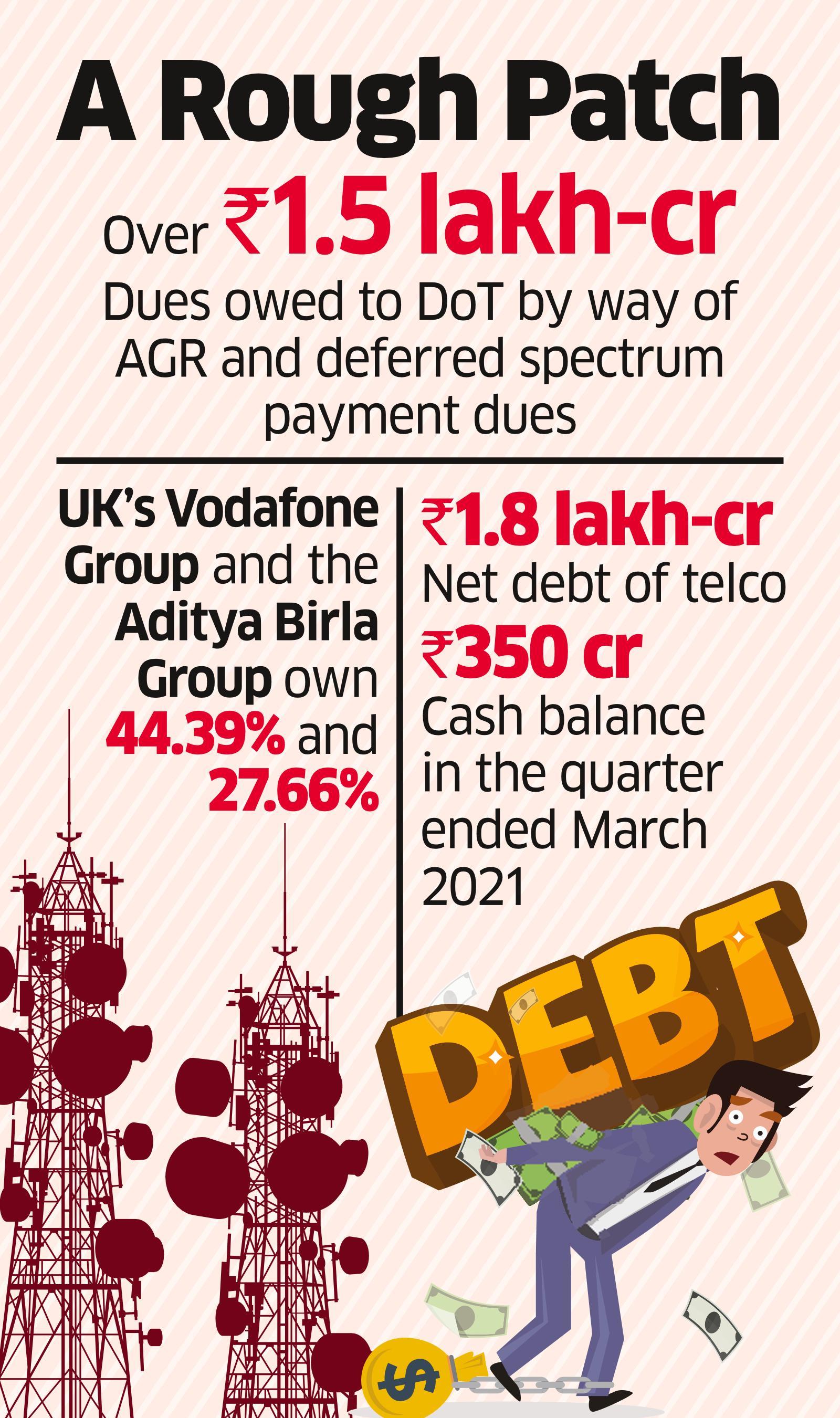

Accordingly “there is a slim chance that the government could salvage this, especially as it stands to lose if Vi were to end up in NCLT”. Brokerage Kotak said as things stand, Vi’s cash flows are likely to fall short by at least $3.1 billion (₹23,500 crore) in FY23, given an AGR instalment of ₹9,000 crore, spectrum payments of ₹15,900 crore, interest cost of ₹2,500 crores on the non-government borrowings and low run-rate of capital expenditure at ₹6,200 crore.

Analysts said Vi would require several things to fall in place to continue operating as a going concern, including a further moratorium from the government on spectrum payments, a coordinated tariff hike in the industry supported by floor pricing and a material reduction in licence fees and spectrum usage charges to improve operating economics of the telecom sector.

Deutsche Bank added that despite all “talk” of the Indian government wanting three private players, “there has been insufficient action to take that claim very seriously”.