US private equity fund Advent International is among investors in discussions to acquire a minority stake in Apollo 24/7, the digital healthcare platform of Apollo Hospitals, said two people aware of the development. The buyer is likely to invest about Rs 2,100 crore ($250 million), valuing the subsidiary at about Rs 17,000 crore ($2 billion).

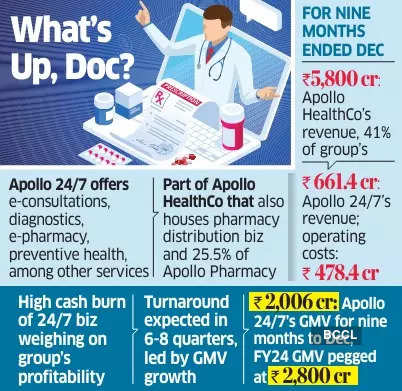

Apollo 24/7 is part of Apollo HealthCo, a subsidiary of Apollo Hospitals. HealthCo also houses the pharmacy distribution business and a 25.5% interest in Apollo Pharmacy. It accounts for about 40% of Apollo Hospitals’ revenue.

The promoters have been in discussions with various investors to dilute a minority stake in the pharmacy subsidiary for the last couple of years. Talks were previously held with Amazon,

General Atlantic, Softbank and a few West Asian sovereign funds but didn’t result in a deal.

Spokespersons for Apollo Hospitals and Advent declined to comment.

Apollo 24/7 offers e-consultations, diagnostics, e-pharmacy, preventive health and other services under a single platform. It had 31 million registrations, 620,000 active users and 6,776 doctors on its platform at the end of December 2023. The platform’s daily activities include 14,000 consultations, fulfilling more than 38,000 prescriptions and collecting 2,300 samples for laboratory tests. Apollo Pharmacy had about 5,700 stores in over 1,100 cities and towns.

Advent International has been investing in India since 2007 and has committed or pumped in more than $3.5 billion across 14 companies. Its pharma/healthcare portfolio in the country includes Suven Pharmaceuticals, Cohance Lifesciences and Bharat Serums & Vaccines. It is looking to invest $5-10 billion in India in the next 5-10 years, James Brocklebank, who co-chairs Advent’s executive committee, told ETon February 8.

In 2019, Apollo Hospitals restructured and sold a majority stake in its pharmacy operations under Apollo Pharmacy to a consortium of Enam Securities (44.7%), Jhelum Investment Fund I (19.9%) and Hemendra Kothari (9.9%) for Rs 527.8 crore.

In 2021, Apollo Hospitals carved out the pharmacy business along with its online app 24/7 into 100% subsidiary Apollo HealthCo.

ET reported last year that the company was planning to raise about $200 million by selling a minority stake in Apollo HealthCo at an enterprise valuation expected to be in the range of $2.5-3 billion.

Apollo HealthCo reported Rs 5,800 crore revenue in nine months ended December, accounting for about 41% of Apollo Hospitals’ revenue. Apollo 24/7’s revenue for the same period was Rs 661.4 crore while operating costs stood at Rs 478.4 crore. The Apollo group posted consolidated revenue of Rs 14,115 crore for the period. Apollo HealthCo reported Rs 6,704.5 crore revenue in FY23, with an ebitda of Rs 533.8 crore at a margin of 8%.

The high cash burn of the 24/7 business has been weighing on the group’s profitability. Apollo 24/7 expects a turnaround will take another six to eight quarters, led by growth in gross merchandise value (GMV) or the total value of sales over a certain period of time.

Apollo 24/7’s GMV was `658 crore in the December quarter, up 21% on a sequential basis. In the nine months to December, GMV grew 91% to `2,006 crore. The company pegged FY24 GMV at `2,800 crore and expects 60-70% growth in FY25.

To achieve a higher GMV, Apollo will be adding more services such as digital therapeutics, insurance distribution and monetisation of digital assets, Apollo Hospitals CFO Krishnan Akhileswaran told ET last year.

“Currently, 24/7, in terms of cash, is self-sustaining, so does not require a cash infusion, but we are looking at maybe some time, if we require some cash, we are open to the idea,” Apollo Hospitals managing director Suneeta Reddy said on an analyst call in February. “Let me just leave it at that, because we are looking at growth coming from 24/7 and achieving profitability between the sixth and eighth quarter of operations.”

Digital health platforms are facing strong headwinds due to offline and online competition, a discount-led model and customers switching back to offline channels with the end of the Covid pandemic. Apollo has an advantage over others as it can leverage its network of pharmacies, labs, clinics and hospitals, but that hasn’t been enough, experts said.

Apollo 24×7 competes with Tata 1mg, Flipkart Health, PharmEasy, Netmeds and Amazon Pharmacy. As of September 2023, Apollo 24/7 was ranked second with 18% market share, behind Tata-owned 1mg (31%), as per data from research firm Redseer.

Source: Economic Times