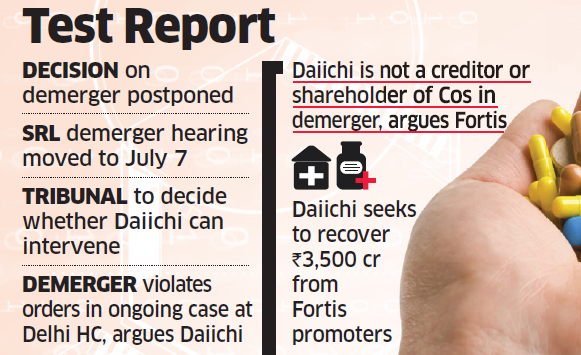

The National Company Law Tribunal (NCLT) in Chandigarh has postponed its decision on a demerger of SRL Diagnostics from parent company Fortis HealthcareBSE -0.94 % while it decides whether Daiichi Sankyo has a right to intervene in the process, people familiar with the development said.

Plans by Malvinder and Shivinder Singh to separate their diagnostics business from Fortis are not blocked at this point as the tribunal is yet to pass any orders on Daiichi’s application, said two people.

The final hearing on the demerger plan was stalled on Thursday following a move by Daiichi to block the process, citing ongoing litigation against the Fortis promoters in the Delhi High Court.

Daiichi argued the demerger violated orders in its litigation to recover about .`3,500 crore from the Fortis promoters, according to lawyers present at the tribunal on Thursday. On the other hand, Fortis argued that Daiichi could not intervene in this matter as it was neither a creditor nor a shareholder of the companies involved in demerger, the lawyers said.

“NCLT did not pass any orders, but has postponed the final hearing on the demerger until it decides whether to issue notice on Daiichi’s application,” a lawyer told ET on condition of anonymity.

Since January, Daiichi has moved court several times to block the Singhs from selling their stake in entities including Fortis and Religare. The Delhi High Court recently gave the brothers the green light to enter into corporate transactions provided they maintained the value of the unpledged assets they disclosed to court.