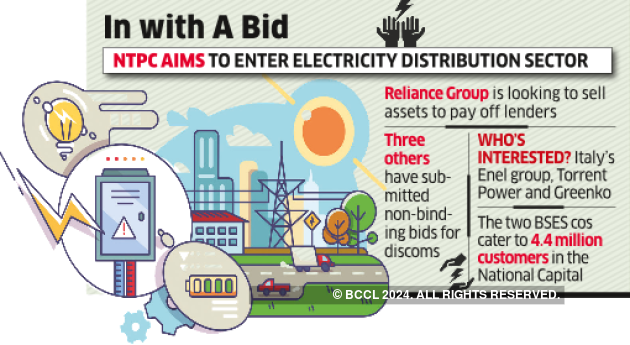

NTPC has entered the race to acquire Reliance Infrastructure Ltd’s majority stake in Delhi electricity distribution businesses. The state-run major has written to Delhi Electricity Regulatory Commission (DERC) expressing willingness to acquire 51% in BSES Rajdhani Power (BRPL) and BSES Yamuna Power (BYPL), provided the sale process is transparent, sources said.

Sources said Italy’s Enel group, Torrent Power and Greenko have submitted non-binding bids for buying BSES Delhi discoms.

NTPC has only been keen on buying stressed private power projects that moved to bankruptcy court. Early this year the company outbid the Adani Group in the race for the Avantha Group’s 600 mw Jhabua power plant in Madhya Pradesh with a Rs 1,900 crore offer. In its letter to DERC secretary Mukesh Wadhwa, NTPC said it has decided to foray into distribution sector and is keen on acquiring distribution assets. NTPC and BSES did not offer any comments.

Anil Ambani-led Reliance Group is looking to sell assets to pay off lenders. Reliance Infrastructure, which owns 51% each in BYPL and BRPL, said it aims to be a zero debt company in the next financial year.

Reliance Infrastructure sold its Mumbai power distribution business to Adani Transmission Ltd for Rs 18,800 crore in August 2018. Reliance Group and Tata Power supply power to about 93% of Delhi. The two BSES companies cater to 4.4 million customers in the National Capital, handling peak power demand of 4.8 GW.

These companies were acquired in 2002 during privatisation of Delhi distribution utilities. The distribution losses of Delhi are one of the lowest in the country at 9%. As of March 2020, the combined revenue of BSES discoms is Rs 15,250 crore with an EBITDA of Rs 2,050 crore and their total debt is Rs 1,900 crore. However, the two BSES Delhi discoms have nearly Rs 30,000-crore regulatory assets or deferred tariff hikes that are yet to be approved by the regulator. In FY18, DERC approved Rs 12,000 crore of such claims.

Source: Economic Times