Vedanta’s bid to acquire Meenakshi Energy through the insolvency resolution process was approved by the Hyderabad National Company Law Tribunal last week.

The Anil Agarwal company offered ₹1,440 crore against admitted claims of ₹4,625 crore, equating to a 31% recovery, distributed among lenders, trade creditors and employees.

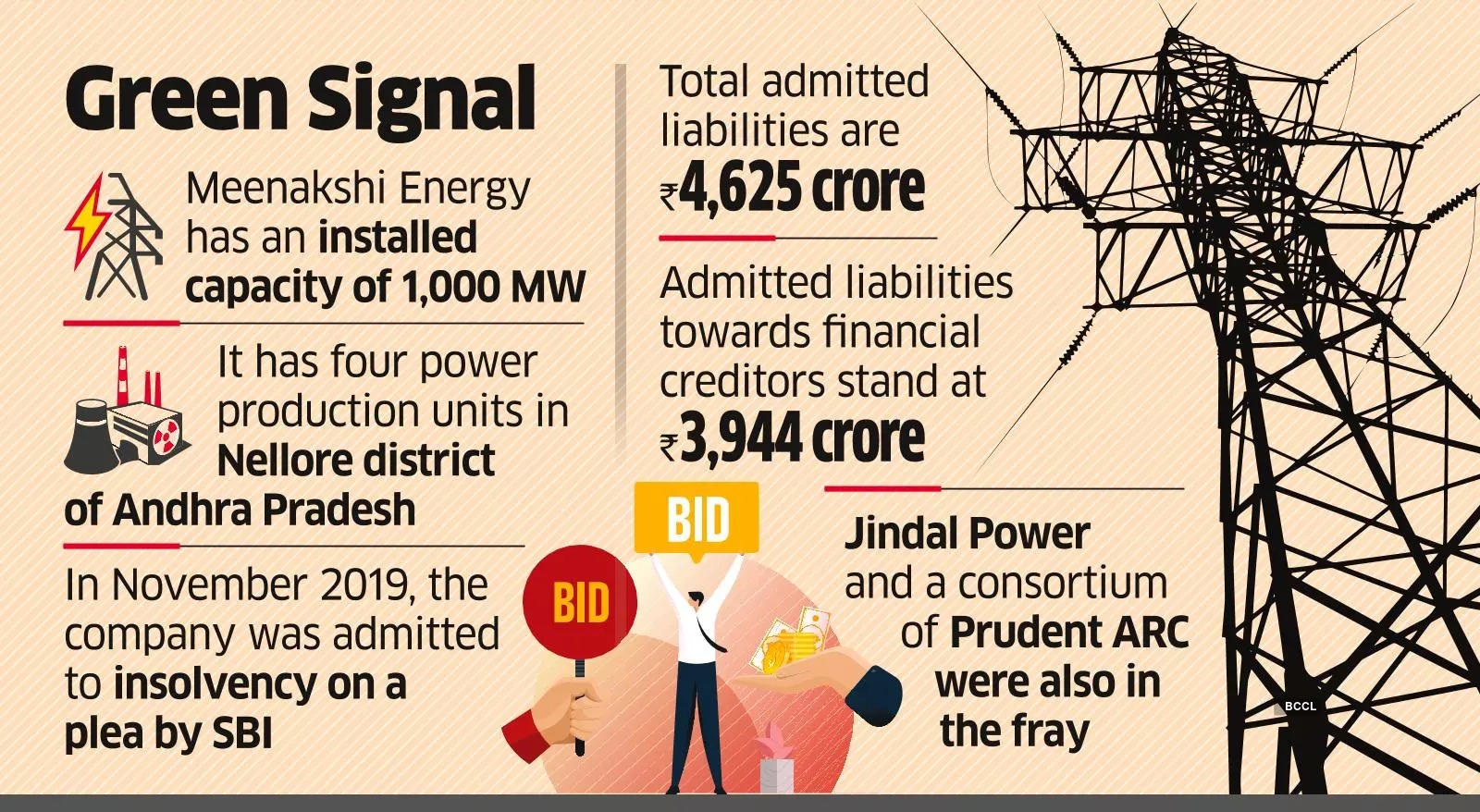

Two other bidders – Jindal Power and a consortium of Prudent Asset Reconstruction Company with Vizag Minerals – were also in the fray for the distressed thermal plant, court documents show. Government-promoted National Asset Reconstruction Company offered ₹1,003 crore to acquire lenders’ debt, as reported by ET on November 1, 2022. However, lenders declined the offer as Vedanta’s was higher.

Vedanta’s resolution plan stands approved by a majority of 94.96% of the committee of creditors (CoC), according to an order uploaded by the bankruptcy court.

Vedanta submitted a plan on August 29, 2022, which was amended on October 28. Again, on December 26, Vedanta submitted an improved offer – from ₹650 crore to ₹1,440 crore, the court order showed.

However, lenders did not immediately approve Vedanta’s offer. They decided to give other bidders an equal opportunity to submit an improved offer. On December 29, they decided to run a challenge process, wherein Vedanta emerged as the highest bidder, as reported by ET on January 7.

Of the ₹1,440 crore offer, lenders will receive ₹1,143 crore against their admitted claims of ₹3,778 crore, implying a recovery of 30%. Vedanta will make an upfront payment of ₹312 crore and the balance will be staggered over five to seven years.

Vedanta’s offer is above the average liquidation value, pegged at ₹1,100 crore but below the average fair value pegged at ₹2,150 crore.

The division bench comprising Justice Telaprolu Rajani (judicial) and Charan Singh (technical) rejected a plea filed by Devi Trading and Holding, a minor CoC member. It appealed that the plan offered by Vedanta is not feasible and did not adequately balance the interest of all stakeholders. The court ruled the plea was ‘baseless and false and thus denied.’

India Power Corporation (IPCL), which provided a corporate guarantee for Meenakshi Energy is part owned by Aksara Commercial, according to stock exchange disclosures. In February 2016, Srei promoter Hemant Kanoria announced the acquisition of Meenakshi Energy from Engie Group of France for $1.

Meenakshi Energy’s project cost is estimated at ₹7,583 crore, which includes debt of ₹3,473 crore and an equity contribution of ₹4,110 crore, according to the information memorandum circulated by the resolution professional.

The project has two phases: Phase I has two units of 150 MW each, and Phase II has two of 350 MW each. Phase I is dependent on imported coal for production and is operational, while Phase II is commissioned but not operational and is dependent on both domestic and imported coal. The power generating units are located adjacent to Adani’s Krishnapatnam port in Andhra Pradesh.

Meenakshi Energy had a long-term power purchase agreement with Bangladesh, but it was terminated in November 2021.

Source: Economic Times