Mahindra & Mahindra, India’s leading utility vehicle maker is seeking approval from the National Company Law Tribunal for a merger of Mahindra Electric Mobility Ltd to itself – i.e. Mahindra & Mahindra Ltd.

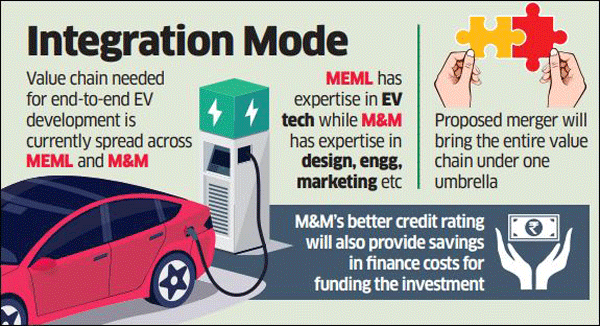

Seeking the tribunal’s approval for the merger – M&M explained that the value chain required for end-to-end EV (Electric Vehicles) development, manufacturing and sales is currently spread between M&M and MEML and it needs to be consolidated.

“MEML has expertise in EV technology while M&M has expertise in automotive design, engineering and manufacturing, sourcing network and sales, marketing & service channels,” stressed the company through its lawyers. “M&M also envisages significant investments in the EV business to scale up the business and develop a robust EV product pipeline for which the proposed consolidation will be critical. Further, M&M’s better credit rating will also provide significant savings in finance costs for funding the investment,” the company told the tribunal.

Agencies

AgenciesAccording to the group, the proposed merger will bring this entire value chain under one umbrella driving a sharper focus for smooth and efficient management of the value chain requirements with the scale and agility required to meet the increasing focus on EVs.

The company also informed the tribunal that as of October 31, 2021, Mahindra Electric Mobility Ltd had about 846 unsecured creditors with a collective value of Rs 485 crore and Mahindra & Mahindra Ltd has 43,596 unsecured creditors with a combined value of Rs 16,535 crore.

On June 10, the division bench, preceded by Justice PN Deshmukh and Shyam Babu Gautam directed M&M Ltd to hold a shareholders meeting on August 19, 2022, to seek their approval.

The tribunal has appointed the group’s chairman Anand Mahindra as chairperson for the meeting and has said that failing him, Anish Shah, managing director of Mahindra & Mahindra Ltd or Rajesh Jejurikar, executive director of Auto & Farm Sector division can chair the meeting.

Advocate Hemant Sethi, while appearing for the group, informed the tribunal that optimizing capital investments for manufacturing EVs by leveraging the manufacturing and R&D infrastructure of M&M and hence lower EV costs.

“Leveraging M&M Sales & Marketing channel to increase EV penetration, optimize price points for customers and improve dealer viability,” asserted Sethi.

At present, the capabilities with M&M Group are distributed, the aim is to offer a sharper consolidated focus on the business through this merger.

To transition into a future of electrification, M&M had started putting in place a new structure within the company in 2021. The company had divided the EVs into the last-mile transport solution and the first-mile personal SUV EVs – to offer a sharper focus.

The last mile mobility division is headed by Suman Mishra, whereas the EV Tech Centre division will be headed by Pankaj Sonalkar. Both reports into ED Rajesh Jejurikar.

M&M Group is readying itself for a world where electric vehicles will evolve through different adoption curves with different trajectories across segments, Mahindra needs to deliver a strategy to meet both the short-term needs while preparing for the long-term, hence the restructuring was implemented, a little over a year back.

The company had committed Rs 3000 crore on an investment of electric vehicles in the future and its last-mile mobility division has already become the largest selling electric three-wheeler maker in India in FY-22 with a market share of over 70%.