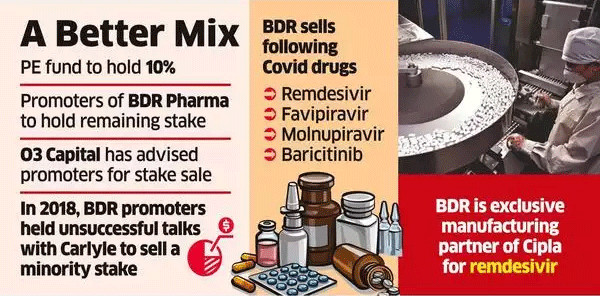

Renuka Ramnath-led private equity (PE) fund Multiples Alternate Asset Management will invest around ₹750 crore to take an about 10% stake in Mumbai-based generic drugs manufacturer BDR Pharmaceuticals, multiple people aware of the development said.

BDR will be valued at around ₹7,500 crore following the fundraising, they said. In 2018, its promoters – Dharmesh Shah and family – had held talks with Carlyle to sell a minority stake, but that did not fructify.

Investment bank O3 Capital advised the promoters in the latest stake sale. BDR Pharma and Multiples did not respond to ET’s emails till press time on Sunday.

ET was the first to report in July last year that global and domestic PE funds were in initial discussions to purchase a minority stake in the drugmaker, whose portfolio includes Covid-19 drugs remdesivir, favipiravir, molnupiravir and baricitinib in India. It is also the exclusive manufacturing partner of Cipla for remdesivir.

Last month, BDR began manufacturing oral anti-Covid-19 pill molulife (Molnupiravir) in the country, after joining hands with Mankind Pharma. It posted a revenue of ₹1,200 crore and earnings before interest taxes, depreciation and amortisation (Ebitda) of ₹400 crore in FY21, sources in the know said.

Shah, who worked with Hyderabad-based Hetero Pharma since its inception in 1993, left to set up the company in 2003.

BDR, which was into contract manufacturing of finished products for leading pharma players, launched its own brands, and put in place a marketing team recently. Its operations are divided into two companies – BDR Pharmaceuticals International and BDR Life Sciences – which are into the manufacture of active pharmaceutical ingredients (APIs) and formulations, respectively.

BDR focuses on development in four specialised therapeutic segments – oncology, critical care, gynaecology and neurology.

BDR launched a generic version of the J&J prostate cancer drug Zytiga (abiraterone) in 2013. It also launched India’s first generic – midostaurin – under the brand name MSTARIN, which is used to treat acute myeloid leukemia (AML). Since global pharmaceutical companies have adopted a China-plus-one strategy, where they are investing in other countries in addition to China, Indian API makers have become a sought-after investment destination for PE funds.

API formed more than one-third of the overall M&A activity in the pharma space in 2021, according to data compiled by EY.

M&A and PE transactions in the API space more than doubled during 2021 to $800 million compared with $293 million in 2020 and just $30 million in 2019. Multiples, founded by former ICICI Ventures veteran Renuka Ramnath in 2009, has invested in logistics firm Delhivery, RBL Bank, among others.

Source: Economic Times