Global payments platform PayPal Holdings Inc. is in the final stages of closing a deal to take a significant minority stake in domestic digital payments platform Freecharge, two people aware of the development said on condition of anonymity.

The deal could see the sale of a 25% stake for around $200 million, one of the two added.

The move could heat up competition in the online payments industry in India that has received a boost in recent weeks with the government invalidating old high-denomination currency notes and driving the move towards a cashless economy.

The second person said PayPal’s offer will be discussed by the board of Jasper Infotech Pvt. Ltd (the parent company of Freecharge Payment technologies Pvt. Ltd and online retailer Snapdeal) in the first week of January. “PayPal’s initial offer was for a controlling 51% stake in Freecharge. But SoftBank, which is the largest shareholder in Snapdeal, is not keen to divest a majority stake and may sell between 20-25% in Freecharge, although a final decision is pending,” this person added.

Interestingly, Alibaba, in which SoftBank has a significant stake, has a controlling stake in Freecharge rival Paytm.

Talks between PayPal and Freecharge began in August, added the first person.

PayPal is believed to have hired Goldman Sachs as an adviser while Deutsche Bank is advising Jasper Infotech in the transaction. Jasper Infotech founder Kunal Bahl and Snapdeal’s head of M&A Abhishek Kumar are leading the deal, according to the people cited above. The transaction is also subject to approval by the board of Nasdaq-listed PayPal. PayPal and Deutsche Bank did not respond to emails seeking comment; a spokesperson for Goldman Sachs declined to comment. And a Freecharge spokesperson denied there was a deal in the works.

Last week, PayPal filed a trademark infringement suit against Paytm and claimed the latter was using a logo and colour scheme similar to its own.

Paytm was founded in 2010 as a prepaid mobile recharge website by One97 Communications, a company founded to provide mobile value-added services (such as cricket scores through text messages). It launched a digital wallet in 2014. Since then, Alibaba Group of China and its affiliate Ant Financial Services Group have invested more than $680 million in the company, becoming its largest shareholders. The company’s founder Vijay Shekhar Sharma was also awarded a payments bank licence by the Reserve Bank of India, and the Paytm payments bank will likely launch in early 2017.

In October, The Economic Times reported that SoftBank was in talks to invest up to $150-200 million in Freecharge along with other investors.

The report said that the transaction would value the company at around $900 million to $1 billion.

“While there were a few more financial investors ready to invest in Freecharge, what makes PayPal’s offer interesting is that it comes with global experience and know-how,” said the first person.

This is the “primary reason Snapdeal’s board is keen to consider the offer in the first place”, the person added.

Freecharge was founded in August 2010 by Kunal Shah and Sandeep Tandon and secured funding from Sequoia Capital, Tybourne Capital Management, and San Francisco-based fund Valiant Capital Management before its acquisition by Snapdeal in April last year for roughly $450 million.

Recent Articles on M&A

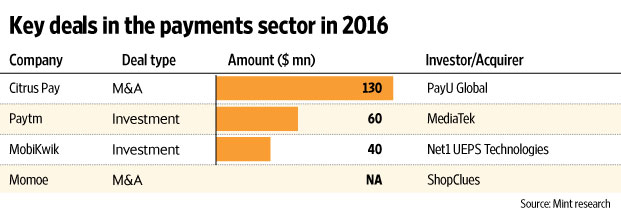

Source: Mint