The Department of Investment and Public Asset Management (DIPAM) will shortly seek cabinet approval for Oil and Natural GasBSE 0.76 % Corp to buy the government’s entire stake in refiner Hindustan PetroleumBSE -0.51 % Corp Ltd in line with the oil ministry’s proposal of creating a domestic oil giant, people with direct knowledge of the matter told ET.

The move is based on the recommendations of consultancy Deloitte, which the oil ministry had hired to suggest ways of restructuring state firms. The Ministry has left it to the Department of investment to decide on how the divestment in HPCLBSE -0.51 % should be achieved, although it’s suggested the refiner be retained as a separate unit of ONGCBSE 0.76 %, and not merged with it.

“The divestment of HPCL stake will help government generate resources that could be deployed for social welfare,” said one of the persons cited above.

|

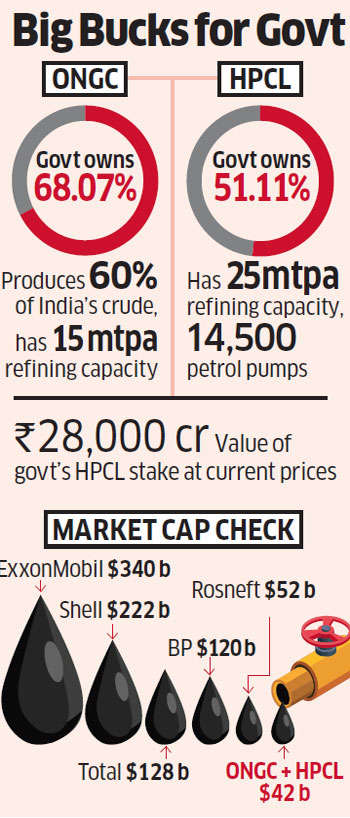

The combined market value of ONGC and HPCL is Rs 2.76 lakh crore, or $42 billion, which is comparable with Rosneft’s $52 billion.

An ONGC-HPCL combine will, however, be much smaller than global giants such as ExxonMobil ($340 billion), Shell ($222 billion), Total ($128 billion) or BP ($120 billion).

The February Budget had proposed the creation of an integrated public sector ‘oil major’ through consolidation that would match global rivals.

The Budget announcement had fuelled speculation that state oil firms may be radically reorganised into fewer units with each having a presence in both upstream and downstream segments. Currently, there is no other proposal for reorganising state firms, barring ONGC’s proposed acquisition of HPCL, sources said.

Since February 28, when ET first reported the government’s plan to sell its stake in HPCL to ONGC, their stock has fallen 3% and 11%, respectively, while the benchmark Sensex has risen 8%.

ET’s report also said other state oil firms would stay unaffected.

The acquisition of HPCL would make ONGC, an exploration and development company that produces 60% of country’s crude oil, a much more integrated player with a large presence in the downstream segment. ONGC already has a presence in the refining sector with its subsidiary MRPL operating a 15 million tonne plant in Mangalore that it plans to expand to 25 million tonnes.