Patanjali Ayurved has made a late bid to acquire the debt-laden Rolta India with an all-cash offer of about ₹830 crore, just days after Pune-based Ashdan Properties was declared the highest bidder by banks late last week.

It approached the Mumbai bench of the National Company Law Tribunal to direct lenders to consider its bid earlier this week. In a hearing on Thursday, after listening to the objection from Ashdan Properties, the bench put the onus on the committee of creditors to decide whether to consider the offer since it came after the bidding process was completed.

“The offer is between ₹820 crore and ₹830 crore and is much better than what lenders had in hand so far because it is all upfront and comes from a cash-rich company. This is a happy problem for lenders to have but they have to now decide how to proceed further,” a person familiar with the matter said on condition of anonymity.

Lenders are taking legal opinions on whether to start a new process since the plans were submitted last month and the highest bidder has already been decided, according to people in the know.

“This is a strong bid and will have to be considered since it offers better value. Since the plans have not been voted on, lenders are within their rights to call for fresh interest and seek plans from all bidders in a new process to give all an equal opportunity,” said a second person.

Patanjali Ayurved spokesperson SK Tijarawala said, “We have approached the competent authorities and will submit a plan when permitted. We have evaluated the options and have made the decision after due consideration.” He declined to say why the consumer company is interested in a technology firm.

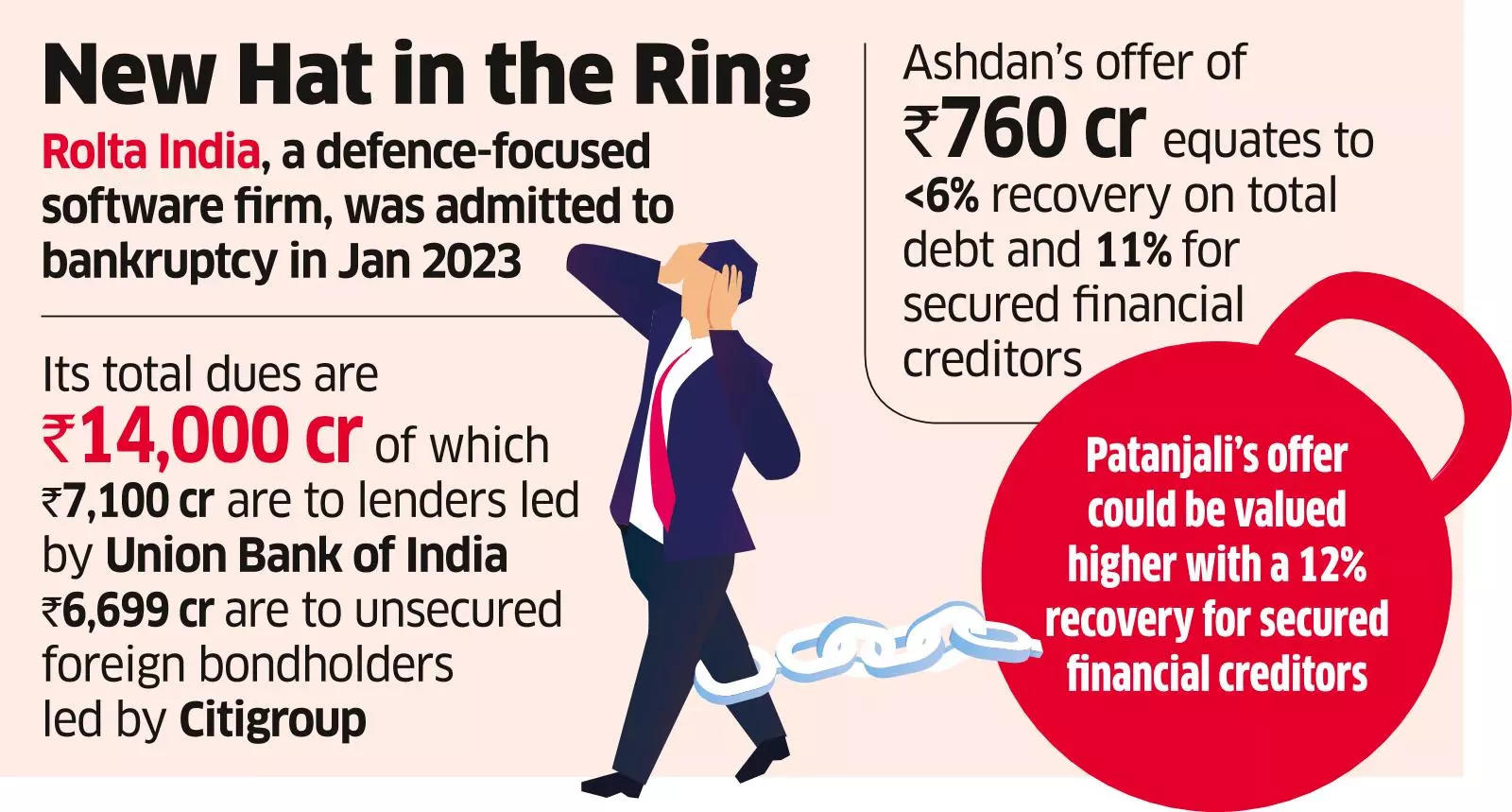

Kamal Singh-promoted Rolta India is a defence-focused software company which was admitted to the bankruptcy process in January 2023. It owes banks, led by Union Bank of India (UBI), ₹7,100 crore and another ₹6,699 crore to unsecured foreign bondholders, led by Citigroup, with total debt of close to ₹14,000 crore.

Ashdan Properties had offered ₹760 crore on a net present value (NPV) basis equalling less than 6% recovery on the total debt and about 11% recovery for secured financial creditors led by Union Bank of India, ET reported on January 29.

But unlike Ashdan Properties’ bid, Patanjali Ayurved’s offer does not include any deferred payment and is totally upfront, which is why it could be valued higher. At ₹830 crore, it offers close to 12% recovery for secured creditors.

“Patanjali, like others, could be looking at Rolta’s real estate, especially in Mumbai, or maybe also the tax gain this acquisition brings because Rolta’s accumulated losses will give it a straight gain,” said a third person privy to the discussions. “But Patanjali Ayurved is also building a mobile application called OrderMe for home delivery which could also be a reason it is looking for a software company.”

Resolution professional Mamta Binani and process advisor BOB Capital Markets did not reply to emails seeking comment.

The committee of creditors will meet next week to decide its next course of action after seeking legal opinion.

Source: Economic Times