American asset manager Oaktree Capital, which is in a fierce race to acquire the bankrupt mortgage lender Dewan Housing Finance Corporation (DHFL), plans to use an alternative investment fund (AIF) for taking over DHFL NSE -4.91 %’s life insurance venture Pramerica and comply with India’s foreign ownership rules in the insurance industry.

AIF is the regulatory term for pooled private investment vehicles like private equity and venture capital funds. Even if investors in an AIF are foreign, the fund’s equity stake in an Indian company is treated as domestic holding as long as the AIF’s asset management company is locally owned and controlled.

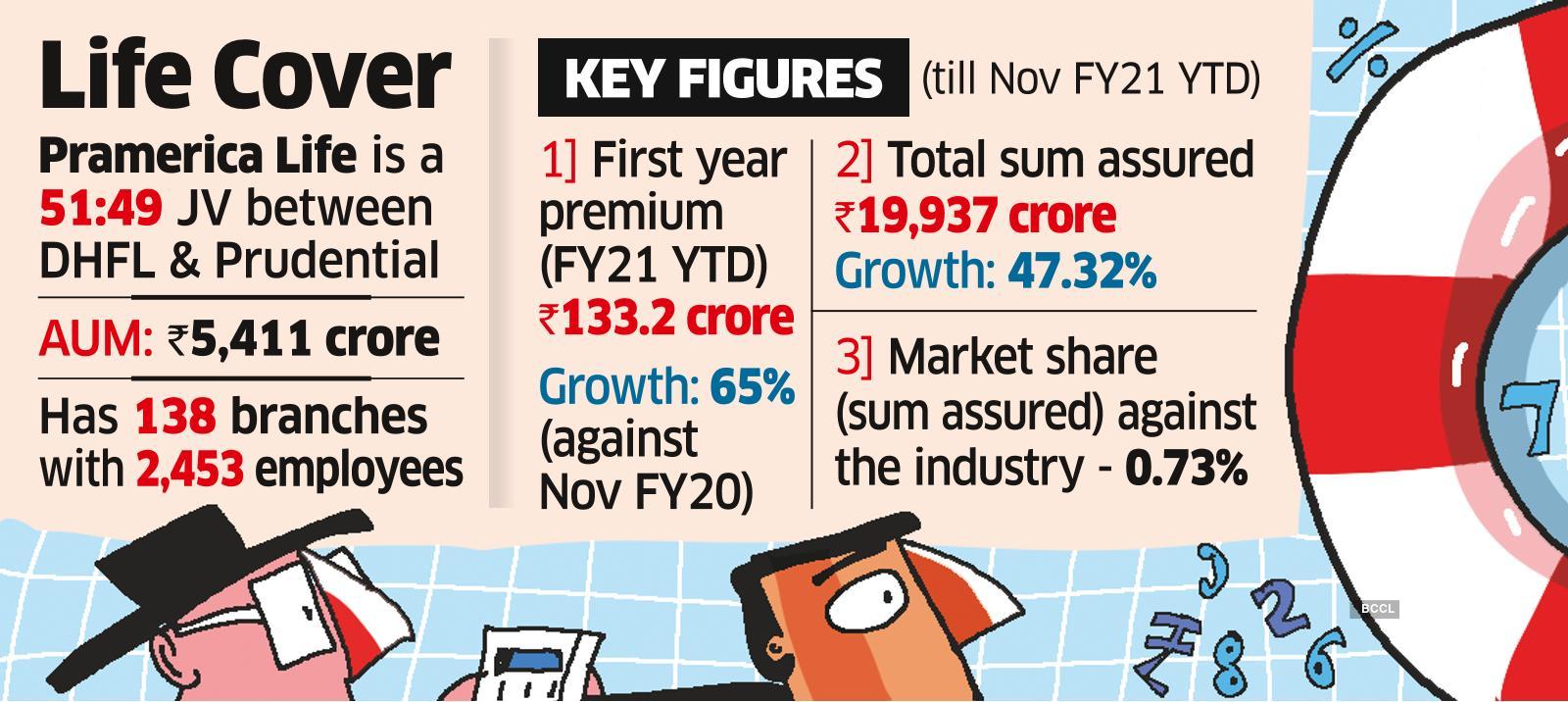

Foreign direct investment (FDI) in Indian insurance companies is capped at 49%. DIL, a wholly-owned subsidiary of DHFL, and the group’s promoters together own 51% stake in Pramerica.

CoC to Take Final Decision

US-based Prudential International Insurance Holdings own the rest in the joint venture.

If Oaktree eventually acquires DHFL, the interest in the insurance company — which would change hands with the parent DHFL — can be housed in the AIF vehicle without breaching FDI norms.

Oaktree declined to comment.

“Oaktree has outlined this in the resolution proposal. Similar vehicles have been used by others. The committee of creditors will take the final decision. AIFs diversified holdings and are regulated by Sebi,” a banker told ET. Even though there can be a single investor in an AIF, the fund cannot hold more than 25% of its corpus in one stock.

NYSE-listed Okatree’s ₹1,000 crore offer for the full business is higher than that of Piramal and Adani, which bid ₹300 crore and ₹200 crore for it, respectively. About ₹1,500 crore, according to Oaktree’s proposal, would be set aside in an escrow account in order to meet any tax liability arising from any potential sale of the DIL’s shareholding in Pramerica.

HOLDBACK PROVISION

Oaktree’s rivals are believed to have told lenders that Pramerica could run into a regulatory hurdle if the US fund acquires DHFL, thereby further delaying the exercise. They claim Oaktree’s proposal includes a “₹1,500 crore holdback” (escrow mechanism) to meet contingencies arising on account of investment in the insurance business. This holdback is proposed to be carved out from the amount belonging to financial creditors and is in gross violation of the RFRP. Additionally, since the holdback is for indefinite period, the same should not be considered for the NPV calculations; and excluded from upfront cash payment.

However, sources directly involved say unlike previous rounds, Oaktree’s fourth round offer submitted on Monday is unconditional.

“As long as the fund manager and sponsor are residents, it fulfils regulatory requirement of a domestic entity, and its possible shareholding in Pramerica would not be considered as foreign holding,” said a lawyer who is not an advisor to any of the parties in the DHFL deal. A sponsor in an AIF chips in 2.5%or ₹5 crore, whichever is lower, of the fund corpus.

DHFL entered insurance by buying out DLF’s stake in DLF Pramerica Life Insurance in 2013. The insurance business got dragged into controversy after EY, which was supposed to have run a separate sale process did not do so and instead chose to club it to the main business – a move that a few argue led to lowball offers for it by potential bidders.

On Monday, Oaktree Capital and Piramal Enterprises trumped Adani Properties in the fourth round of bids for DHFL.

Source: Economic Times