A difference over valuations is holding back the proposed $1.5-2 billion purchase of shares in Bharti Airtel by founder Sunil Mittal’s family from Singapore Telecommunications Ltd (Singtel), said people with knowledge of the matter.

Singtel and the Mittal family are shareholders in Bharti Telecom, a promoter company of Bharti Airtel. In addition, both own shares directly in Bharti Airtel.

ET was the first to report on May 26 that Singtel had initiated talks with Bharti Airtel chairman Sunil Mittal to sell a small part of its holding in the Indian telco to the Mittal family as part of its portfolio management strategy. The long-standing Singaporean partner is keen to book some profit by selling Bharti shares and redeploying some of the capital in new investment opportunities.

Sources in both companies said the Mittals were initially keen to complete the acquisition of shares by early June. They were also in active dialogue with banks such as DBS, Standard Chartered, Citi, JP Morgan, MUFG and Goldman Sachs and had even lined up $1.5 billion of credit lines–as rupee debt or via the foreign portfolio investor (FPI) route–for the acquisition of shares.

“They have certainly not abandoned it but it’s got pushed out,” said an executive. “And one of the key factors is the valuation mismatch. The Bharti stock has been quite volatile in recent months. ”

In May, the Airtel stock was 33% higher than in the year before although it is down from its high of Rs 781.80, which it touched on November 24. In the past three months, it’s dropped 12%. The stock ended Wednesday at Rs 693.95, up 1.41% from the previous day.

People familiar with the matter said the delay in closing the deal and the imminent 5G spectrum auction may mean the transaction is predicated on the strategy the partners adopt during the bidding process and how much money will need to be raised to acquire the airwaves, they said.

Bharti and Singtel didn’t respond to queries.

Prized possession

Singtel has been a shareholder in Bharti Airtel since 2000. The Mittal family and Singtel own 50.56% and 49.44%, respectively, in Bharti Telecom, which in turn holds a 35.85% stake in Bharti Airtel. In addition, Singtel and the Mittal family through investment companies directly hold 14% and 6.04% in the telco. The effective shareholding of the Mittal family in Bharti Airtel is 24.13% while that of Singtel is 31.72%.

The plan was for the Mittals to acquire about 4% of what Singtel owns in Bharti Airtel, or a 2% stake sale in Bharti Telecom, as an inter-promoter transfer of shares. Selling Bharti Airtel shares worth $1.5 billion would have reduced Singtel’s holding to less than 28.6% while divesting shares worth $2 billion would have lowered it to 27.60%, said people with knowledge of the matter.

