Global advertising giant Omnicom has unveiled a sweeping reorganisation of its business in India, retiring multiple agency brands and shuffling its leadership team, as part of a global restructuring following its merger with rival holding company Interpublic Group (IPG). The merged entity, comprising some of the best known agency brands, will operate a consolidated creative business as well as a media practice, named Omnicom Advertising and Omnicom Media, respectively.

A media agency is a specialist firm that plans, buys and manages advertising on behalf of brands. The merger is expected to eliminate 4,000 jobs globally and save the corporation $750 million in wages. In India, the announcement of the reorganisation sparked fears that layoffs were about to commence.

Omnicom Advertising India will be led by Aditya Kanthy, president and managing director, while Prasoon Joshi has been appointed chairman. S Subramanyeswar has been named chief strategy officer.

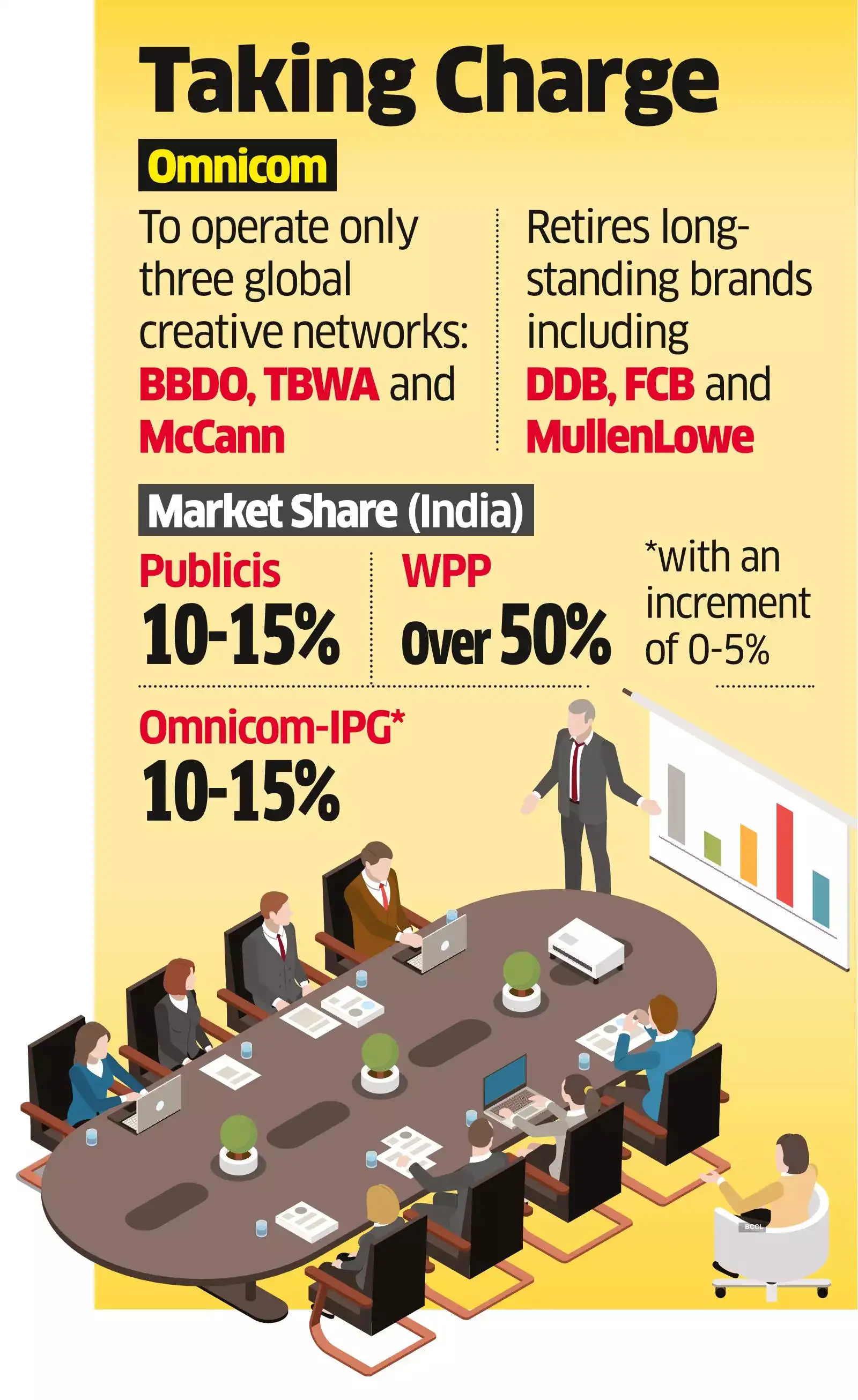

The consolidated India creative network will operate through three retained brands-TBWA\Lintas, BBDO Group and McCann. DDB (formerly DDB-Mudra), FCB (formerly FCB Ulka) and Mullen Lowe have been retired.

Merged entity will operate a consolidated creative business as well as a media practice.

Govind Pandey and Prateek Bhardwaj have been appointed CEO and chief creative officer of TBWA\Lintas India. Dheeraj Sinha and Rahul Mathew will lead McCann as CEO and chief creative officer. Josy Paul continues as chairperson and CCO of BBDO Group.

In an internal note, Sean Donovan, president of Omnicom Advertising Asia, said India’s combination of scale, talent depth and strong legacy brands necessitated a more localised organisational structure. On the media side, Omnicom Media has named Kartik Sharma as CEO, Amardeep Singh as COO and Shashi Sinha as strategic advisor. It will house six networks-OMD, PHD, Hearts & Science, Initiative, LodestarUM and Mediahub-under the unified Omnicom Media umbrella.

The Omnicom-IPG merger comes at a time of disruption for the traditional agency model, buffeted by the rise in digital advertising, disintermediation driven by tech platforms and the rise of generative AI. The industry has sought to resist with a series of mergers into larger entities, in the hope that scale and synergy will help, and also allow for greater investments in technology.

A June 3 assessment by the Competition Commission of India (CCI) on the Omnicom-IPG merger indicates that WPP continues to dominate media buying in India with more than half the market. Publicis remains second with an estimated 10-15% share.

The combined Omnicom-IPG entity also will have a 10-15% share. The regulator noted that the two networks were not strong rivals earlier and will remain significantly smaller than WPP. Madison and Dentsu hold 5-10% each, while Havas remains below 5%.

The CCI concluded that the merger enhances Omnicom’s competitiveness without altering the broader market structure dominated by WPP.

Globally, Omnicom has rolled out the operating structure for its expanded operations following the IPG acquisition, which eliminates IPG as an independent entity and consolidates two of the world’s largest agency systems. The company said the expanded unit now forms the world’s largest media organisation by billings.

Source: Economic Times