Industrialist CK Birla has approached Gautam Adani to sell his promoter stake in listed Orient Cement after rejecting initial offers from other domestic players for failing to meet his valuation demand, people aware of the talks told ET. Senior management executives on both sides have also met to discuss a potential deal for the Adanis, who already own India’s second largest cement capacity.

Earlier this summer, JP Morgan was roped in by Birla to find a buyer for his business.

The promoter stake in Orient Cement – held by the Birla family and private investment vehicles – is 37.9%, with a current market value of ₹3,878 crore. The stock has seen a 29% spurt in past three months in anticipation of a sale. The transition will trigger an open offer for an additional 26% stake in accordance with takeover laws, which mandate an incoming promoter or controlling entity to buy the additional shares from existing minority investors.

“I have nothing to contribute to your story as I am unaware of what you are talking about,” said Deepak Khetrapal, MD, Orient Cement.

Formal talks in past few months

“As the MD of the company, my job is to run the company and I talk about the performance of the company,” he said.

Mails sent to Adani Cement on Saturday remained unanswered until the publication of this report.

In January, both companies denied to the stock exchange that they were in discussions after Informist first reported about the developments. Sources said formal talks have taken place only in the past few months. However, there is no guarantee that the Adani discussions will culminate in a transaction, the sources mentioned above warned.

Sanghi buyout

This August, Adani trumped competition from Nuvoco, JK Lakshmi and market leader UltraTech to buy Sanghi Industries for an enterprise value of ₹5,000 crore – its first cement acquisition after the $6.5-billion buyout of Holcim’s India assets comprising Ambuja Cement and ACC.

Cement industry players said CK Birla’s expectations – of double the current market price to factor in the control premium – could be a deal breaker. Orient Cement is believed to be comparing valuation benchmarks with the Ambuja-ACC sale to Adani Cement largely on account of access to limestone reserves that could help double capacity to 16 million tonnes per annum (MTPA). Sources in the know said JSW Cement did put in a non-binding offer, but that didn’t progress far.