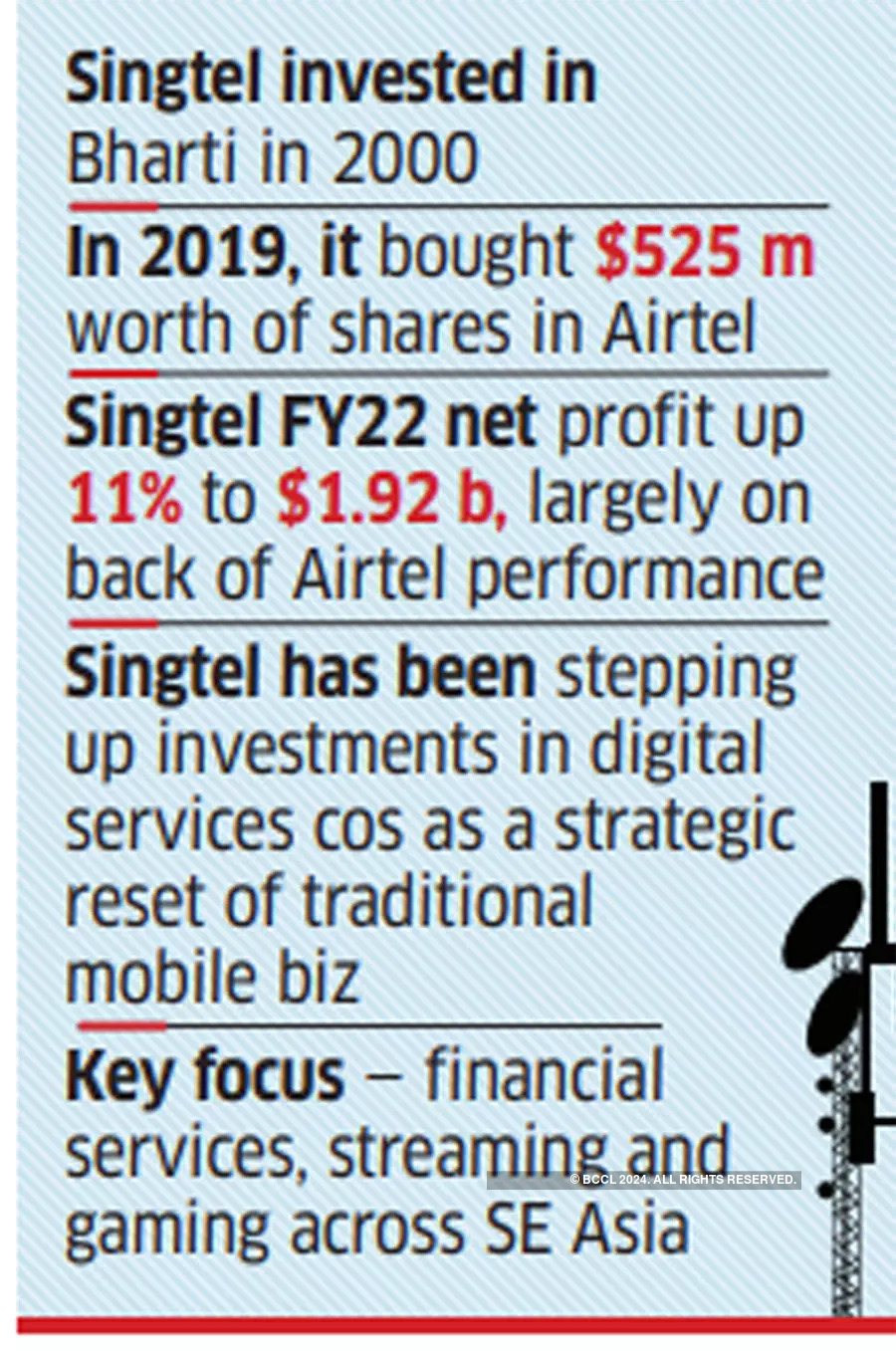

At the end of May, Singtel said its underlying net profit for fiscal year 2022 grew 11% from the year before to S$1.92 billion, mainly lifted by associate company Bharti Airtel’s turnaround. It posted a nearly 164% on-year jump in consolidated net profit to Rs 2,007.8 crore in the March quarter, its sixth successive quarter in the black.

Singtel group CEO Yuen Kuan Moon said in a May 27th statement that its regional associate’s pre-tax contributions rose 21% to S$2.07 billion “driven by Airtel’s double-digit increases in operating revenue and ebitda as it staged a sturdy recovery in India and saw sustained growth in its African operation.”

In an earlier statement to ET, a Singtel spokesperson had said: “We’ve been strategic investors in Airtel for decades and it remains a core investment in our international portfolio. We have not hired a bank to explore such a sale and we will not comment on any market speculation. We abide by market disclosure rules to report all material transactions.”

5G auctions this month

With staggered spectrum purchase payouts as per the new relaxed payment regime offered by the government, analysts expect an initial outgo for buying 5G and other airwaves to be less than Rs 5,000 crore for operators like Bharti Airtel and Reliance Jio Infocomm. Motilal Oswal’s pegs Bharti Airtel’s total spending at Rs 15,000 crore ($2 billion) to Rs 20,000 crore ($2.5 billion) in the upcoming auction. Experts expect Airtel to raise equity–rights or preferential allotments–and debt as it has done in the past. The Singtel stake sale, many expect, is likely to happen at that juncture.

Last October, Airtel had raised around Rs 5,247 crore as the first tranche of its Rs 21,000 crore rights issue. The remaining Rs 15,753 crore will be raised after the 5G auctions.

Analysts estimate that Airtel’s rights issue requires its promoters, Singtel and Bharti Enterprises of the Mittal family, to contribute around Rs 6,661 crore and Rs 5,067 crore, respectively. If Singtel does not fully subscribe to it’s quota of “rights” and it’s share is transferred and subscribed by Bharti, then too the shareholding will get recalibrated or adjusted, giving the same outcome in favour of the Mittal family.

In 2019, Singtel bought shares worth $525 million in Airtel, which was in the midst of a fund-raising spree to boost its balance sheet amid the need to make statutory payments and invest in its network to better compete with rival Reliance Jio.

Earlier this year, Google agreed to invest $700 million (Rs 5,224.4 crore) from its $10 billion Google for India Digitization Fund to buy a 1.28% stake in Bharti Airtel through a preferential issue of shares at Rs 734 apiece. The remaining $300 million will be used over the next five years for multiple commercial agreements, such as Bharti Airtel’s plans to make smartphones more affordable to get about 350 million users of feature phones to upgrade to devices that support online access.

Telecom analysts see Q1FY23E to have slower mobile revenue growth due to subs decline for Bharti and Vodafone Idea Limited; fewer 4G net add due to lower smartphone sales, thus, not much advantage of premiumisation; negligible benefit of Dec’21 tariff hike, except for RJio which will benefit on higher proportion of long validity recharge subs.

“Bharti’s India EBITDA will be up 1.6% QoQ (25.2% YoY) and incremental EBITDA margin will be restricted from higher diesel prices. Bharti’s Africa dollar revenue and EBITDA will rise 0.8% QoQ to $1.2billion and 0.5% QoQ to $579 million, respectively,” feels Sanjesh Jain of ICICI Securities.

“On a consolidated basis, we anticipate Bharti EBITDA margin to decline 145bps QoQ due to inflationary cost pressures. Key things to watch will be management commentary on 5G rollout, 4G subscriber addition, and traction in home broadband and other new initiatives,” adds Pranav Kshatriya, of Edelweiss.

The plan was for the Mittals to acquire about 4% of what Singtel owns in Bharti Airtel, or a 2% stake sale in Bharti Telecom, as an inter-promoter transfer of shares. Selling Bharti Airtel shares worth $1.5 billion would have reduced Singtel’s holding to less than 28.6% while divesting shares worth $2 billion would have lowered it to 27.60%, said people with knowledge of the matter.

At the end of May, Singtel said its underlying net profit for fiscal year 2022 grew 11% from the year before to S$1.92 billion, mainly lifted by associate company Bharti Airtel’s turnaround. It posted a nearly 164% on-year jump in consolidated net profit to ₹2,007.8 crore in the March quarter, its sixth successive quarter in the black.