KKR, TPG Capital and Apax Partners are among private equity firms that are evaluating a purchase of India’s largest cardiac stent maker Sahajanand Medical Technologies (SMT), valuing the company at about ₹ 3,500-4,000 crore, said people in the know.

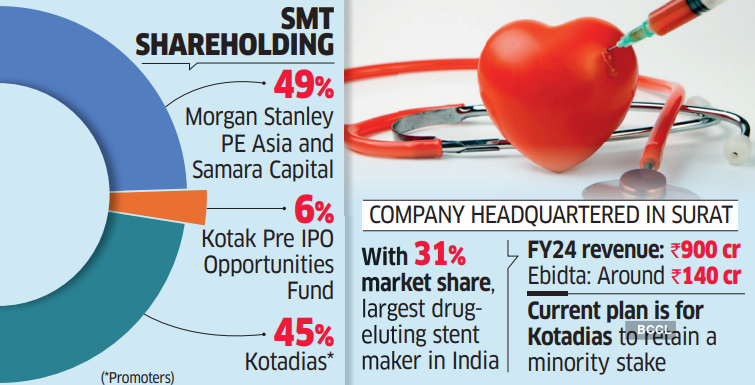

Morgan Stanley PE Asia and Samara Capital collectively own 49% of the company while Kotak Pre IPO Opportunities Fund holds 6%. The Kotadias, the company’s promoters, own the remaining 45%.

Mumbai-based pharmaceuticals firm Alkem Laboratories and one other global private equity firm are also in the fray, said the people cited earlier. About five bidders have been shortlisted and due diligence will start shortly, said the people cited.

ET had first reported on shareholders’ intent to sell stakes in SMT on March 7.

KKR recently outbid a consortium of Mankind Pharma, ChrysCapital and Novo Holdings to acquire surgical sutures manufacturer Healthium for Rs 7,000 crore. This deal has reignited interest in the surgical equipment sector, trade watchers said. SMT is the largest drug-eluting stent (DES) maker in India with 31% market share and is expanding in Europe as well.

It posted FY24 revenue of Rs 900 crore and earnings before interest tax depreciation and amortisation (ebidta) of around Rs 140 crore. The shareholders are seeking a valuation that is 25 times the company’s earnings, according to sources.

The current plan is for the Kotadias to keep a minority stake.

“They could retain about 15-20% stake post the deal,” said one of the persons familiar with the ongoing discussions.

The company had filed a draft red herring prospectus (DRHP) in 2022 for a Rs 1,500-crore IPO, a plan that was put on hold.

SMT, Samara Capital, Morgan Stanley PE Asia and Alkem didn’t respond to queries. KKR, TPG and Apax declined to comment.

Founded by Dhirajlal Kotadia in 1993 to offer laser-based solutions to the diamond industry, SMT diversified into stents and other medical devices. It has expanded its global distribution network and product portfolio through multiple acquisitions.

SMT purchased structural heart medical device firm Vascular Concepts in 2020 following the acquisitions of Brazil-based Zarek Distribuidora De Produtos Hospitalares and Spanish firm Imex Clinic Salud S.L, also a distributor, in 2019.

Early this month, SMT won a two-year tender to supply its Hydra Transcatheter Aortic Valve Implantation (TAVI) devices to all hospitals across Italy.

The cardiac stent market comprises drug eluting stents, bare metal stents, bioresorbable vascular scaffold and drug-eluting balloons (DEBs). The coronary stent market in India is estimated at Rs 1,300 crore and expanding at 12% CAGR.

Abbott, Boston Scientific and Medtronic hold about 60% share of the cardiac stent market in India.

Higher capacity, healthy prospects for domestic players due to price caps and the acquisition of sales and distribution entities in Brazil and Spain should aid growth, said a July report by Crisil Ratings. The group is also expanding its network in Europe, which will support improvement in the revenue profile over the medium term, it said.

The National Pharmaceutical Pricing Authority (NPPA) imposed a price cap on stents in 2017, reducing prices by up to 85%. That meant a windfall for domestic manufacturers. The decision made stents more affordable, thus pushing demand for local products, giving domestic manufacturers greater market share.

Earlier, global private equity firm Warburg Pincus invested $210 million in Micro Life Sciences, a leading medical devices manufacturer specialised in therapy areas such as structural heart devices, orthopaedic implants, endo-surgery, surgical robotics & in-vitro diagnostics. Goa-based diagnostic equipment maker Molbio Diagnostics is backed by Temasek and Motilal Oswal funds.