NTPC Ltd may join ONGC as an equal partner in the latter’s bid to acquire Ayana Renewable Power, according to the people with knowledge of the matter.

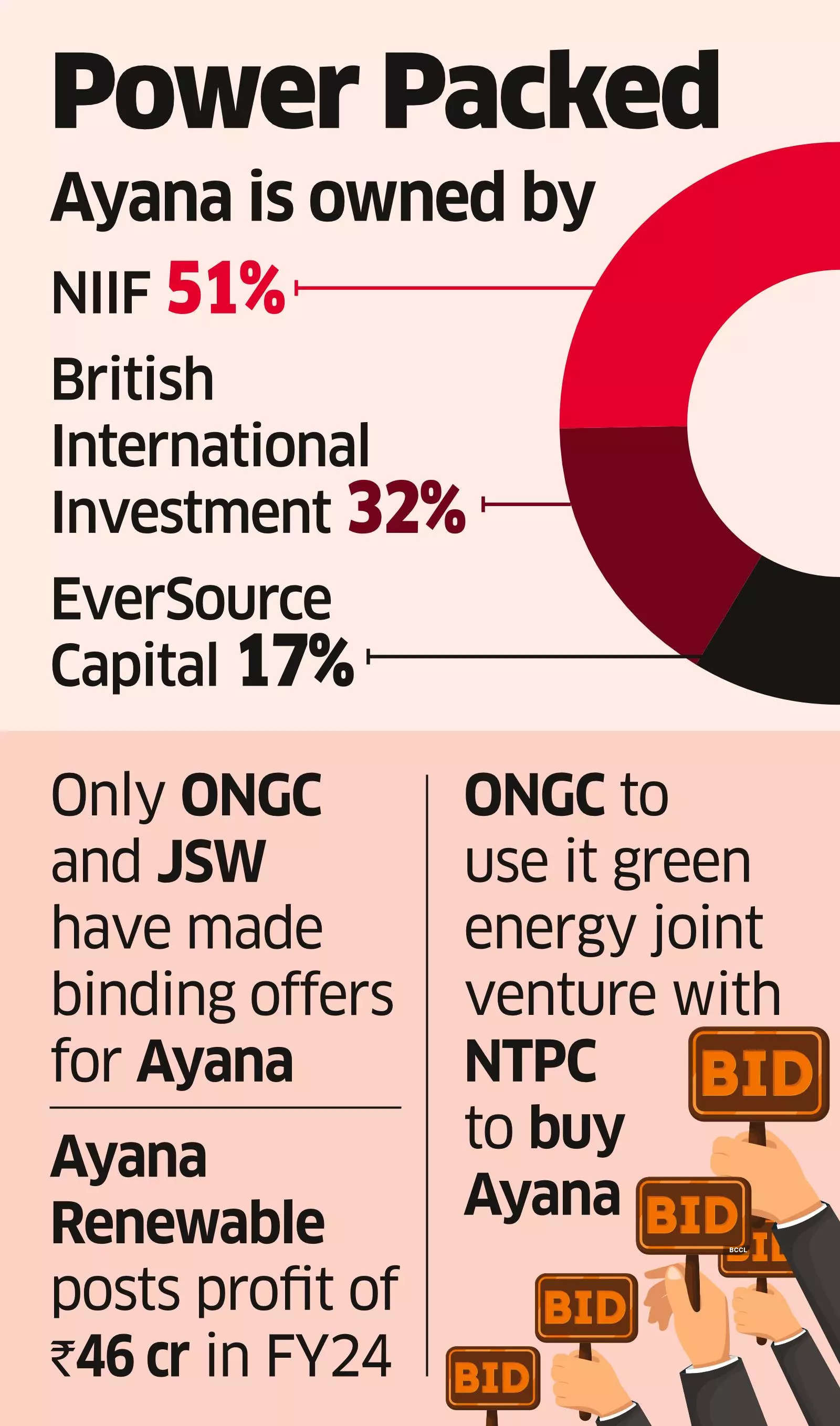

Oil and Natural Gas Corporation (ONGC) has emerged as the highest bidder, ahead of JSW Neo Energy, for Ayana Renewable Power, which is co-owned by India’s sovereign investment fund NIIF (51%), British International Investment (32%), and EverSource Capital (17%), the people said.

The state-run oil and gas producer is currently negotiating the share purchase agreement with Ayana’s owners and, if all goes well, it may use its planned green energy joint venture (JV) with NTPC to acquire 100% stake in the renewable energy platform in an all-cash deal, they added.

On Monday, NTPC said its subsidiary NTPC Green Energy had applied to the corporate affairs ministry to incorporate a 50:50 JV company with ONGC Green after obtaining clearances from the finance ministry’s divestment department and NITI Aayog. “The JV company will also seek opportunities to acquire renewable energy assets,” the state-owned company added.

“The deal with ONGC will likely go through if there are no surprises in the share purchase agreement,” a person familiar with the matter said on condition of anonymity, adding that the deal could still take months to close as the current Ayana shareholders might try to maximise gains.

‘Bankers may nudge JSW’

While ONGC seems determined to close the deal, bankers are trying to persuade JSW to improve its offer, said the people cited earlier. Only ONGC and JSW have made binding offers for Ayana, they added. ONGC, NTPC, JSW, NIIF, BII and EverSource Capital declined to comment.

The current shareholders have infused ₹3,700 crore in Ayana so far against their capital commitment of $721 million (about ₹6,000 crore at the current conversion rate), according to a report released in September by rating agency ICRA.

Ayana operates 1.6 giga watt of renewable energy capacity and is developing another 3 GW, the report added. The company posted a consolidated profit of ₹46 crore on an operating income of ₹856 crore for FY24.

A partnership with NTPC would help split acquisition risks and get ONGC access to the power sector capabilities it doesn’t currently possess. The Ayana deal would herald a new era for the oil producer under pressure to go green while providing exit to private equity investors at a time when multiple renewable energy platforms are finding it hard to get new owners in the country.

ONGC’s renewable play

In August, ONGC chairman Arun Singh had said that the company intended to acquire more than 1 GW of renewable assets in this financial year. By 2030, ONGC aims to scale up its renewable portfolio to 10 GW.

BII incorporated Ayana Renewable Power in 2017. NIIF and EverSource bought a 25.5% stake each in the company in 2019. NIIF’s stake rose to 51% in 2021. Ayana group’s pending capital expenditure for the under-construction portfolio is about ₹13,500 crore, as per the ICRA note.

Source: Economic Times