The bankruptcy court in Kolkata has approved the acquisition of Khaitan family-promoted listed engineering firm McNally Bharat Engineering Co by BTL EPC.

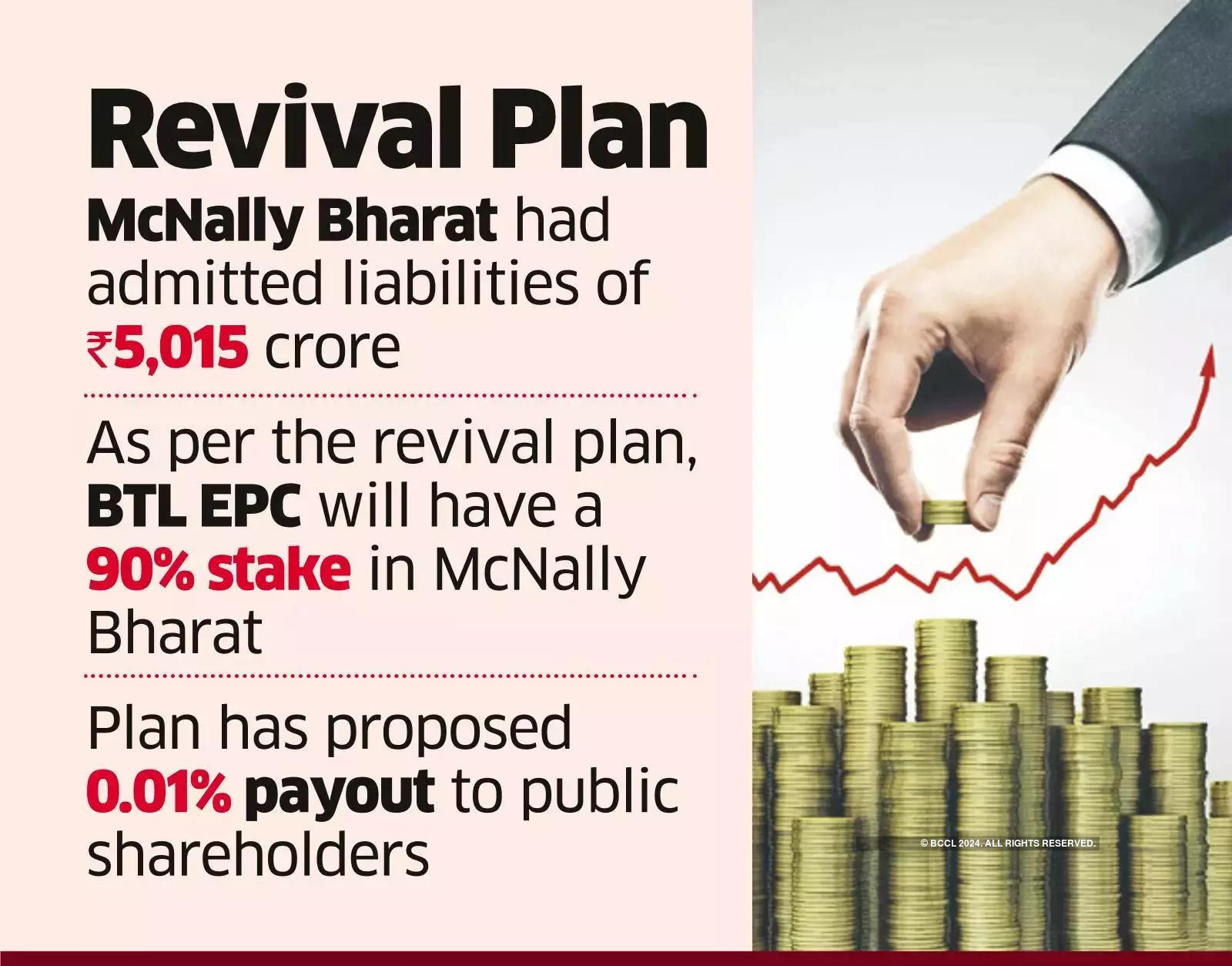

McNally Bharat had admitted liabilities of ₹5,015 crore. The lenders have approved the Kolkata-based EPC firm’s over ₹441-crore resolution plan with 90.06% votes in favour.

Originally, the National Company Law Tribunal had admitted the company under the corporate insolvency resolution process (CIRP) in 2020 following an application filed by its lender, Bank of India.

When the company’s resolution professional (RP) Ravi Sethia invited the bids, four bidders – Amit Metaliks, Nalwa Steel & Power, BTL EPC and Rashmi Metaliks – showed interest in acquiring the company.

But only two bidders-BTL EPC and OP Jindal Group-promoted Nalwa Steel & Power-participated in the second challenge process, in which nine rounds of bidding were conducted.

On July 27, the RP informed the lenders that the resolution plans of both Nalwa Steel and BTL EPC were approved by the lenders with 90.06% of votes in favour, which led to a tie, hence the tie-breaker formula was applied.

As per the tie-breaker formula, the revival plan with the higher net present value (NPV) was selected, which was that of BTL EPC in this case.

NPV is a financial metric used to evaluate the profitability of an investment or project. It compares the present value of expected cash inflows with the present value of expected cash outflows.