National Asset Reconstruction Company Ltd (NARCL), the bad bank promoted by the government, has offered to acquire the debt of SSA International Ltd from the lenders of the basmati rice exporting company.

This is the fourth company where a Swiss challenge auction is triggered following a binding offer made by NARCL. The other three companies are Jaypee Infratech, Mittal Corp and Consolidated Construction Consortium Ltd.

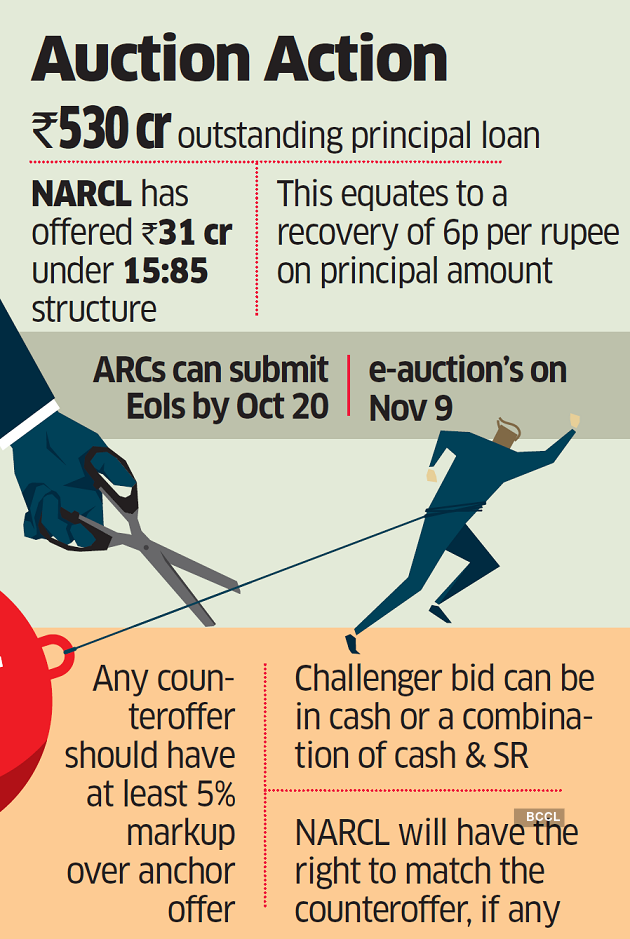

NARCL has offered ₹31 crore under the 15:85 structure on an outstanding principal loan of ₹530 crore. This equates to a recovery of six paise on a rupee principal for lenders.

Lenders have invited expressions of interest from asset reconstruction companies by October 20 and scheduled an e-auction on November 9.

They have stipulated that any counteroffer should have a markup of at least 5% over the anchor offer. NARCL will have the right to match the counteroffer, if any.

Of the ₹530 crore outstanding loans, State Bank of India has an exposure of ₹368.3 crore, while Canara Bank has ₹ 118 crore and IDBI has ₹43.4 crore. SSA International has not yet been admitted for corporate insolvency.

Under the NARCL offer, 15% of the consideration would be paid upfront and for the balance amount, NARCL would issue security receipts which would be redeemed as the government-owned ARC recovers money from the defaulter. The government has guaranteed to pay for any shortfall in the promised recovery by the ARC.

Challenger bids can be in cash or a combination of cash and SR. However, the SRs will have to be guaranteed by a ‘first-class bank’, as per the offer document. Lenders have not defined ‘first class bank.’

SSA International is a 100% subsidiary of BSE-listed Samtex Fashions Ltd, a loss-making textile maker. According to Samtex’s annual report for FY22, it had given a corporate guarantee of ₹807.4 crore against secured loans raised by the subsidiary. Lenders have issued a revocation of their corporate guarantee.

According to the annual report, IDBI has declared SSA International, its directors and guarantors (Samtek) as wilful defaulters. At present, there is no manufacturing activity at the plant.