Fresh from the divestment of 3.5% holding in ITC Ltd, the conglomerate’s largest shareholder BAT Plc chief executive Tadeu Marroco said it does not want to dilute any more of its remaining 25.51% stake in ITC since BAT wants to have an influence in the ITC board and its future plans.

“ITC is transforming itself, making a number of investments and divesting the hotel business which we supported. We want to have a say in those decisions. We are very happy to keep our shareholding on that level,” Marroco said. He was talking at the UBS Global Consumer and Retail Conference early hours of Thursday.

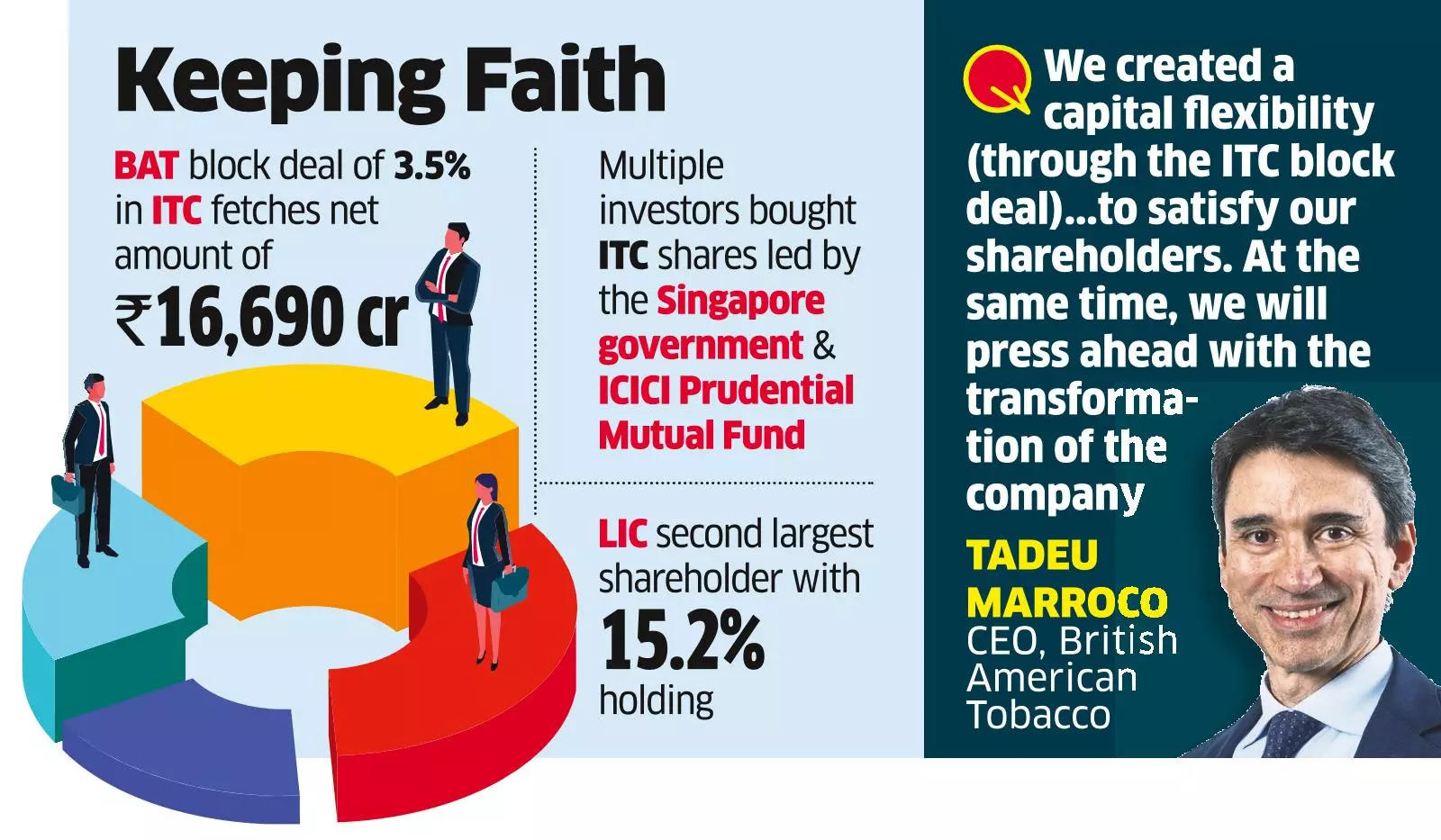

BAT on Wednesday completed its block deal of 3.5% holding (selling 43.69 crore shares) in ITC to institutional investors which reduced its shareholding of 29.01% to 25.51%. The company said in a notice to the London Stock Exchange that the net proceeds from the block trade amount to Rs 16,690 crore (about £1.5 billion).

A clutch of investors bought the ITC shares such as Singapore government, ICICI Prudential Mutual Fund, People’s Bank of China, Aditya Birla Sun Life Mutual Fund, Kuwait Investment Authority, Blackstone, International Monetary Fund and Goldman Sachs amongst several others.

Post the block deal, BAT continues to be the largest shareholder in ITC with the Life Insurance Corporation of India being the second-biggest stockholder in the century-old Kolkata company with 15.2% holding.

Marroco in Thursday’s conference said ITC is a company where BAT is “very satisfied to be a very relevant shareholder”. He said ITC is performing extremely well in the most populous country in the world with a “great demographic economy which is growing” which is a “massive positive prospect.”

“ITC has high growth in a very good economic environment. It has a generous dividend payout policy. We are very happy with the shareholding (in ITC) and we want to keep a level of influence in the board. When we wanted to trim some of the shareholding, we decided to keep it above 25% and use the proceeds for buyback (of BAT shares),” said Marroco.

ITC enjoys 75% market share in cigarettes but has been diversifying its business running the country’s second largest hotel business, one of the largest packaged food companies and the largest player in paper, packaging and agriculture in the private sector.

It is in the process of demerging the hotel business into a separate entity. BAT CEO has earlier indicated that it may divest its shares in the hotel business which it will receive as part of the demerger process.

BAT has earlier this week said it will use the net proceeds from the ITC block deal to buy back BAT shares over a

period ending December 2025, starting with £700m in 2024. “We created a capital flexibility (through the ITC block deal) we need to satisfy our shareholders. At the same time, we will press ahead with the transformation of the company,” Marroco said.

While ITC share price closed at a gain of 4.5% on Wednesday after the completion of the BAT block deal, on Thursday it closed at Rs 419.8 falling by 0.62% at the Bombay Stock Exchange when the benchmark Sensex rose by 0.46%.