A merger with an existing private sector bank or a non-bank finance company was among options proposed for IDBI Bank at recent roadshows held to assess interest for the privatisation of the lender, according to people aware of the matter.

The option was proposed by some of the participants at the roadshows who were of the view that an all-cash offer for the bank would work out to be too costly.

As many as 18 participants attended the investor meetings, or roadshows, organised by the advisers to IDBI Bank’s sale process. They included private banks, non-bank finance companies and some local private equity funds.

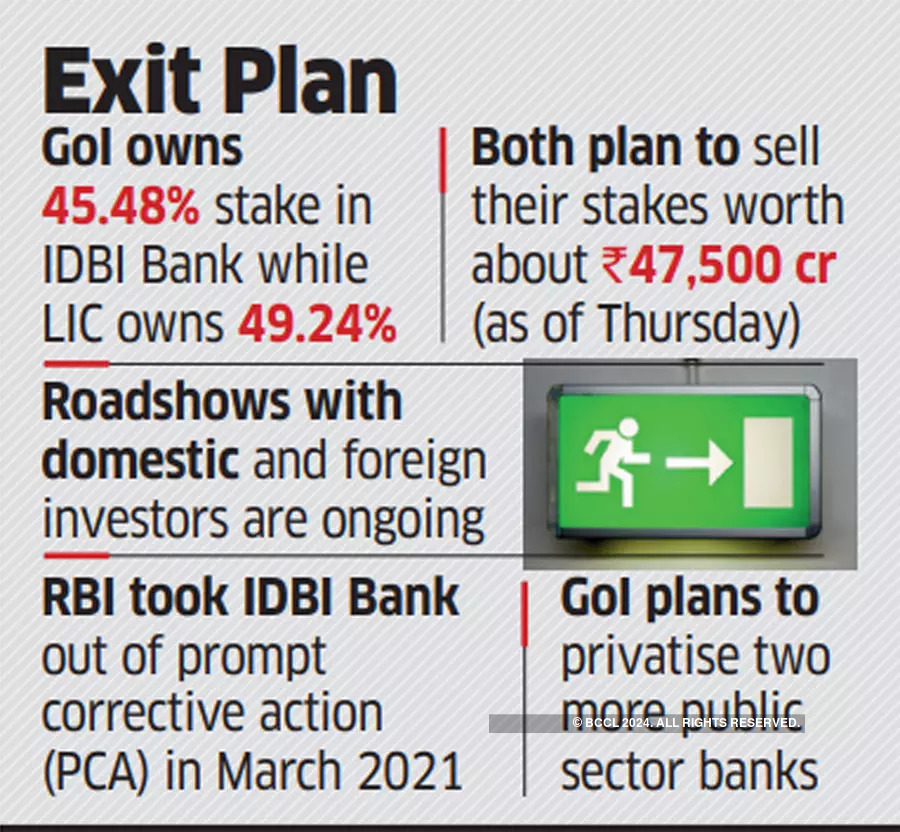

The government and state-run Life Insurance Corporation of India together hold 95% of IDBI Bank. Their stake is worth about ₹47,500 crore (about $6.2 billion) based on the lender’s market cap of nearly ₹50,000 crore on Thursday.

Govt Could have Reservations

However, according to people in the know, the government could have reservations over a structure that would involve a merger with an existing entity, because that would not lead to disinvestment and only result in its existing shares in IDBI Bank being swapped for another in a new merged entity.

The government in that case would remain a shareholder, maybe even as a fringe one, and that would defeat the purpose of getting out of the businesses all together.

Moreover, in a share-swap deal, the government may not immediately get the money for its stake.

Queries emailed to Department of Investment and Public Asset Management secretary Tuhin Kanta Pandey did not elicit a response until press time Thursday.

The government had first announced its plans for the privatisation of IDBI Bank in February 2021 and intended to complete the process in the fiscal year ended on March 31, 2022. It subsequently also announced that two other public sector banks could be privatised.

It has yet to call expressions of interest (EoIs) to formally invite bidders to participate in IDBI Bank’s privatisation process. The EoI is usually the first step in the process which is followed by vetting of the applications of the potential bidders and signing of non-disclosure agreements before a formal request for proposal is issued to shortlisted applicants.

The privatisation plans of other government-owned companies, such as Bharat Petroleum Corp, Shipping Corporation of India and Container Corporation of India have all been running behind schedule.

The number of government-owned banks has more than halved from 2017, when the government-owned 27 banks. Those have now reduced to 12 due to a series of mergers involving the existing entities. Though banking has been earmarked as a strategic sector, the government will look to further reduce its presence over time.

The IDBI Bank privatisation process will be the first case in India’s banking sector of voluntary discovery of the buyer through an open bidding process. However, potential buyers will undergo Reserve Bank of India’s scrutiny for ‘fit and proper’ norms to be eligible to acquire the public sector entity.