The Hyderabad bench of the National Company Law Tribunal (NCLT) has admitted a petition by the State Bank of India (SBI) to start bankruptcy proceedings against Gayatri Projects as lenders increase pressure on the debt-laden engineering, procurement and construction (EPC) company to recover dues of over ₹6,000 crore.

SBI’s petition to initiate insolvency proceedings was admitted on Tuesday by a two-judge bench of VR Badarinath Nandula and S Ranjan Prasad, documents accessed by ET showed. SBI was the third lender to file a plea against the company. Previous pleas by the Bank of Baroda (BoB) and Canara Bank are still pending before the tribunal.

“It’s a case of third time lucky. Now banks can initiate a joint recovery for their dues because this account has been a troubled one for years,” said a person involved in the process. The company did not reply to an email seeking comment till press time.

BoB’s petition against the company has been pending for over a year. Earlier this month a two-judge bench of Srinivas Chitturu and P Bhaskara Mohan had reserved its order to admit BoB’s plea. Canara Bank too filed a petition before the Hyderabad bench of the NCLT, ET reported in its October 2 edition.

To be sure, the latest petition by SBI was admitted ex parte as no lawyers representing the company were present in court. Bankers expect the company to challenge it.

“This is a company with very good connections. They will still try to stonewall it. But since now it is admitted we have moved a step ahead. Besides, other petitions by BoB and Canara are still pending and the court will surely see through it,” said a banker.

Gayatri Projects is promoted by former Rajya Sabha member and film producer T Subbarami Reddy. His wife T Indira Reddy is the non-executive chairperson and son TV Sandeep Kumar Reddy the managing director, according to the company’s website.

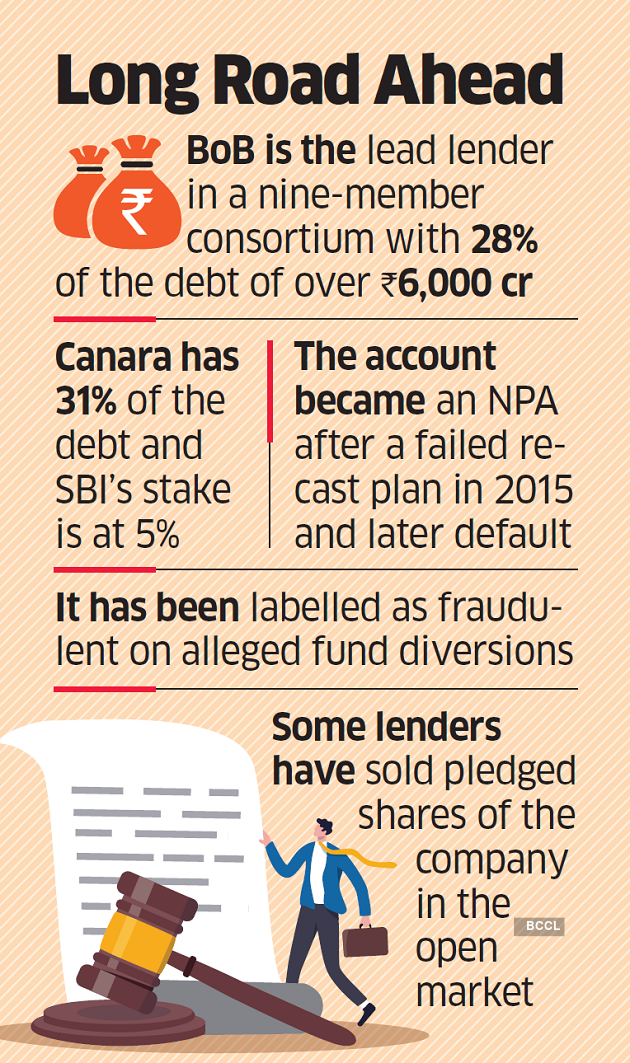

BoB is the lead lender in a nine-member consortium with 28% of the debt, while Canara has 31%. SBI’s stake is relatively lower at 5%. Federal Bank, Punjab National Bank, Union Bank of India, Bank of Maharashtra and Indian Overseas Bank are the other lenders to the company.

A failed restructuring plan initiated in 2015 and subsequent default have marked the account as a non-performing asset (NPA). Some lenders including BoB have sold pledged shares of the company in the open market and have also labelled the account as a fraud after evidence was found that the company allegedly diverted payments to fictitious subcontractors and never pursued recovery despite cancellation of contracts. The company has filed writ a petition in the Telangana High Court against such coercive action by the lenders.

Lenders are still hopeful that some money can be salvaged because it has ongoing road, water and irrigation projects across the country.