Bharti AirtelBSE 0.01 % will emerge stronger in the enterprise and undersea cable business and narrow the gap with the Vodafone-Idea combine in mobile service revenue market share (RMS) if the Sunil Mittal-led Bharti Enterprises and the Tatas form an alliance, analysts said.

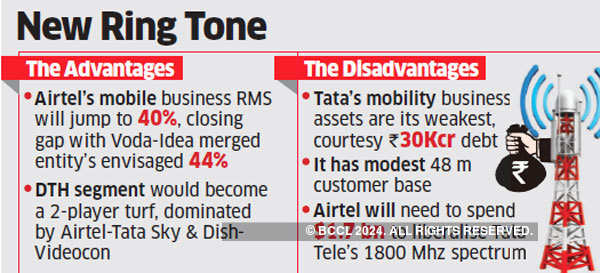

However, Airtel will face some challenges from a merger: over Rs 30,000 crore in debt and a modest 48 million subscribers of Tata’s mobile service business, breach of market share cap in eight circles, and the need to spend $1.7 billion (over Rs 11,000 crore) to pay market rates for airwaves in the 1800 MHz band held by Tata Teleservices to use them for 4G, they said.

Bharti Enterprises and the Tata Group held exploratory talks to evaluate a mega alliance involving their telecom, enterprise services, overseas cable and direct-to-home TV businesses, ET reported last week. Both entities have not commented on the matter.

If a deal gets confirmed “and subsequently completed, Bharti Airtel would have an RMS of 40% on the cellular business front, closing the gap with the potential Idea-Vodafone merged entity (that will command a 44% RMS),” Bank of America-Merrill Lynch said in a note to clients. At present, Airtel’s RMS is 33%.

BankAm-Merrill Lynch said the DTH industry would turn into a two-player market with an Airtel-Tata Sky combine commanding 43% of the subscribers and Dish-Videocon controlling 45%. Edelweiss backed the view and said such a potential merger would strengthen the bargaining power of DTH companies and help lower content cost.

Experts see strong business sense for Airtel to buy both the listed Tata Communications, a provider of network, cloud and security services, and Tata Sky.

“TataComm potentially brings a lot of value to the table by virtue of its sizeable intra-city fibre resources, its sub-sea cable system assets coupled with its strong enterprise business which would complement Airtel’s,” said an analyst at a Mumbai-based brokerage.

Brokerages also foresee minority/strategic stakeholder interests in Tata group outfits such as the listed Tata Communications and Tata Sky as a potential hurdle.

Edelweiss said minority stakeholders like the government – which owns 26% of Tata Communications – and Rupert Murdoch’s 21st Century Fox (owner of 30% in Tata Sky) “may not find their strategic stakes relevant in the combined (Tata-Bharti) entity and alignment of their interest could be a challenge.”

Among the challenges are Tata group’s mobility business assets, analysts said.

BankAm-Merrill Lynch said the Tatas’ holding of spectrum in the 850 MHz band may prove inadequate for Bharti Airtel to launch full-scale 4G LTE. Since the Tatas have 2.5 MHz of airwaves in the 850 MHz band, which are expiring in a few years, such spectrum can be used only for narrow-band LTE, the US brokerage said.

Edelweiss said the synergy benefits “are not meaningful” because a significant chunk of Tata’s spectrum holdings are unliberalised, for which market prices haven’t been paid.

BankAm-Merrill Lynch estimates Bharti would need to invest $1.7 billion to liberalise Tata Tele’s 1800 MHz spectrum and would also cross the revenue cap in eight circles.

India’s telecom M&A norms require a single entity’s revenue and subscriber market share to be below 50% and spectrum holding to be below specified caps.