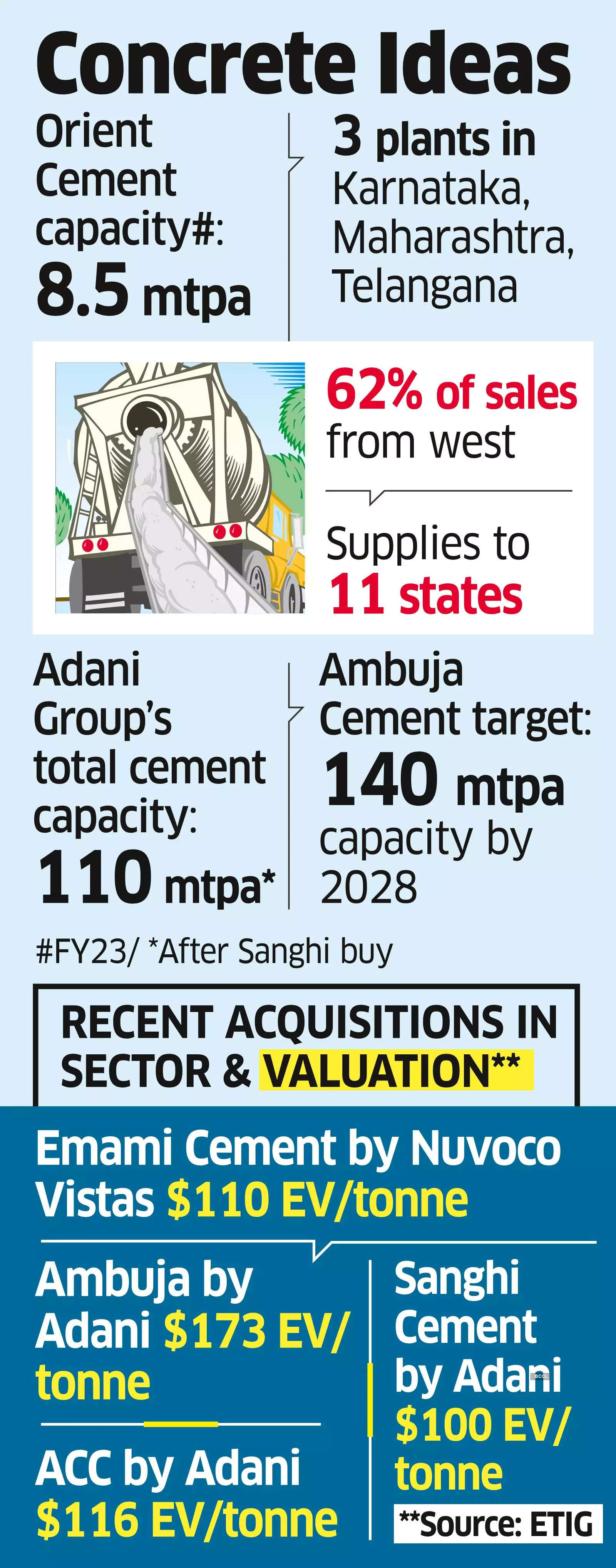

Adani Cement bought Ambuja and ACC at an implied valuation of $173/tonne of replacement value and $116/tonne on EV/Ebitda basis. Currently, Orient’s per tonne implied valuation is $59/tonne at current market price.

Access to limestone mines

In the past, regional player Binani Cement has received premium valuation when UltraTech acquired its assets due to the availability of limestone reserves that helps ramp up capacity. Although limestone’s final contribution in the cost structure of finished cement rarely exceeds 5-7%, access to deposits that are highly regulated often creates a bottleneck in building capacities. The bulky nature of limestone – and its eventual contribution in the cost bucket – also make long-distance transport or external purchase of the material unviable for large capacities.

After Sanghi, Adani Group’s total cement capacity has gone up to 110 MTPA. Ambuja Cement has been aiming at a 140 MTPA capacity by 2028.

As per the FY23 annual report, with 8.5 MTPA cement capacity that includes a 5.5 MTPA clinker capacity, Orient Cement’s footprint includes manufacturing plants at Devpur (Telangana), Jalgaon (Maharashtra), and Chittpur (Karnataka). The company supplies to 11 states in central, western and south India, with 62% of the company’s sales from the western states and 10% from central. The balance comes from other markets, the company said after announcing Q1FY24 earnings. The management also highlighted plans to spend Rs 1,000 crore in capex this June, a lion’s share of which was for the Karnataka unit.

Sector watchers see Orient’s assets backing up ACC’s south India operations. ACC also has a manufacturing plant at Wadi in north Karnataka, while Orient Cement in Chittapur is in the same region. So, the acquisition would help ACC broaden its base in south India. ACC has capacity constraints in the south; hence acquisition of Orient Cement assets would help gain market share in the region.

Capacity constraints

Orient in recent years failed to scale due to its efforts to deleverage the balance sheet. It managed to bring down its gross debt by 80% from FY18 to Q1FY24.

The company’s revenues climbed 8% to Rs 2,949 crore in FY23. Capacity utilisation increased 300 basis points, while operating profit (Ebitda) dropped 37% YoY to Rs 376 crore — mainly on account of “unprecedented cost inflation throughout the year, especially in energy sources.” Also, higher demand from the B2B segment after November 2022, leading to higher sales of Ordinary Portland Cement (OPC), dented profitability.

The recent transition of Adani Cement and Sanghi industries were at $100 per EV/tonne for a regional cement player based in Kutch, Gujarat. According to market participants, Orient Cement could be an attractive acquisition target as promoter holding in Orient Cement is 37.9%; so after a potential suitor gets half of the share in a proposed open offer, the total fund outgo would be around Rs 3,500-4,000 crore for the company.

“Adani bid aggressively for Sanghi due to its limestone reserves, coastal operations and excess land to significantly ramp up the current 6.5 MTPA capacity. Adani aims to produce lowest cost clinker in the country at Sanghipuram and then ship clinker and cement to western markets of Karnataka, and even Kerala and sell at a premium. For Orient, it is unlikely to pay such a premium,” said an official aware of the talks.

Most analysts believe if CK Birla brings down his expectations, then JSW would take a serious relook at the opportunity. There is also widespread assumption that Birla will eventually take the deal to UltraTech – the Kumar Mangalam Birla flagship — to try and get the best deal. Kumar Mangalam Birla is CK Birla’s nephew.

An Aditya Birla Group spokesperson remained unavailable for comment.

UltraTech was also in fray for Sanghi and Holcim’s assets. It is aiming to achieve a production capacity of 200 MTPA, up from its existing commissioned capacity of 138 MTPA, chairman Kumar Mangalam Birla said at the company’s annual general meeting this August.

Source: Economic Times