A bankruptcy court has allowed the resolution professional of V Hotels to resume the Corporate Insolvency Resolution Process (CIRP) initiated against the company and undertake a review of all transactions undertaken the past three years.

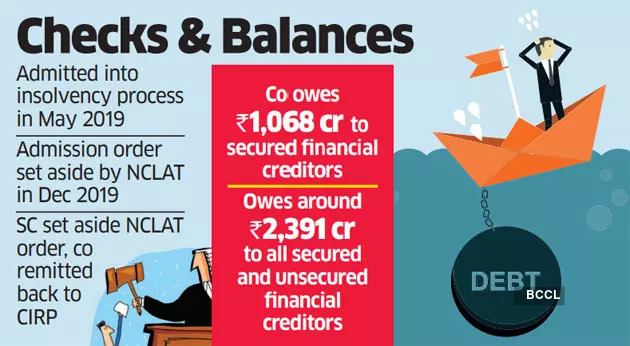

This review will be conducted from the perspective of their being preferential, undervalued, fraudulent or extortionate, and they will file appropriate applications with the court against any such transaction. The company owes about Rs 2,391 crore to its financial creditors, including Rs 1,068 crore to secured financial creditors.

The Mumbai bench of the National Company Law Tribunal (NCLT) has also permitted the resolution professional to recalculate the fair value and liquidation value of the company as of August 1, 2022, and use that value for all purposes of the Insolvency and Bankruptcy Code (IBC).

The company was admitted into the insolvency process in May 2019. This admission order was set aside by the National Company Law Appellate Tribunal (NCLAT) on December 11, 2019. However, the Supreme Court set aside the NCLAT order and as a consequence, the company has been remitted back to the CIRP.

“We are of the opinion that the applicant (resolution professional) is duty-bound to perform his obligations as the resolution professional and is allowed to take appropriate steps to proceed with the CIRP. The corporate debtor (the company) is liable to be readmitted into the rigours of CIRP and released from the control of its directors and management who are at present at the helm of affairs,” Justice PN Deshmukh and technical member Shyam Babu Gautam said in the ruling.

The account of Tulip Star Hotels, which along with affiliate firm Tulip Hotels owns V Hotels in the Juhu area of Mumbai, was declared non-performing on December 1, 2008. Bank of India, which had led a consortium of lenders to the company, assigned its receivables to the asset reconstruction company on December 31st of the same year.

The Supreme Court has set aside the ruling of the National Company Law Appellate Tribunal (NCLAT) rejecting Asset Reconstruction Company (India) Ltd’s claim in Tulip Star Hotels’ insolvency case.

In this matter, the appellate tribunal accepted the hotel operator’s claim that the ARC filed its case against the company under the IBC after the limitation period of three years from the date of declaring the asset as non-performing.

But in its order from August 1, the Supreme Court noted that Tulip Star Hotels had asked for more time to pay the arrears. It also said that the entries of debt in a company’s books of account and balance sheets could be seen as an acknowledgement of the liability and taken into account when setting the limitation period.

The NCLT Mumbai bench in its latest order has also allowed all stakeholders who had already filed their claims as of May 31, 2019 to update their claims as of August 1, 2022.

It has also permitted all persons dealing with the company during the period from December 11, 2019 to August 1, 2022 and having any claims to file their claims with the resolution professional.